On July 1st, the U.S. spot Bitcoin ETF pulled a whopping $130 million. That’s an enormous change! This is the biggest influx we’ve seen in weeks and could hint at an investor perspective shift.

This surge marks the largest influx in weeks and might signal the start of changes in investor sentiment.

Also Read: Bitcoin (BTC): Analysts Predict ‘Bullish July’ After 7% Fall in June

Crypto ETFs Rake in $130M: What’s Driving This Investment Wave?

Current ETF Inflow Trends

Let’s break down these amazing ETF inflows to better understand how impressive this shift is. Fidelity’s FBTC has the highest inflow, with $65 million.

At the same time, Bitwise’s BITB was also close to this value. It had an impressive $41 million. Furthermore, Ark Invest and 21Shares’ ARKB saw $13 million in net inflows.

If you’re asking the question ‘’But, what about the other player?’’, you are not the only one. Other players like Ivesco, Galaxy Digital, and VanEck also recorded inflows of about $5 million.

What’s even more surprising is the fact that BlackRock’s IBIT and Grayscale’s GBTC saw zero flows on that day. Furthermore, these are the two largest spot bitcoin ETFs when calculating net asset value. Interesting, right?

Also Read: Ethereum ETFs Expected to Capture 20% of Bitcoin ETF Flows

Investment Trends in the Crypto Market

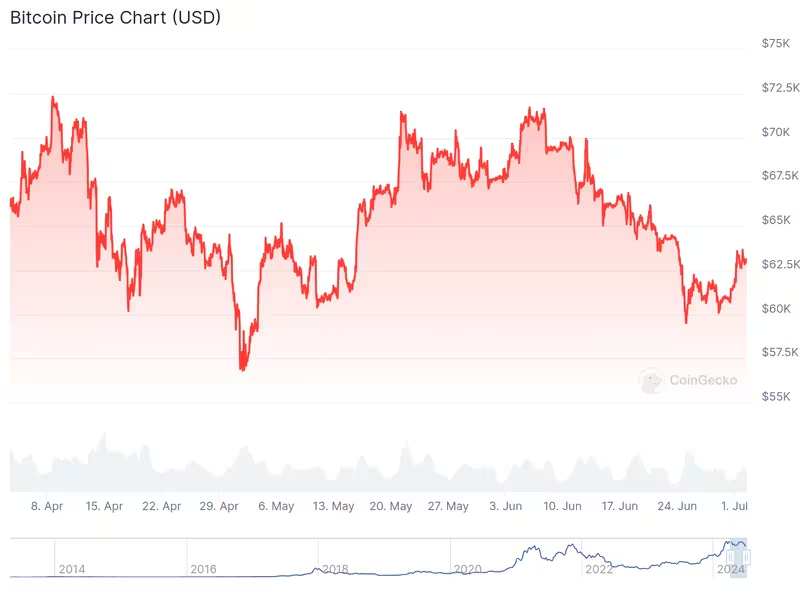

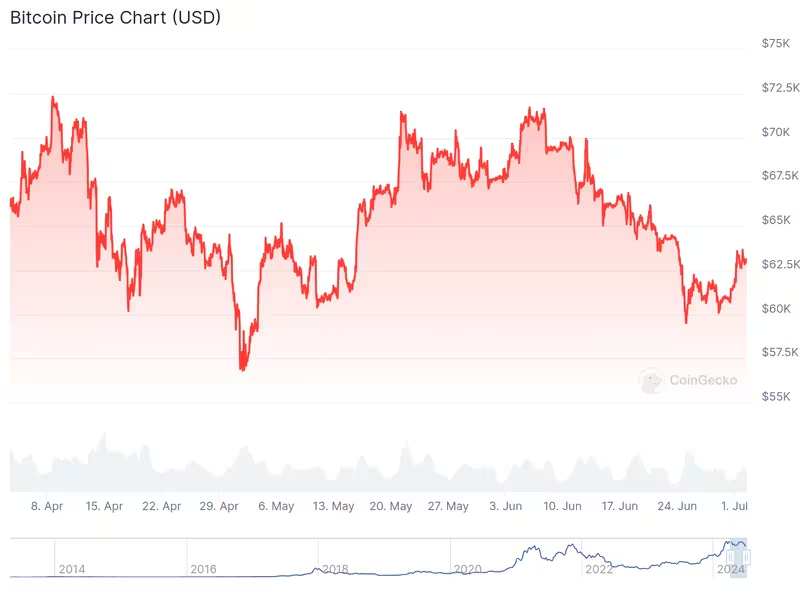

These above-mentioned ETF inflows are, of course, closely related to the larger trend of investments. Furthermore, while bitcoin’s price has dipped 0.3% to $63,094 on the first day, it’s important to note the bigger picture. Bitcoin has unfortunately been on a rollercoaster ride, recovering from a dip below 60.000 a week before. Of course, its value is still lower than the $71.000 peak in June.

Furthermore, investment trends are also influenced by seasonal patterns. If we take a look at the history of this topic, both Bitcoin and ether tend to perform better in July.

Also Read: Bitcoin Predicted to Reach $200,000 by 2025 Says Bernstein

As we all know, a 130 million surge in ETF inflows is a significant shift in the crypto trends. By looking at the transactions that were made, we can safely state that there is a three-week high which might be caused by the investor confidence skyrocketing.