Even though The Merge is nearing, the broader market seems to be getting ripe for short traders. The upgrade, on its part, is expected to play the role of a catalyst and turn the tables around. However, at this point, it seems like Bitcoin is the captain of its own ship. As highlighted in a recent article, the largest crypto has been hesitating to join the Merge party, and with every passing day, its disinterest is only becoming more obvious.

Bottom formation anytime soon?

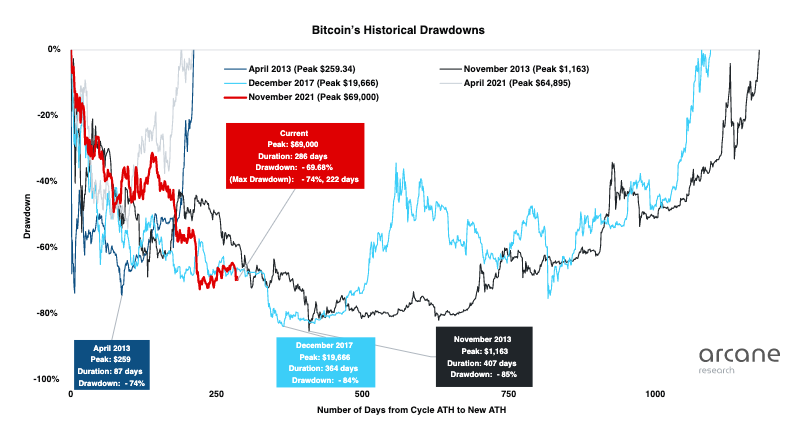

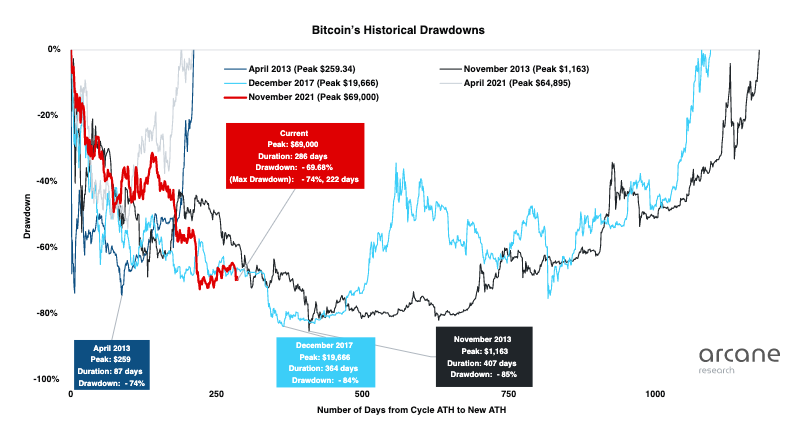

At the moment, Bitcoin is down by approximately 70% from its ATH of $69k and the current drawdown has lasted for more than 280 days. In the 2014 and 2018 bear markets, the bottoms occurred 12-13 months after the bear markets began. Notably, the maximum drawdown noted was 84-85%.

The current market cycle shares traits similar to past cycles, and per Arcane Research, the 2022 bear market is on track with the 2018 bear market. Per the research and analysis platform,

“If history is to repeat, a bottom could be expected to form near the year-end.”

However, the market has been evolving and with the rising macro-adoption, it’s a slightly different ball game for Bitcoin now. Last year’s double top in April and November was nothing like what the markets had previously seen. Similarly, the eco-systemic collapses like that happened earlier during the year were also a first of a kind.

So, before jumping to any conclusions, let’s have a look into the trader sentiment to get a better understanding of where Bitcoin is headed next.

CME’s Bitcoin futures trading at sharpest discount ever

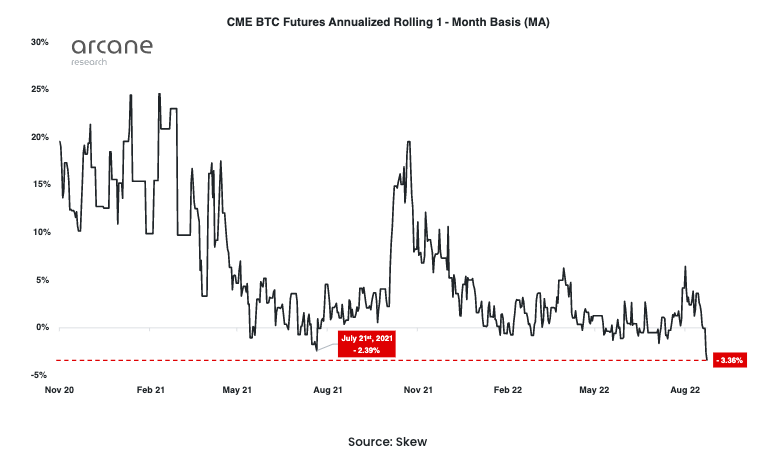

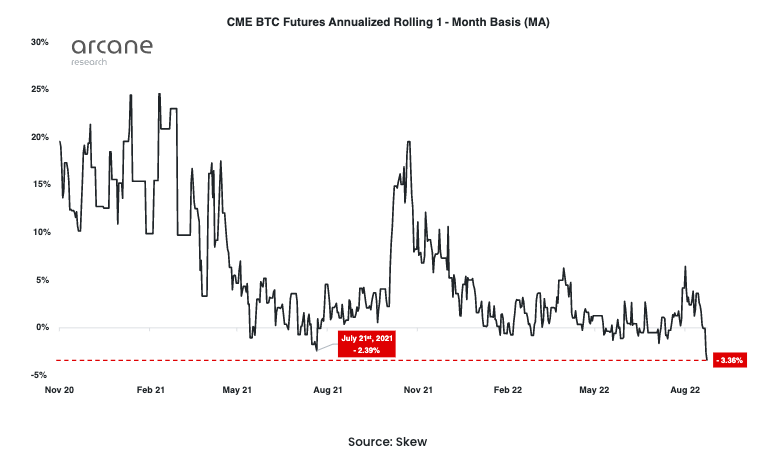

It was recently observed that BTC futures premiums dropped down to local lows. During last Friday’s sell-off, BTC’s futures basis on both Binance and CME was propelled to its lowest levels since late June. Basis, as such, represents the difference between the spot price of an asset and the futures price of the asset.

Furthermore, Arcane Research highlighted,

“CME’s front-month contract sees its largest discount to the spot market ever recorded.”

The front-month futures contract is basically CME’s most traded BTC contract. And as illustrated below, the futures’ basis is trading in sharp backwardation as the annualized basis reached an all-time low of -3.36% during the beginning of this week. Per Arcane Research,

“…such extreme discounts have not appeared during previous rolling periods. They might be a symptom of worsening liquidity or general de-risking…”

Despite the not-so-favorable trader outlook, it is worth noting that,

“While BTC derivatives might signal a climate ripe for a short squeeze, the choppy trading range alongside global market turmoil speaks in favor of conservative positioning and gradual accumulation in the spot market.”

Furthermore, it is also interesting to note that CME’s quarterly contracts trade at a slight premium at this stage, indicating that the road ahead is not completely dark for Bitcoin over the mid-term. As discussed above, the short-term trader sentiment, however, remains to be pessimistic.