Bitcoin reclaimed the $91,000 mark on Tuesday, but is struggling to go above the $100,000 range. It fell below the $100,000 mark in mid-November, and it’s been more than two months of failure to reclaim the level. Investors are worried about a potential flash crash that could erase their money in minutes.

Bitcoin Could Face a Major But Normal Correction, Might Fall to $10,000

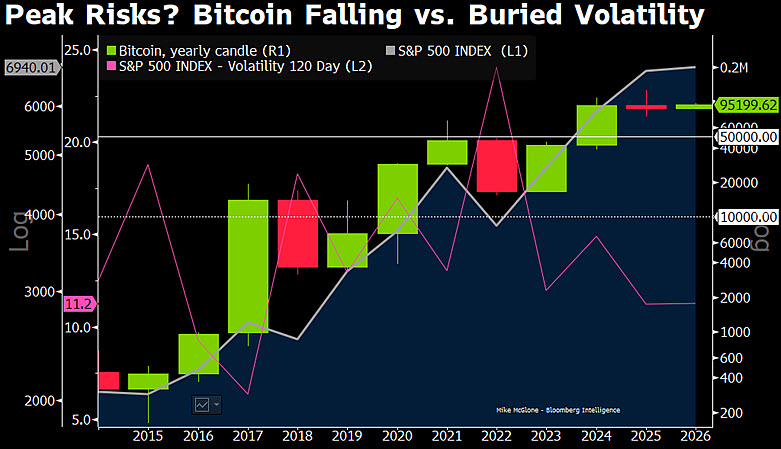

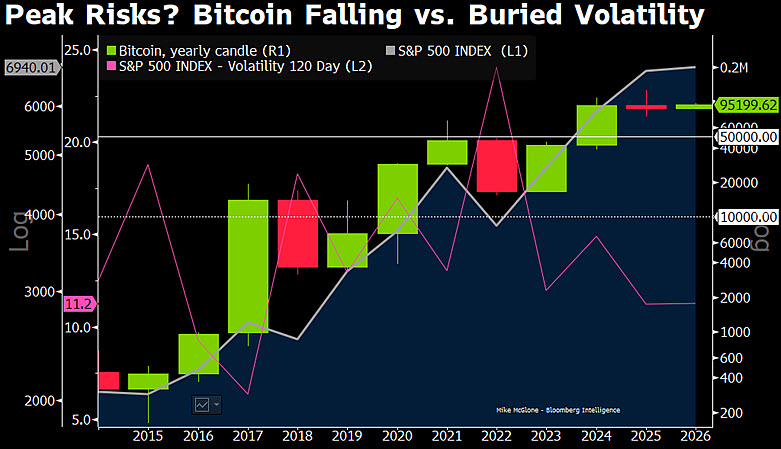

Senior Bloomberg commodity analyst Mike McGlone warned on Sunday that Bitcoin could fall to $10,000. He explained that the correction could be normal, and BTC cannot hold on for long below $100,000. He warned that Bitcoin could first fall to $50,000 that could lead to a string of sell-offs.

The domino effect could get worse when institutional clients make away with their ETF investments. This could be the final straw for Bitcoin, sending it down to the $10,000 range, he said. “Launched in 2009, Bitcoin has led liquidity-pumped reflation in risk-assets and staying below $100,000 could signal an end-game, and normal reversion toward $10,000,” McGlone wrote on X, highlighting a chart that BTC could go from $95,000 to $10,000 next.

Also Read: Fed To Inject $8.3 Billion On Jan 20: Will Bitcoin Rally?

What To Do Next?

The warning is dire as the prediction estimates a decline of close to 90%. The entire cryptocurrency market would be majorly hit if the scenario plays out. However, there’s a silver lining in all of these, as many other analysts had recently projected Bitcoin to fall 90%. Nonetheless, the leading cryptocurrency only soared in the charts, rewarding investors.

HEX and PulseChain founder Richard Heart had also predicted Bitcoin to crash to $10,000. Gold proponent Peter Schiff has been repeatedly calling for the same for two years. Mike McGlone has now joined the bandwagon of the doomsday predictions. Since nine of these predictions turned out to be accurate, the chances of BTC remaining steady in the charts are high.