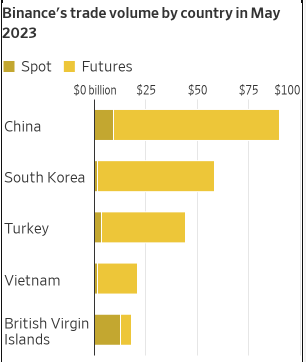

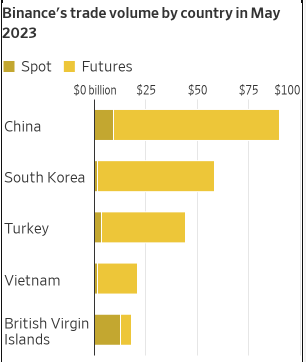

China issued a nationwide crackdown on crypto in 2021. All activities, right from mining to trading and investing, were prohibited. However, China allegedly remains to be Binance’s largest market. A recent report by The Wall Street Journal pointed out that users traded $90 billion of crypto-related assets in China in a single month in May, according to an internal platform at Binance named “Mission Control.” Futures contracts comprised the major chunk of volume. Citing internal figures viewed by reporters, current and former employees, the report noted,

“The transactions made China Binance’s biggest market by far accounting for 20% of volume worldwide, excluding trades made by a subset of very large traders.”

Wall Street Journal’s sources revealed that China’s importance for Binance is “openly discussed internally.” In fact, despite the ban, the exchange’s investigation team works in tandem with Chinese law enforcement to “detect potential criminal activity among the more than 900,000 active users in the country,” the report highlighted.

According to an internal document regarding the procedure blueprint, Binance aided users dodge restrictions by “directing them to visit different websites with Chinese domain names before rerouting them to the global exchange.” This document was reportedly circulated inside the company prior to the 2021 ban, but after China blocked Binance’s website in 2017.

Also Read: FTX Confirms Plan to Relaunch Exchange

Binance Says Exchange Website is Blocked in China

When asked about the accuracy of the report and the claims, a Binance spokesperson told Watcher Guru via mail,

“The Binance.com website is blocked in China and is not accessible to China-based users.”

Despite the ban in place, it should be noted that China has been clinching unexpected records. As reported in May 2022, this region continues to be a top Bitcoin mining destination. It only stood behind the U.S. Furthermore, as pointed out in a recent article, China is the second major crypto hub in Asia. It employs around 9,900 people. A Chainalysis report from H2 2022 asserted,

“China is especially strong in usage of centralized services, placing second overall for purchasing power-adjusted transaction volume at both the overall and retail levels. Our data suggests that the ban has either been ineffective or loosely enforced.”

The Wall Street Journal reported that there were 5.6 million China-based users registered with Binance. Among them, 911,650 were active, according to Mission Control. Furthermore, internal documents and a former employee alleged that about 100,000 Chinese users at Binance [as of January] were deemed to be “politically exposed persons.”

With a 13% share, South Korea is Binance’s second-largest market. Turkey follows behind at 10%. All other countries’ volume account for less than 5%.

Also Read: India Becomes Top Crypto Employer in Asia: China, Singapore Trail