It has been ten days now since Bitcoin’s price has been hovering around the $19k mark. Even though the asset has been trading in green over the last couple of days, the gains have merely been single-digit. After inclining by 1.5% on the daily and 2.3% on the weekly, the largest crypto was priced at $19.55k at press time on Tuesday.

Macro Bitcoin Trends

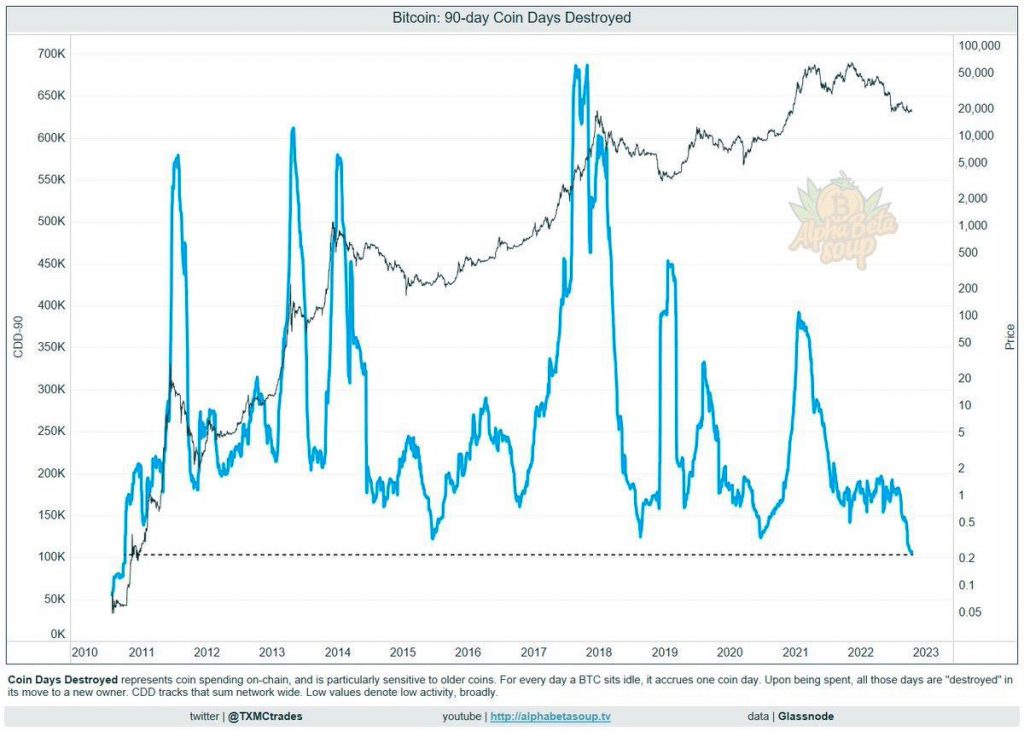

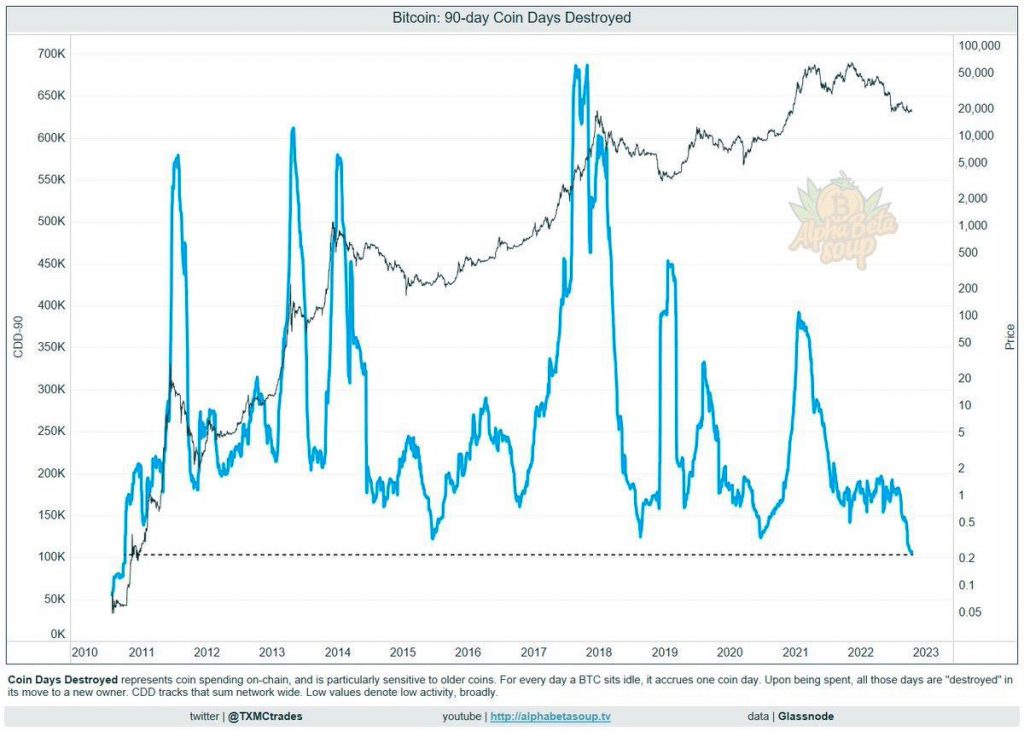

Bitcoin’s on-chain activity has been nearly “non-existent” of late. Take the case of Coin Days Destroyed, for instance. After consistently dropping over the past few weeks, this metric has clinched a new multi-year low. As illustrated below, the CDD is currently down to levels that were last observed way back in 2010.

