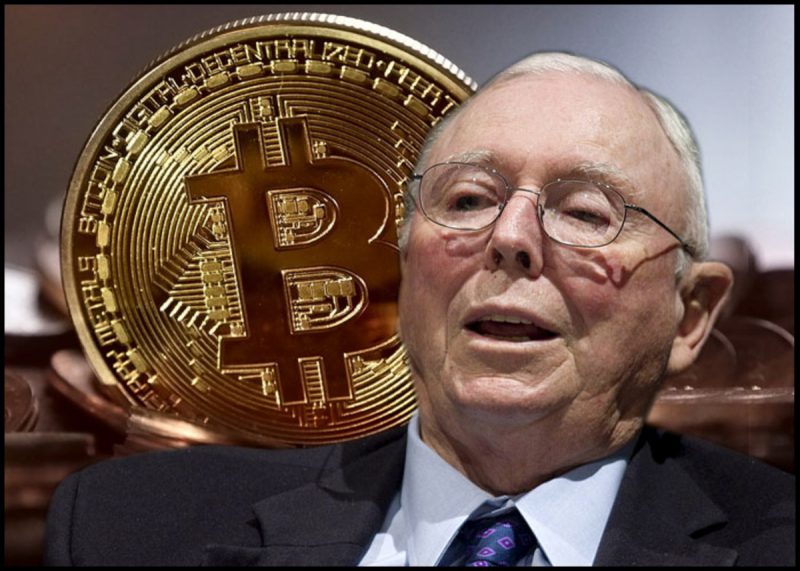

The largest cryptocurrency asset had a rough 2022. Resultantly, skeptics were in the driving seat. Even though Bitcoin has put up an impressive show so far in 2023, people from this side of the spectrum haven’t backed off. In a recent Wall Street Journal opinion piece, Berkshire Hathaway’s Vice Chairman, Charlie Munger, demanded a cryptocurrency ban in the United States.

China was wise to ban cryptocurrencies: Munger

In the article, he criticized the “thousands of new cryptocurrencies” issued by private companies that were allowed to publicly trade without making any disclosures or getting any governmental pre-approval. The Bitcoin critic attributed the “gap in regulation” to their rise.

Munger wrote,

“A cryptocurrency is not a currency, not a commodity, and not a security. Instead, it’s a gambling contract with a nearly 100% edge for the house, entered into in a country where gambling contracts are traditionally regulated only by states that compete in laxity.”

Furthermore, he added,

“Obviously the U.S. should now enact a new federal law that prevents this from happening.”

He asked policymakers to take inspiration from China which announced a cryptocurrency crackdown in 2021. The Bitcoin critic said that the communist government banned this asset class because it “wisely concluded that they would provide more harm than benefit.”

This is not the first time Munger has voiced his opinion. In May last year, he gave Bitcoin the “stupid” and “evil” tags. A couple of months later, he also went on to compare cryptocurrencies to an “open sewer.”

Also Read: Bitcoin: After expressing disbelief, Munger & Buffett bash ‘stupid, evil’ BTC