The crypto markets have once again entered into a slump. Ethereum (ETH), hot off its transition to a PoS (Proof-of-Stake), fell by a violent 10.3% in the last 24 hours. At the time of the merge, ETH was trading at around $1600. Nonetheless, the second largest crypto asset registered its own corrections. Bitcoin (BTC), the original cryptocurrency, has fallen by 6.3% in the same time frame.

Cardano (ADA), another crypto project that is expecting a big upgrade soon, is down by 9.8% in the last 24 hours. Liquidations are once again on the rise, getting close to $500 million in the last 24 hours. At press time, total liquidations stood at $431.61 million and rising.

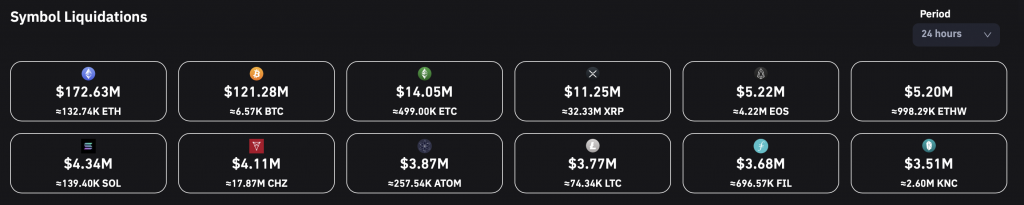

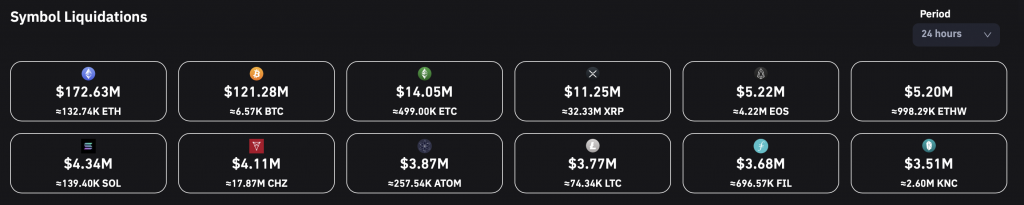

Of all the currencies, Ethereum (ETH) saw the highest liquidations in the past 24 hours, at $172.63 million. Bitcoin (BTC) followed second at $121.28 million, while Ethereum Classic (ETC) came in third with $14.05 million. XRP lost $11.25 million, while EOS lost $5.22 million.

Most of the liquidations came through on long orders, and bearish pressure consumed most of the orders placed for a recovery rally.

The downturn of the markets is most likely due to the CPI numbers which came in on the 13th. The Federal Reserve is set to increase interest rates once again. Not only the U.S but also the European Central Bank is expected to increase interest rates, in an effort to curb inflation. Hence, given the heightened volatility, it is not surprising that liquidations in the crypto markets have skyrocketed.

When will the crypto markets get some relief?

The current situation, as mentioned above, can be attributed to the increase in interest rates. The increase in interest rates is a reaction to increasing inflation numbers. And the increase in inflation can be said to have occurred due to the ongoing Russia-Ukraine conflict, and the pandemic prior to the war. Both situations halted global trade and caused mass disturbances to the movement of goods. The current war in Ukraine has also disrupted energy supplies to Europe. Energy is one of the major contributors to inflation.

Therefore, going by the pattern, interest rates can only be brought down when inflation numbers go down, and inflation numbers can go down when global trade and energy needs are met. With no conclusion in sight for the ongoing conflict, it is uncertain when the markets will start to ease out.

At press time, the global crypto market cap stood at $949 billion, down by 6.5% in the last 24 hours.