This metric helps in gauging the spending behavior of long-term HODLers by considering factors like lifespan and coin volume. Usually, low indicator values flash when older coins remain dormant. Sustained low-trends are usually positive, for they represent participants’ conviction to HODL the asset.

Also Read: Is Bitcoin’s CPI pump sustainable for a new Q4 High?

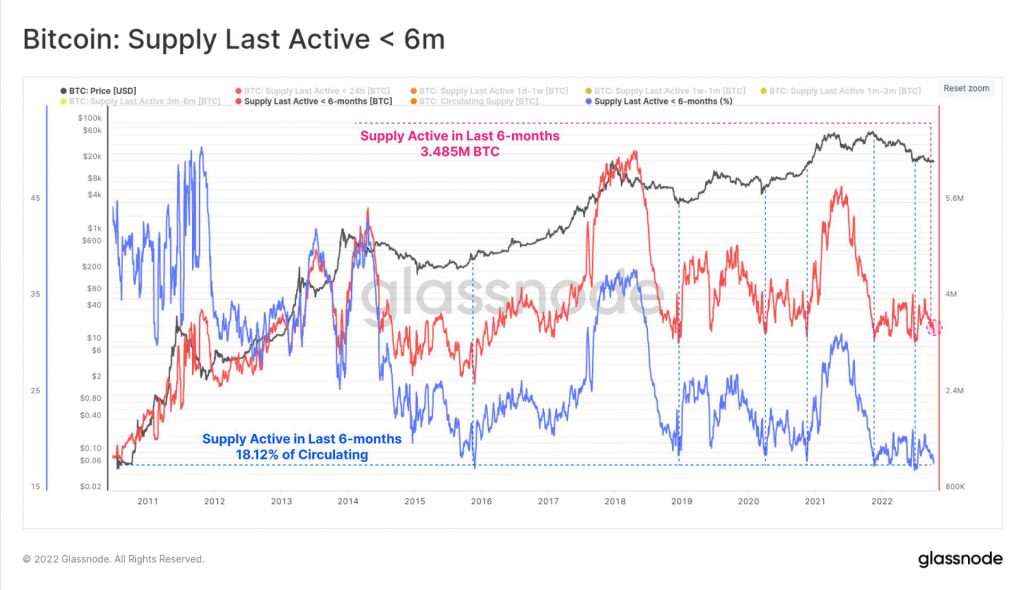

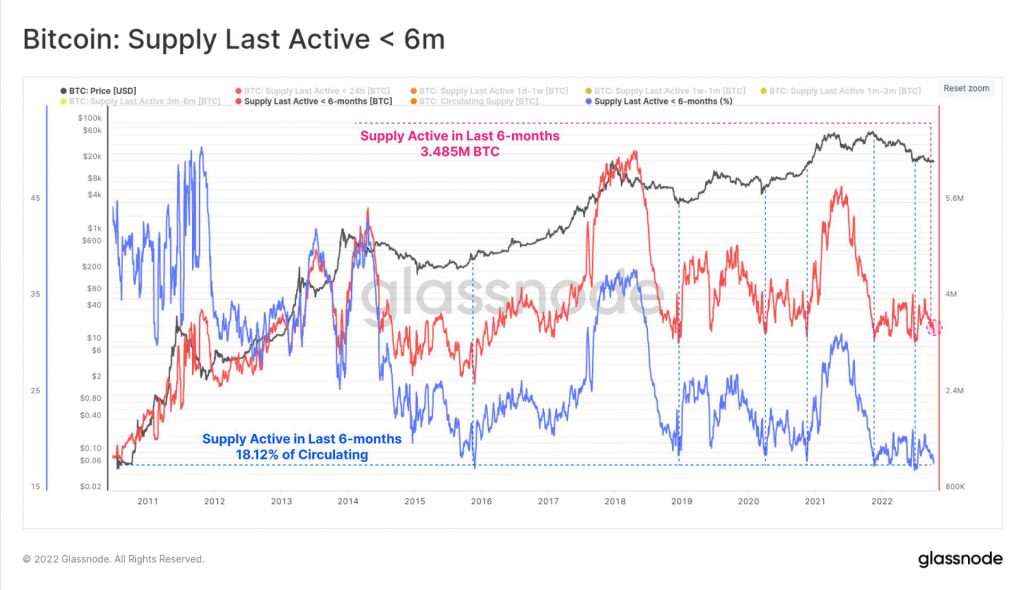

Likewise, the supply moved in the last 6 months is also approaching all-time lows. Data from Glassnode revealed that the same is currently at 18.12% of the circulating supply [roughly 3.485M BTC]. As illustrated below, the volumes of mobile supply typically have been this low during periods of prolonged bear markets. Right after that, in most cases, recovery initiations have taken place.

Clearly, long-term HODLer spending is not taking place at the moment, which is a good sign. Alongside, things are “looking up” for Bitcoin currently, for the equity market kickstarted the week in green. Per Santiment, in such an environment, whale accumulation “should be evident” going forward. However, short-term sellers might hinder the path of Bitcoin’s uptrend because they continue to be “bearish” and are promoting “doom and gloom.”

Also Read: Australian Regulators halt Bitcoin, Ethereum funds for Investment firm