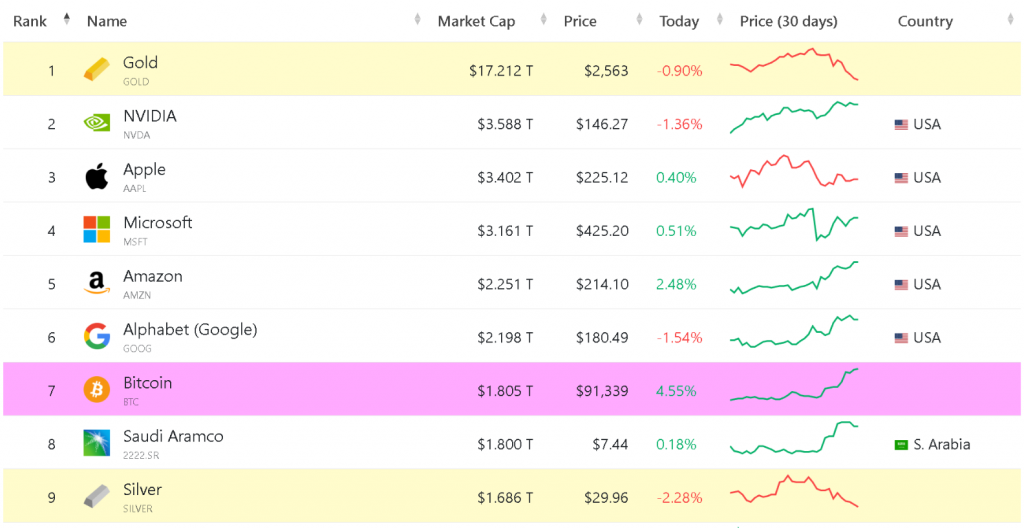

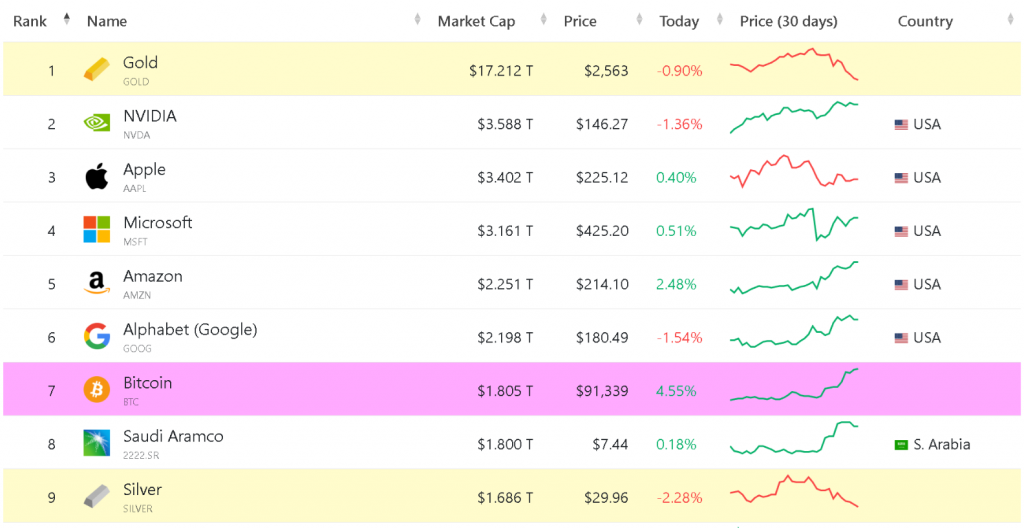

Bitcoin’s value hit $1.8 trillion, passing Saudi Aramco and moving closer to tech giants like Google. The price jumped above $91,000, showing strong growth with few rules holding it back as big investors keep buying. More people and companies buying Bitcoin shows it’s becoming a normal part of finance.

Also Read: Revolut X and VanEck’s SUI ETN: Expanding Crypto and Blockchain in Europe

Bitcoin’s Market Surge: Navigating Risks and Opportunities

Racing Past Traditional Assets

Bitcoin ranks seventh in the world by value, behind Google’s parent company at $2.2 trillion. Investment risks haven’t stopped Bitcoin’s rise among top tech companies. Bitcoin is changing how money works as big investors put billions into digital money. Major banks and firms are buying more cryptocurrency, changing how people invest their money.

Global Market Impact

All cryptocurrencies together are worth $3.02 trillion, making them the world’s eighth-largest economy. Bitcoin leads this growth, with daily trading worth $117.88 billion. This surge shows how digital money is becoming part of world finance, challenging old money systems. Trading companies report more big investors joining as trading systems get better.

