The global economy remains stagnated, and so has Bitcoin’s price. Rising inflation, the energy crisis, company liquidations, unemployment fears, and a host of other factors have together hampered macro growth. Insufficient demand and the not-so-optimistic community sentiment, on the other hand, have kept the largest crypto price suppressed.

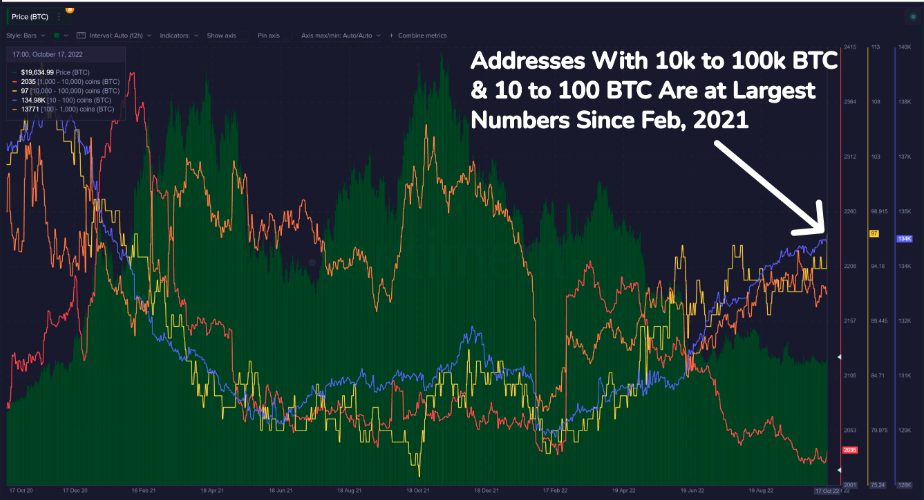

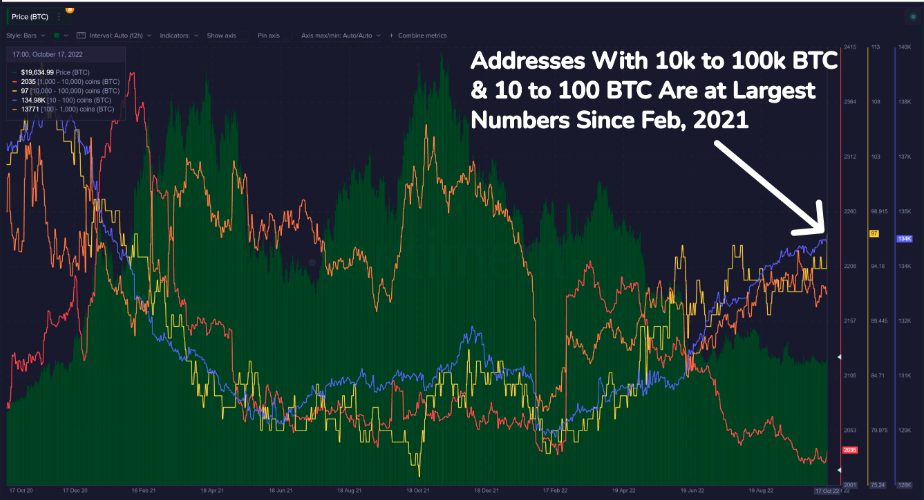

Nevertheless, things seem to be gradually shaping up for Bitcoin. The number of Bitcoin addresses HODLing 10,000 to 100,000 BTC and addresses HODLing 10 to 100 BTC have reached their highest amount of respective addresses since last year’s February. Per the on-chain metrics and analysis platform Santiment,

