Last week, a host of firms including Citadel, Fidelity, and Charles Schwab launched the crypto exchange platform EDX Markets. The aforementioned development was well-received by the community, for it underlined that Traditional Financial [TradFi] players are now gradually backing crypto. Upon the launch, four assets were listed by the exchange. Specifically, Bitcoin, Ethereum, Litecoin, and Bitcoin Cash made the cut.

On the launch day, i.e. June 20, Bitcoin noted a 5.4% rally. The other three assets only inclined by 3%-3.6%. However, in the days that followed, BCH made its rally count. On June 21, it rallied by 23.5%, on June 23 and 24 it glided up by 36.4%, and 16.7% respectively. In effect, by the end of the fifth day, BCH created a high of $222, up by more than 111%. In the same period, BTC and ETH rallied by 11%-16%, while LTC notched up in value by 24%.

Also Read: Is there More to VeChain, VeThor’s 11% Rally?

Clearly, the EDX development acted like an ‘event’ for BCH. However, for the other assets, it was mostly a ‘non-event.’ With traders’ priority oscillating between Bitcoin, Ethereum, and other prominent Altcoins, BCH sort of became a long-forgotten asset. However, the past week saw the Bitcoin-forked asset gain a new life.

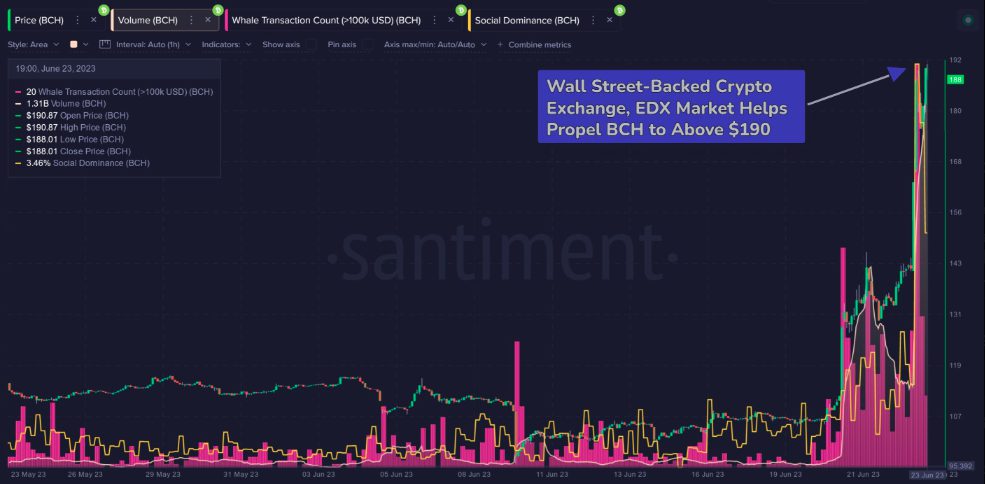

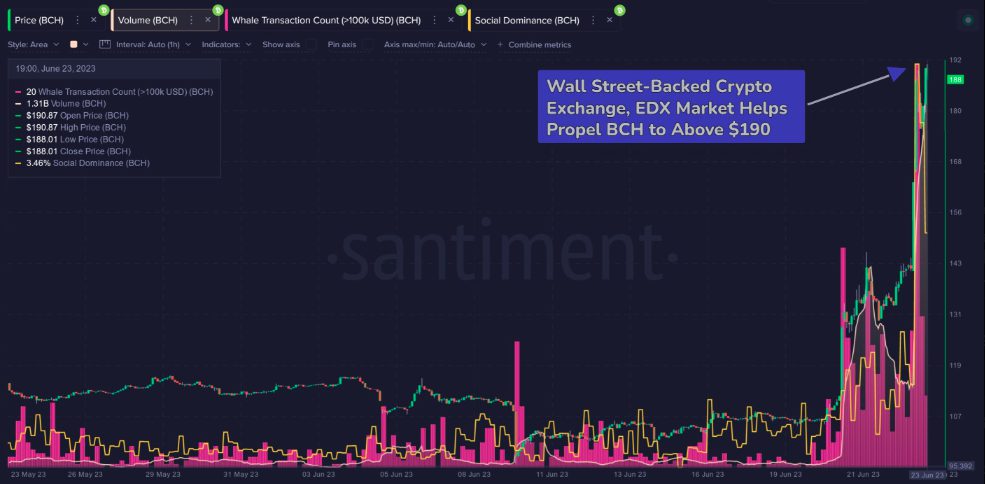

In fact, Santiment recently pointed out that BCH-related discussion rates are at their highest level since 2020. Alongside the three-year high registered on this front, the volume managed to create a new YTD high, pointing towards how this asset is back on traders’ and investors’ radars.

What’s next in store for Bitcoin Cash?

Well, on the weekly BCH is still the largest gainer among the top 100 assets. However, the bullish bias seemed to be fizzling out at press time. A day back, the asset retraced by more than 8%, while today, it has noted a less than 2% uptick.

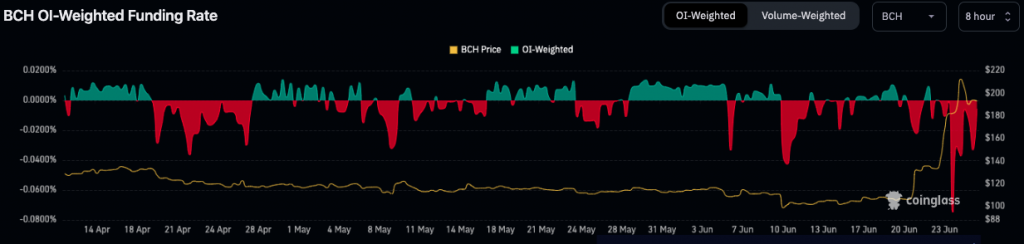

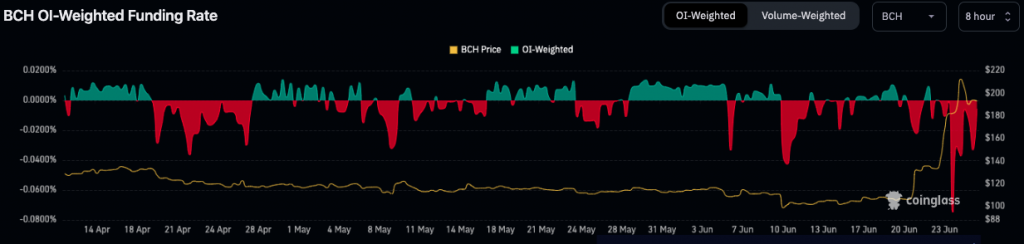

In the derivatives market, the sentiment flip was evidently visible. While the Futures OI continues to hover around a yearly high of $14.63 billion, it should be noted that the funding rate is negative. This means, the current market conditions have proven to be quite attractive for traders, however, bearish traders are willing to pay their bullish counterparts.

Parallelly, the long:short ratio flashed a value of 0.9 at press time, re-asserting the bearish bias. So, if the current conditions continue to prevail, BCH would find it challenging to continue inclining. Thus, the odds of a pull-back transpiring over the short term are fairly higher at this stage.

Also Read: DeFi: Whale Buys $13 Million AAVE Tokens, Price Rallies 35%