Also Read: Microsoft: Strategic AI Investments Could Push MSFT Stock To $550

Broader Market Implications

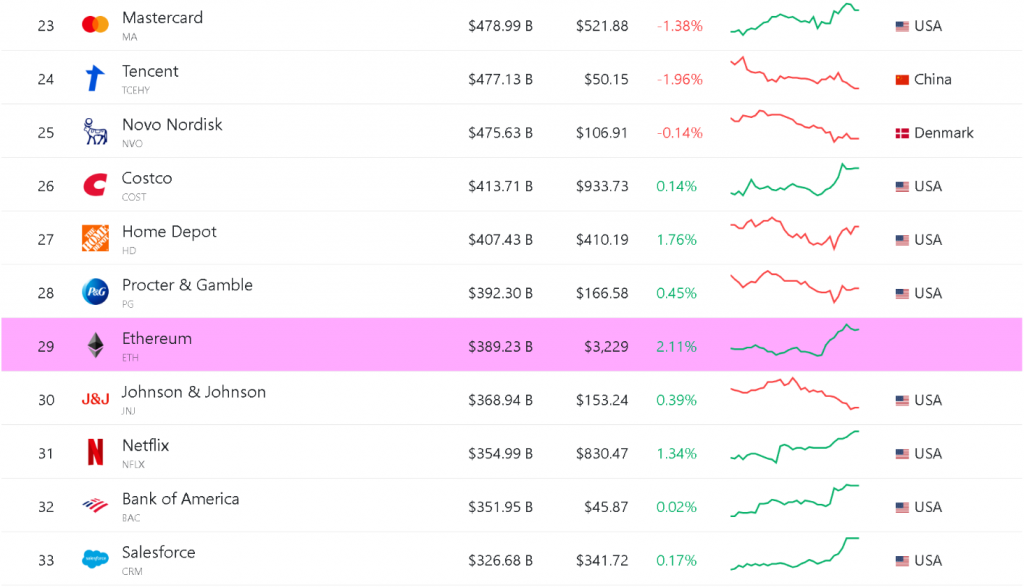

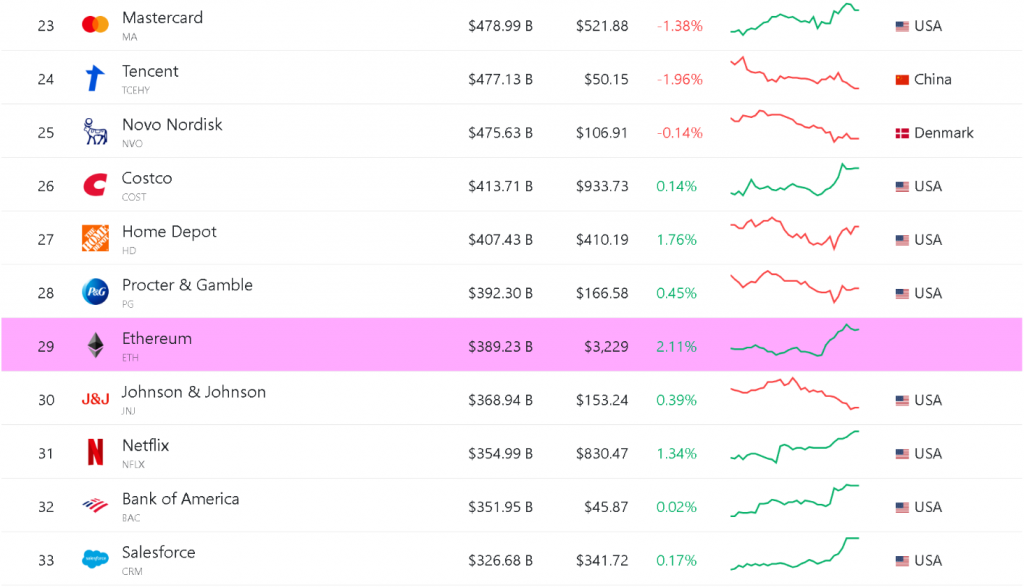

As Bitcoin nears Google’s value, other digital coins grow stronger. Ethereum is now worth $389.23 billion, bigger than Johnson & Johnson and Bank of America. The crypto market is now worth more than many countries, showing how digital money is changing global finance. This shows growing trust in digital money as real investments.

The market keeps growing as more companies join, even with government watching. Trading stays strong, with Bitcoin’s price moving like tech stocks. This mix of crypto and normal banking shows a big change in markets. Better technology helps steady growth while trading centers handle record amounts of buying and selling. Trading platforms show more money moving through them as investors adapt to new ways of trading.

Also Read: BlackRock’s BUIDL Expands: Blockchain Revolution in Full Swing