Most top crypto assets have been in their consolidation phase of late. However, Bitcoin Cash managed to defy that trend and emerge as the top gainer today. In the last 24 hours, it spiked by around 8% and was seen exchanging hands at the brink of $237 at press time. In this article, we will analyze whether the BCH market has enough steam to extend its rally or not.

The Metric Front

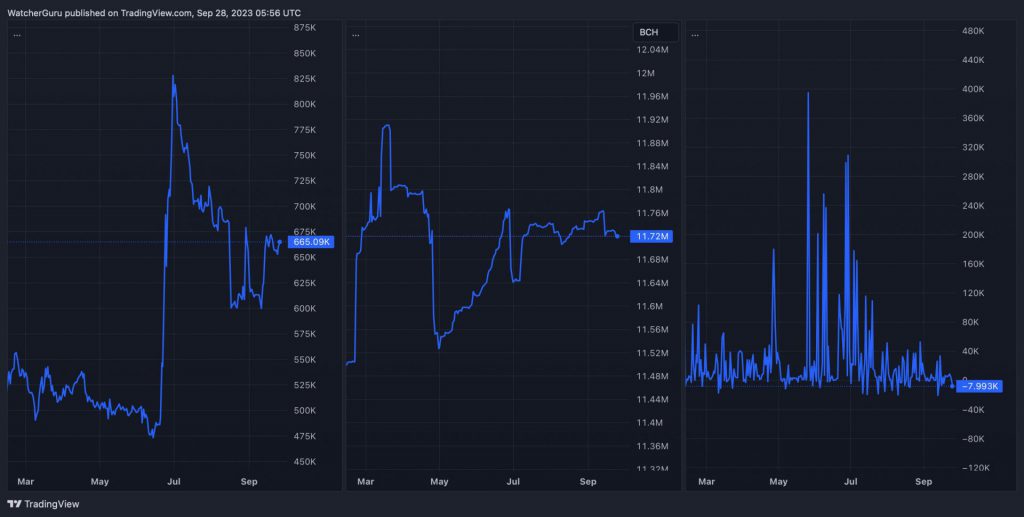

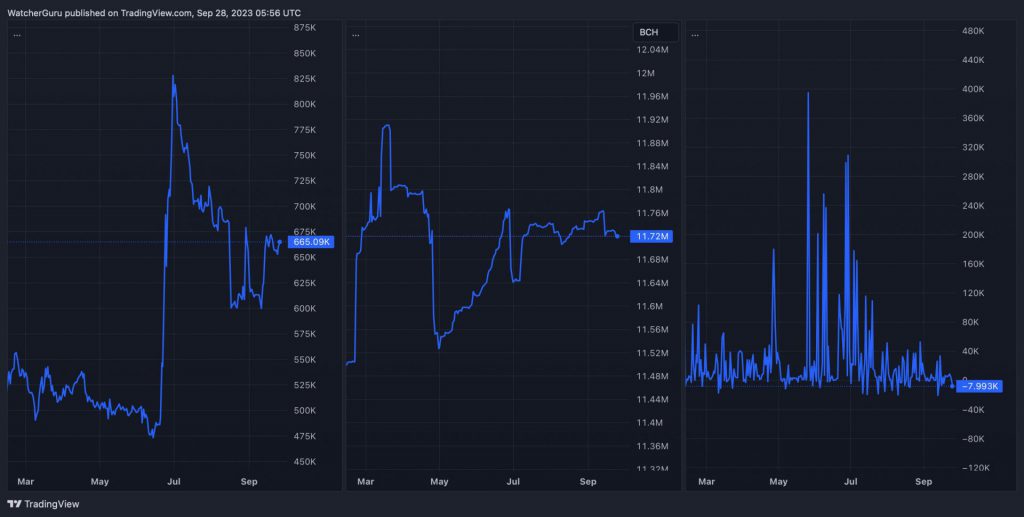

According to on-chain data, the number of unique addresses holding $100 worth of BCH or more has registered a rise from 599.929k to 655.09k since mid-September, indicating that the accumulation trend is on.

However, the balance of Bitcoin Cash belonging to holders has seen a slight dip from 11.76 million to 11.72 million over the past fortnight, suggesting that profit booking has already commenced. However, the intensity is not that high yet. In fact, whales registered similar behavioral patterns as well. Their aggregate net flow has been hovering in negative territory. At press time, their sell orders were greater than their buy orders by around 7.99k BCH tokens.

Source: TradingView

Also Read: Crypto AUM Could Rise to $500 Billion in 5 Years: Bernstein

The Bitcoin Cash Bull-Bear Battle

The aforementioned metrics point out that bears are attempting to gain a commanding position in the market. However, they have not yet been able to assert their full-fledged dominance. If bulls continue fighting, they could end up nullifying the bearish bias. On a weekly, Bitcoin Cash is already in the midst of an uptrend and is only 39% below its 2023 high.

Also Read: Ethereum Creates ‘Bullish’ Divergence: 12% Rally to Follow?

On the technical front, it is essential for Bitcoin Cash to hold above $233.7 over the next few trading sessions. Doing so will keep the doors open for the asset to test $255.3. In fact, even from an on-chain perspective, BCH has no immediate resistance. Its next major hurdle only lies around the average price of $279.5, where 1.15 million addresses have accumulated 1.98 million BCH. So, the odds of the sell pressure rising at the current juncture seem to be fairly low at the moment.

However, the bullish thesis will be invalidated if BCH loses the $230.1 support level. In such a scenario, it could drop down to $210.7 or $201.8, depending on the bearish pressure.

Also Read: PYUSD: Crypto.com Partners With PayPal, Paxos