Bitcoin prices sit near $58,000 as markets await the Federal Reserve’s rate decision. BTC has also seen wild swings lately, as did almost the entire market. Mining profits are down, even as network computing power rises.

Let’s dive right in and explore this topic further. Scroll down for more info!

Also Read: Shiba Inu (SHIB) &, Dogecoin (DOGE) Price Prediction For September End 2024

Navigating Bitcoin’s Future: Fed Rate Decision, BTC Mining, and Price Trends

Fed Rate Cut Looms Large

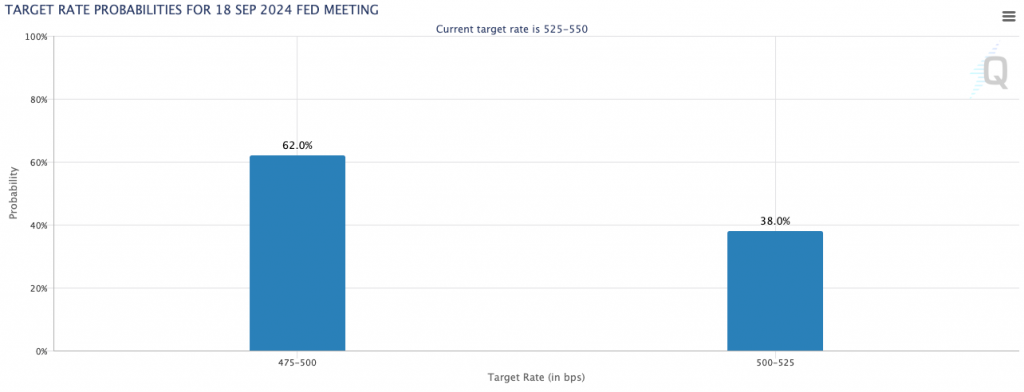

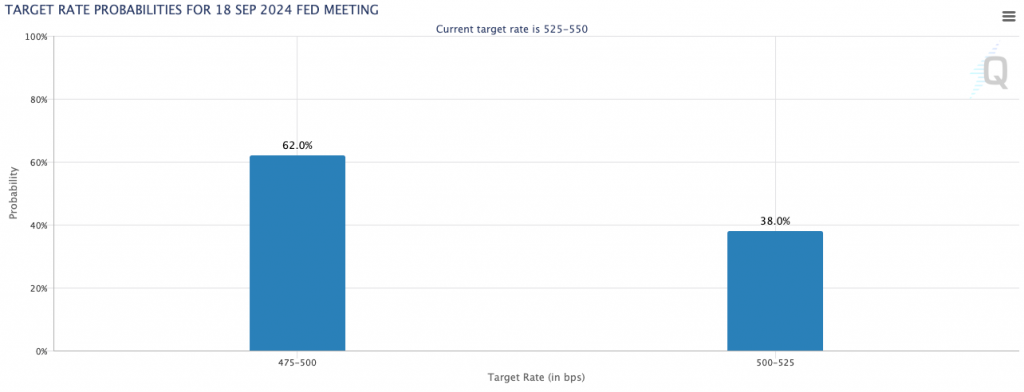

The Federal Reserve will likely cut interest rates on September 18, which is tomorrow. CME Group data has shown a 62% chance of a 0.5% cut.

Jonathan de Wet from Zerocap believes in a bigger cut. He said, “Given the Fed has waited this long for the initial cut, Zerocap is in the 50 bps camp, as opposed to backing the more conservative call of 25bps.”

Bitcoin Price Projections Diverge

Experts disagree on Bitcoin’s short-term price after the Fed decision. De Wet sees a possible range of $53,000 to $65,000.

Also Read: Binance BNB Weekly Price Prediction: Can It Hit $580 This Week?

He noted, “We’re seeing a BTC downside target of 53,000 after the recent range lows, with an upside target of 65,000 after breaking higher from the descending wedge.”

Mining Sector Faces Headwinds

Bitcoin miners struggled in early September. Their profits fell as network power grew. JPMorgan reports a 4% rise in hash rate this month, back to pre-halving levels.

Some companies are changing course. Cathedra Bitcoin now focuses on buying BTC directly. They aim to increase Bitcoin holdings per share, like MicroStrategy does.

Institutional Interest Persists

Despite short-term doubts, big players still believe in Bitcoin’s future. MicroStrategy plans to issue $700 million in convertible notes. They’ll likely use this money to buy more BTC.

De Wet added, “Tough to call on direction until we get closer to the election, but risk on conditions should lead to short-term positive sentiment.”

Also Read: Fed Rate Cuts Will Not be as Deep as Market Expects: BlackRock

The next few days are crucial for Bitcoin. Markets will react to the Fed’s decision. Investors will watch closely to see if BTC breaks out of its recent price range.