The crypto-verse was stretched to its limits in 2022. The downfall of a plethora of projects led to several investors exiting the market. The ones that were retained suffered too. Binance, the world’s largest crypto, on the other hand, not only managed to survive the crypto winter but also flourished during the same period.

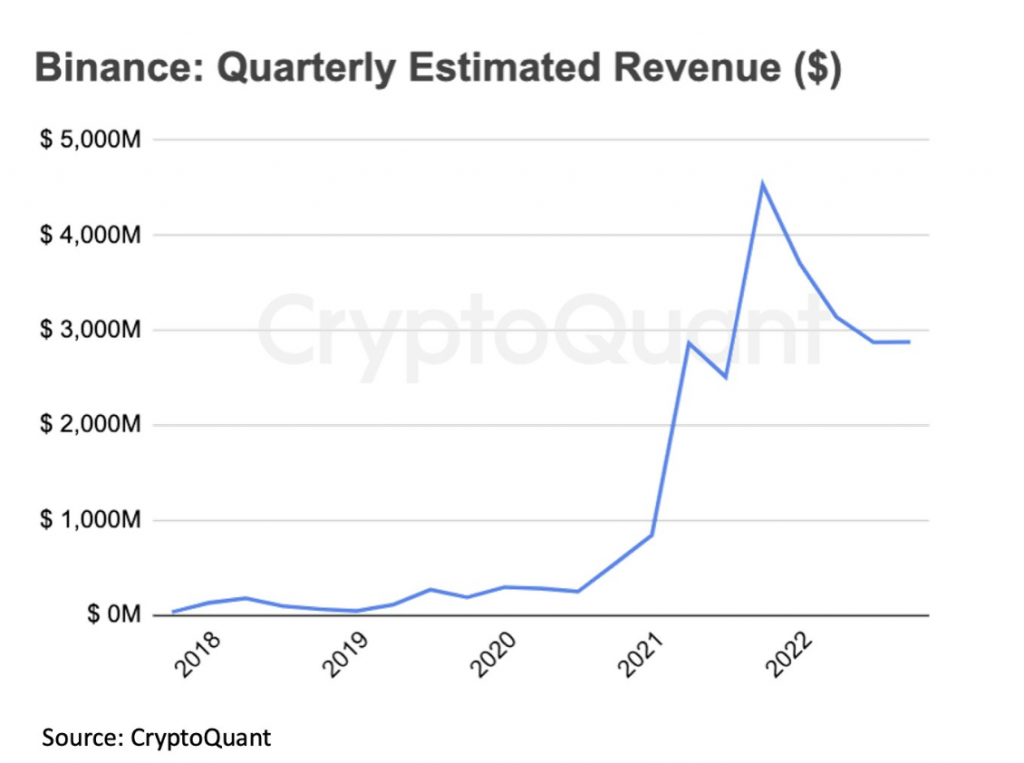

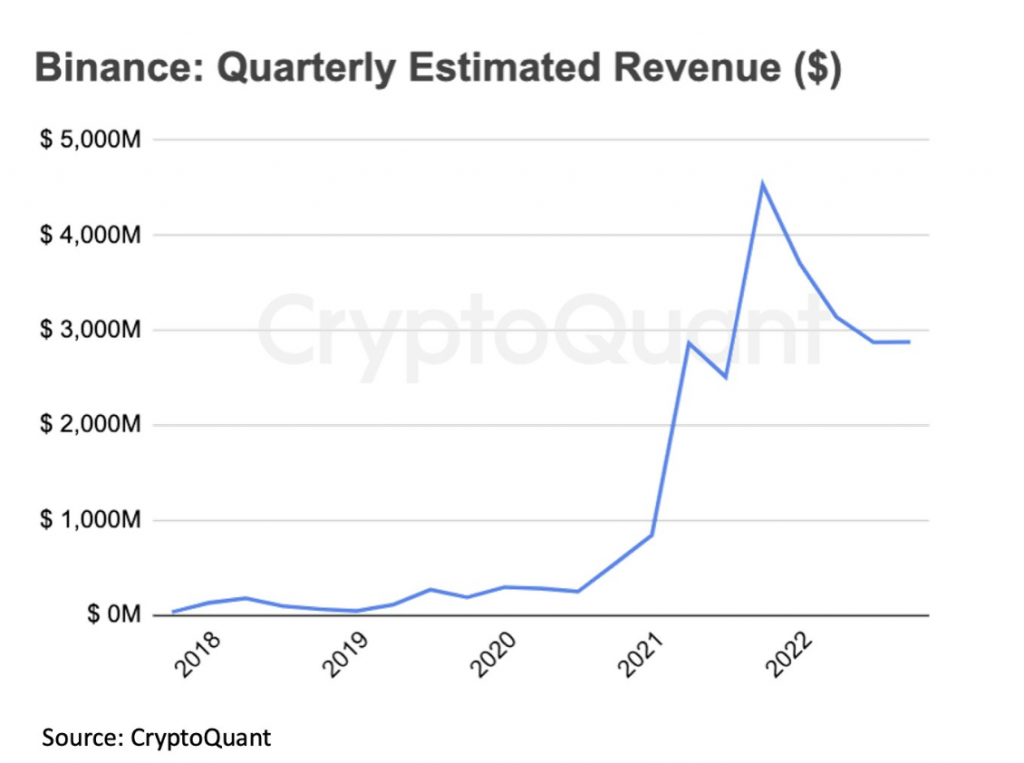

A recent chart by CryptoQuant highlighted the annual growth of Binance over the last two years. According to the report, the CZ-led platform’s annual revenue was $12 billion in 2022. The firm encountered a 10x growth over the last two years.

