According to Arcane Research, there is a high level for the rolling 30-day correlation between Ethereum (ETH) and Bitcoin (BTC), of 0.96. Since December 2016, this metric has been higher only 3% of the time. The only time ETH and BTC had stronger correlations were in late November 2018, early March 2019, in 2021 following the Covid fall, and the 2022 3AC catastrophe. As a result, the cryptocurrency market is currently highly correlated, with BTC acting as the main driving force.

According to the analysis firm, Bitcoin (BTC) and US equities correlation are also declining. Due to the FTX drop, Bitcoin was unable to absorb the favorable equities reaction to the November 10 CPI release’s lower-than-expected reading. The firm attributes the falling correlation to the reduced market cap, reduced liquidity, and BTC’s 77% fall.

The diminished market liquidity may make it less attractive for sophisticated funds to use BTC-related macro trading tactics. However, a 77% decrease from ATH (all-time high) might lead investors to want more exposure regardless of the state of the economy.

The report noted that Bitcoin’s current bear market is comparable to 2014-15 and 2018. BTC’s peak-to-trough drop of 85% in the 2014 bear market lasted 407 days. Meanwhile, the top-to-bottom drawdown of 84% in 2018 lasted 364 days. As a result, while the current downturn period has been similar to earlier cycles, the present depths are higher.

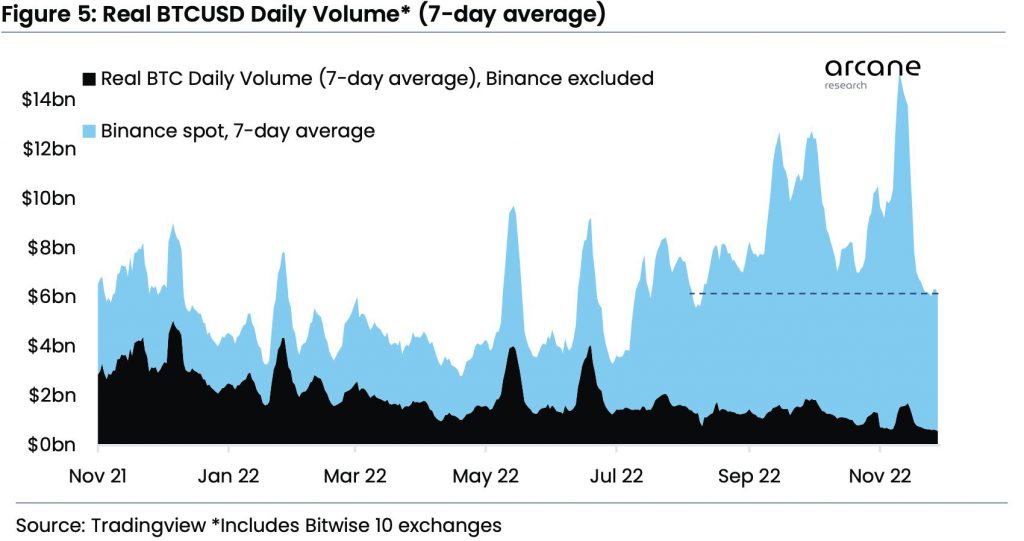

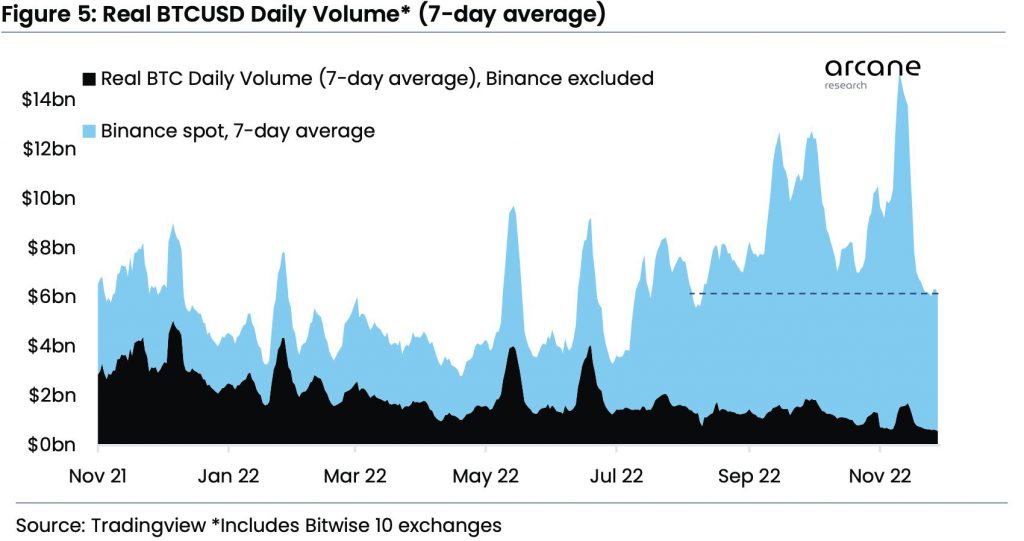

Bitcoin spot market activity

According to Arcane’s research, this week’s Bitcoin trade volume has decreased even more. This past Sunday, BTC spot market trading volumes outside of Binance fell to their lowest 7-day average level since February 2021. Aggregated volumes continue to be high because of Binance’s overwhelming dominance.

