2022 will undoubtedly go down as one of the worst years for the crypto market. The downfall of several projects followed by the crash of the market, led to the exodus of many investors. Bitcoin sank to a low in the mid $15,000 range. As the king coin lingered around this zone, it was declared dead multiple times. This trend, however, wasn’t carried on to 2023.

Bitcoin started 2023 on a rather eventful note. As the crypto asset rebounded from a challenging 2022, its dedicated holders were rewarded, causing a surge in the number of Bitcoin millionaires. Recent data revealed a remarkable increase, with millionaire addresses climbing from 28,084 in January 2023 to 47,994 presently. This further represented a staggering growth of 170.89% over the past few months.

Based on the data provided, it can be observed that there are about 70,747 million addresses holding Bitcoin with a value transcending $1 million. In addition to this, 5,331 holders have accumulated at least $10 million worth of BTC in their wallets.

The increase in the number of Bitcoin millionaires came as a surprise, considering the dominance of meme coins in the market. During that period, the emerging crypto asset PEPE gained significant attention and attracted individuals, overshadowing other assets and their potential gains.

Is Bitcoin poised to create more millionaires?

Bitcoin has experienced a significant price increase of 55% since the beginning of the year. The leading crypto asset reached a peak of $31,005 before facing challenges due to ongoing regulatory scrutiny. As of now, Bitcoin is trading at $26,145, showing a modest daily increase of 0.44%.

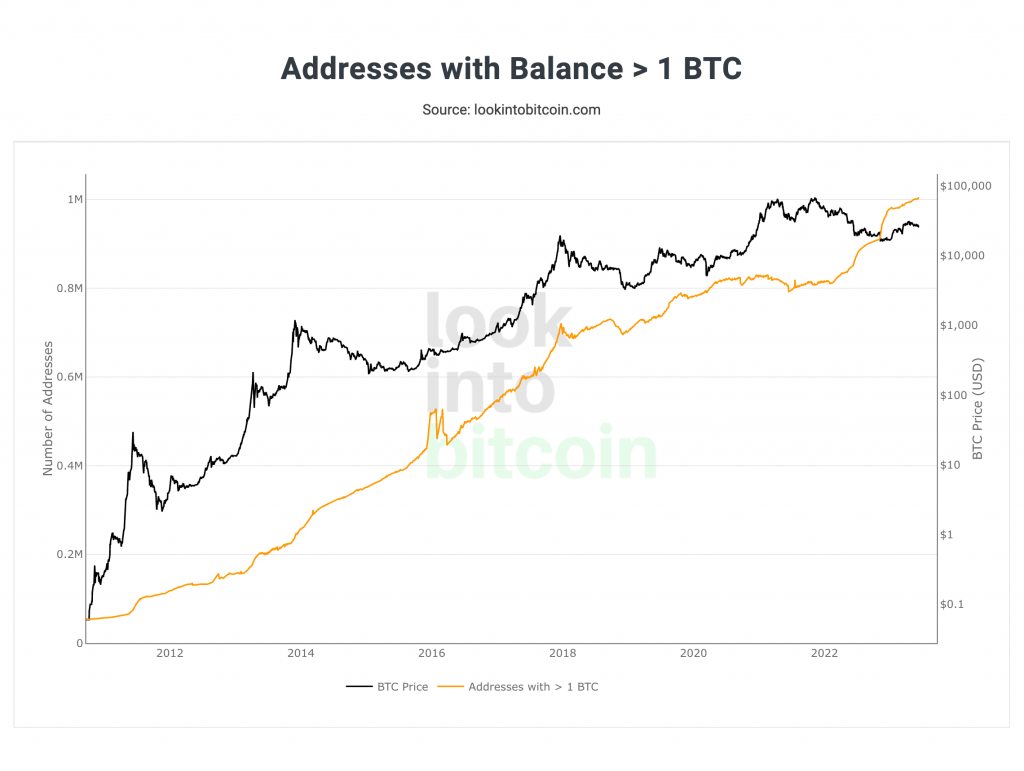

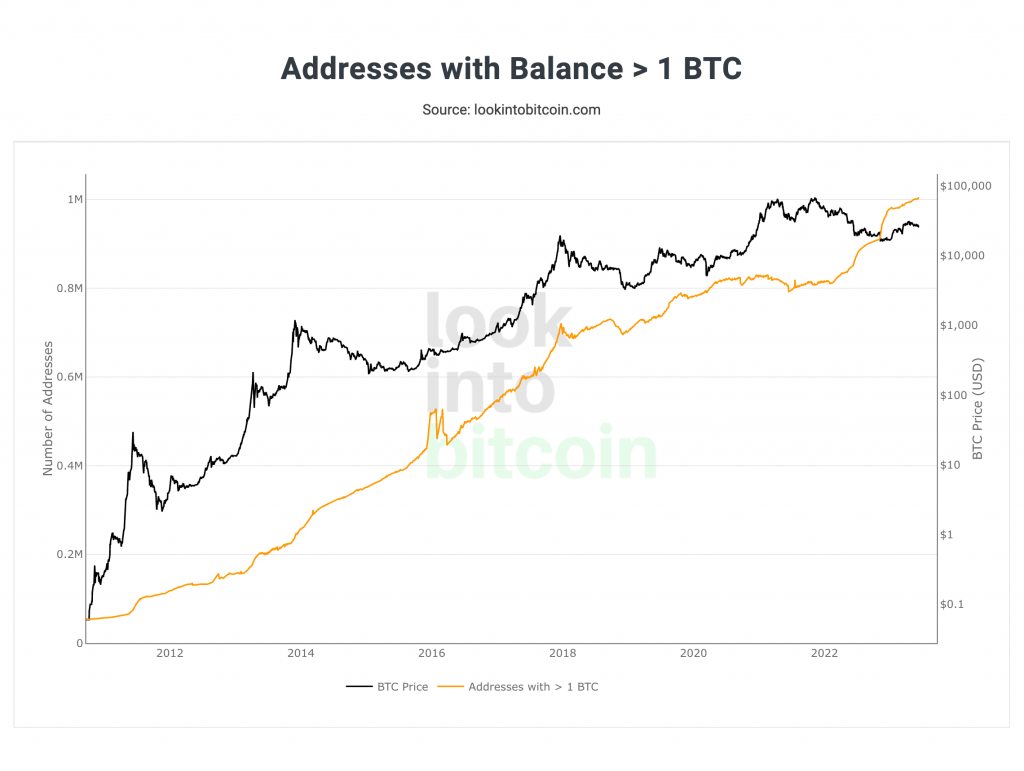

If Bitcoin continues its upward trajectory, the likelihood of creating new millionaires will increase. Moreover, the number of wallets holding 1 BTC or more has recently reached one million, implying that investors have been pocketing the asset despite its price changes.

Due to the various macro factors impacting BTC, predicting its price direction is hard. However, the asset appears to be enhancing the financial well-being of investors. With Bitcoin being the top crypto, it is not surprising that investors remain committed to the king coin.