“As the number of addresses on a network rise, the utility should follow suit.“

A new ATH clinched by Bitcoin

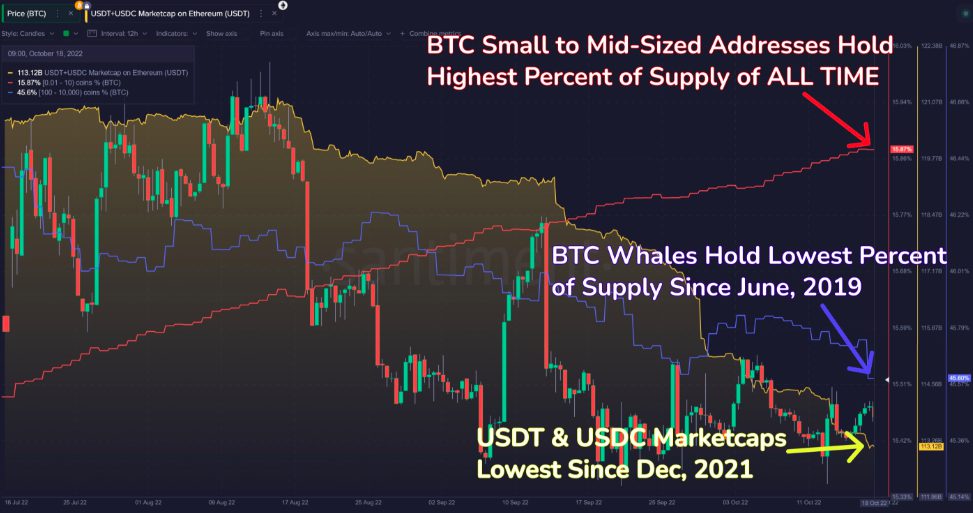

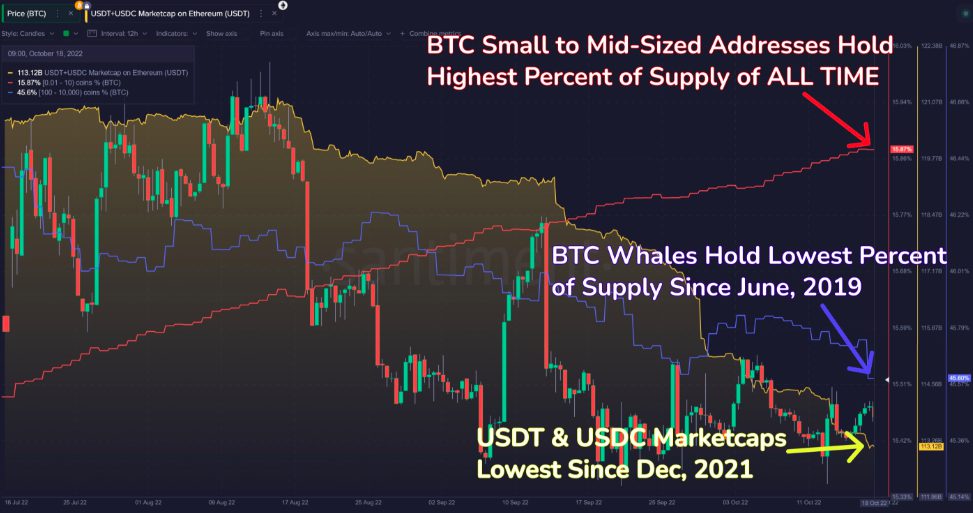

Interestingly, the largest crypto just created a new all-time high. Bitcoin’s small to mid-sized addresses [HODLing 0.1 to 10 BTC] currently possess the highest number of coins they’ve ever held. The same stands at 15.9% of the coin’s available supply.

Every coin has two sides, right? Now, even though very large, small, and mid-sized participants continue to increase their HODLings, the supply of a particular set of participants—the ones HODLing 100 to 10k BTC—is currently at a 3-year low [45.6% of the supply].

Also Read: Bitcoin Spending Metrics down to 2010 levels: Time to Panic?

Time to rewind a little and peek?

Well, despite the ongoing trends and the new highs attained, the market has been in a prolonged downtrend for months now. It’s a known fact that this is not the first time Bitcoin is stuck in such a situation. During previous bear runs, investors have borne negative returns.

In fact, HODLers are currently experiencing losses at a similar level as in 2019-20. The same is depicted in the network-realized-profit-loss [NRPL] chart below that has gauged how rekt the market participants are.

Elaborating on the current state of affairs and rekindling hope, Santiment’s recent analysis post concluded,

“… looking at the long-term data current situation doesn’t look as terrible as it might seem from the outside perspective. Of course, history does not repeat but it might rhyme.”