However, since Binance stopped charging trading fees for its BTC pairs, the 7-day average trading volumes have only fallen once. The lower volumes highlight the current market’s lack of activity. This is further demonstrated in the derivatives slide, where there have been no significant changes in the past week.

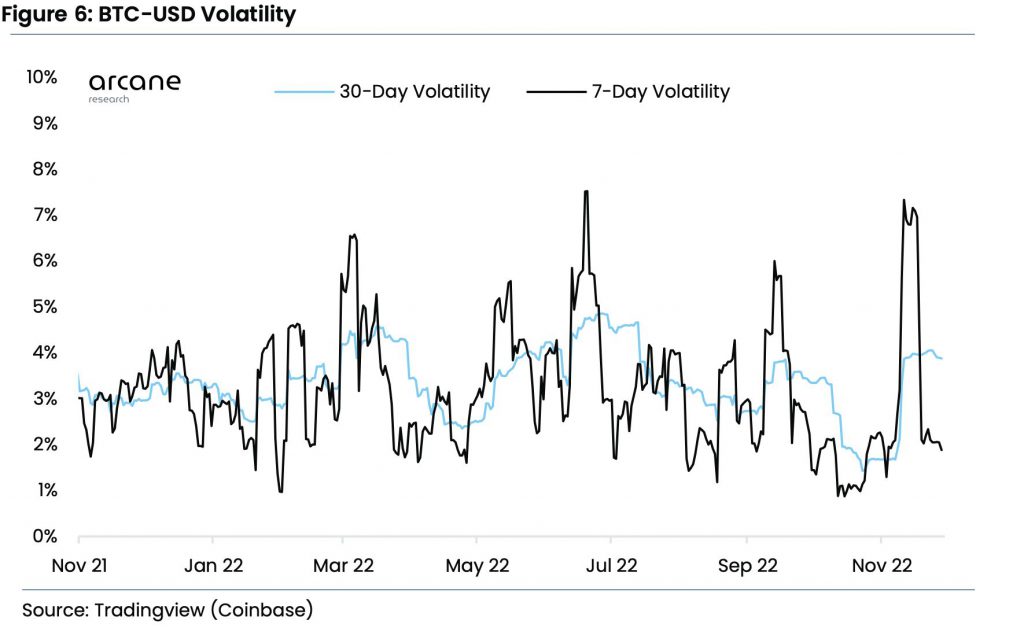

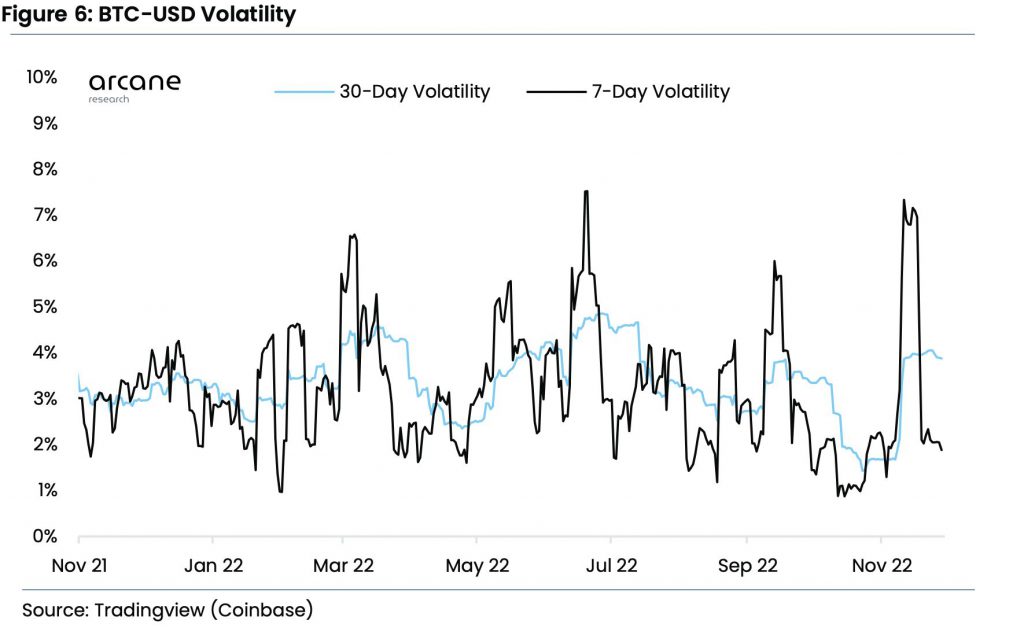

As per the report, BTC’s volatility has significantly decreased, and the market has become less active. The market quickly adjusted to the FTX shock, which caused volatility to soar in mid-November; however, prices have since steadied. Prices have stabilized above $15k as contagion-related fears persist, and BTC’s seven-day volatility has dropped to 1.8%.

At press time, BTC was trading at $17,125.00, up by 1.3% in the last 24 hours.