Meanwhile, its counterparts like Huobi suffered gravely throughout the year. The exchange’s quarterly revenue declined by 98 percent since 2021 Q2.

Additionally, OKX’s revenue mirrored Binance’s notion but not entirely. The exchange’s revenue also recorded 4x organic growth over the last two years. In 2022, the firm’s revenue was $948 million.

FTX was also part of the list. The crypto exchange spawned over $50 million to $120 million in trading fees every month prior to its collapse.

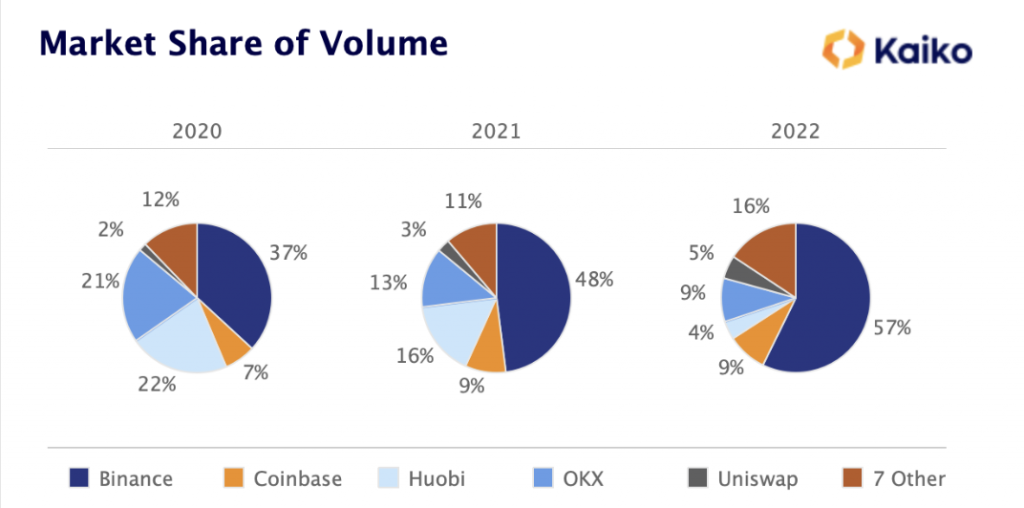

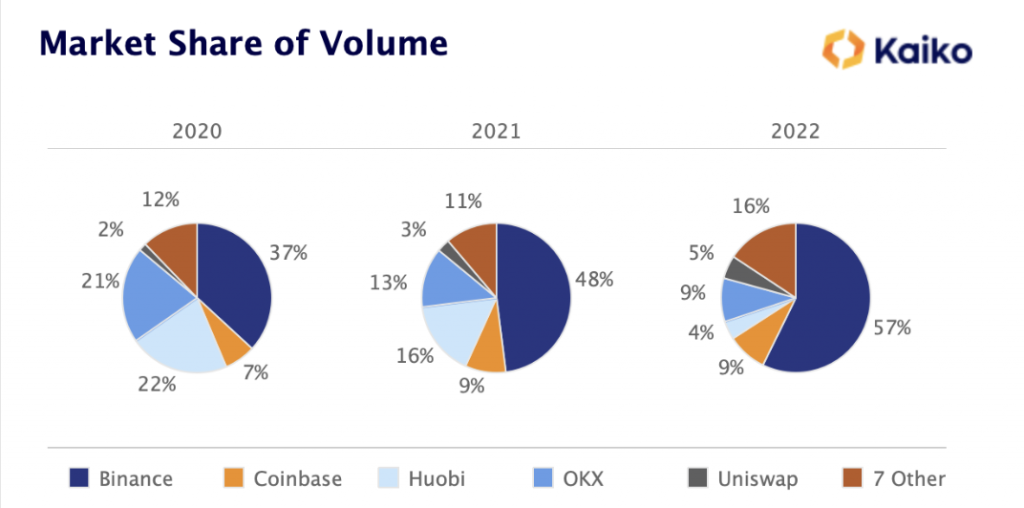

The above data shows how Binance fared immensely well when compared to its rivals. Additionally, a recent report by Kaiko pointed out that Binance’s market share volume was an astounding 57 percent in 2022.

As seen, Binance accounted for only 37 percent of the market share back in 2020. The firm currently dominates more than half of the current trade volume.

$12 billion worth of withdrawals in Binance in 60 days; a matter of concern?

Since November, almost $12 billion in various crypto assets had been taken out of Binance. According to a recent Forbes report, Binance lost a sizeable portion of its assets due to BNB and BUSD outflows during the past two months.

Forbes claims that Binance saw $3.5 billion worth of BUSD flow out of the exchange. This wasn’t all, users reportedly reduced their MATIC, APE, and GALA holdings by 40 – 50 percent since the collapse of FTX. While this unlocked a new fear among users, He Yi, the co-founder and the CMO of Binance gave insights into the firm’s internal policy.

According to Yi, the exchange is stringent with its internal control. This means that no employee is allowed to carry out short-term crypto transactions and is required to hold their position for over 90 days prior to trading.