According to a report by Glassnode, the cryptocurrency industry’s first net capital inflow since April 2022 peaked in February 2023 at over $5.8 billion/month on a 30-day change basis. Inflows were primarily led by Bitcoin (BTC) and Ethereum (ETH). However, in the past month, the market has experienced a reversal outflow of -$5.97B. 20% of that comes from realized losses across BTC and ETH. Meanwhile, 80% came from stablecoin redemption (mainly BUSD).

On the other hand, March 2023 has turned out to be quite the rollercoaster ride. Three banks in the U.S. declared voluntary liquidation or were taken into receivership by authorities. The cryptocurrency market inherited some volatility from the banking crisis, but the carnage was short-lived. As the banking crisis took shape, investors flocked to other investments such as Bitcoin (BTC) and Ethereum (ETH).

A strong rally caught the market off guard and brought Bitcoin back above $22,000 and ETH beyond $1,600. This was driven by the news of bank deposits being guaranteed.

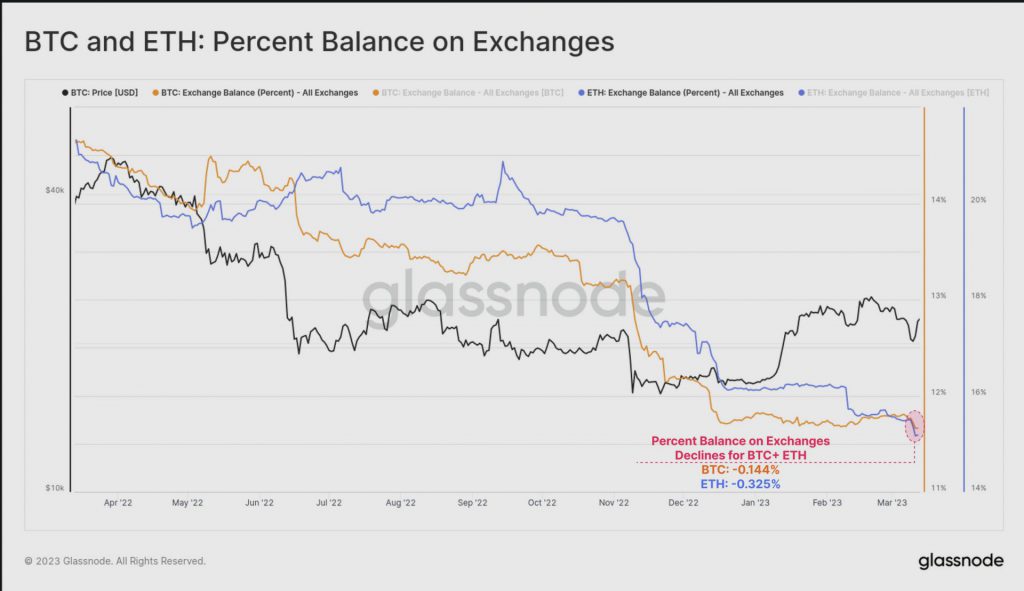

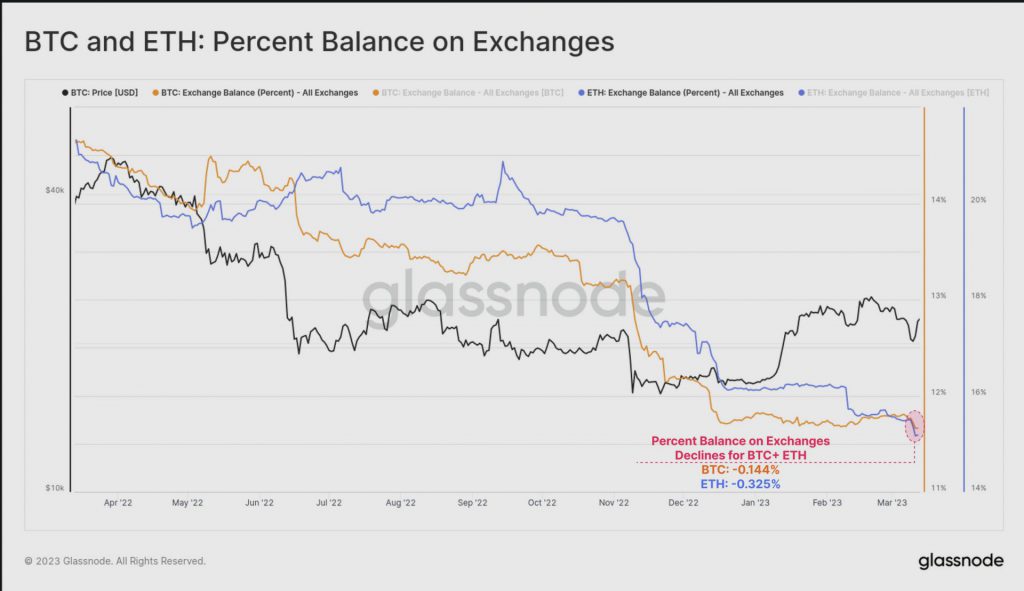

About 0.144% of all Bitcoin (BTC) and 0.325% of all Ethereum (ETH) in circulation were removed from exchanges. The response pattern was similar to the FTX fall in November 2022.

According to Glassnode, $1.8 billion worth of Bitcoin (BTC) and Ethereum (ETH) left exchanges in February on a USD basis. Although this may not seem like much in terms of scale, seeing net exchange withdrawals, particularly in the face of the current unfriendly regulatory climate, does indicate a certain level of investor confidence.

According to a report by Glassnode, last week the first time in Bitcoin’s (BTC) history that the asset has traded below the 200-week moving average (MA).

Bitcoin and Ethereum aside, stablecoins take a hit

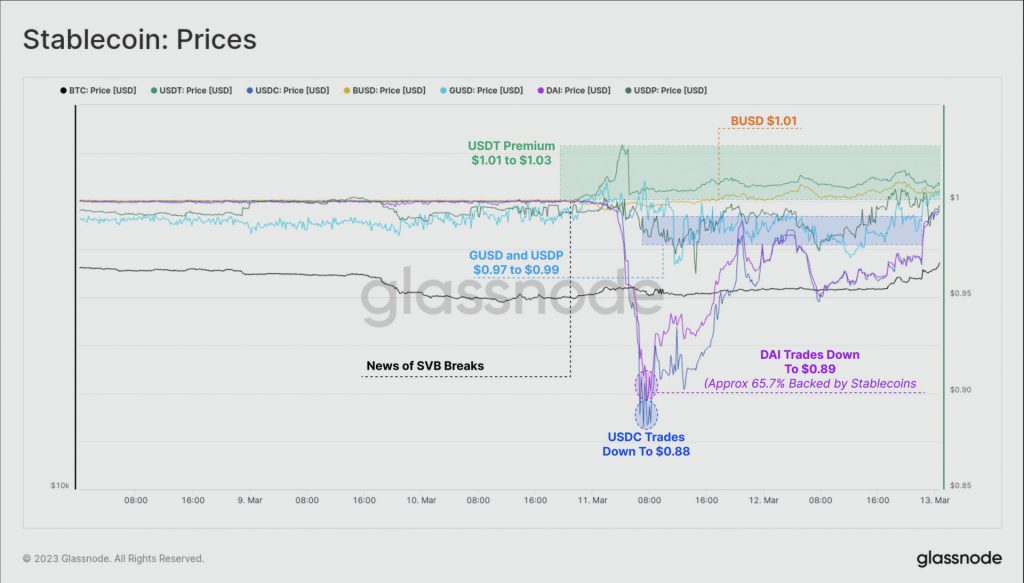

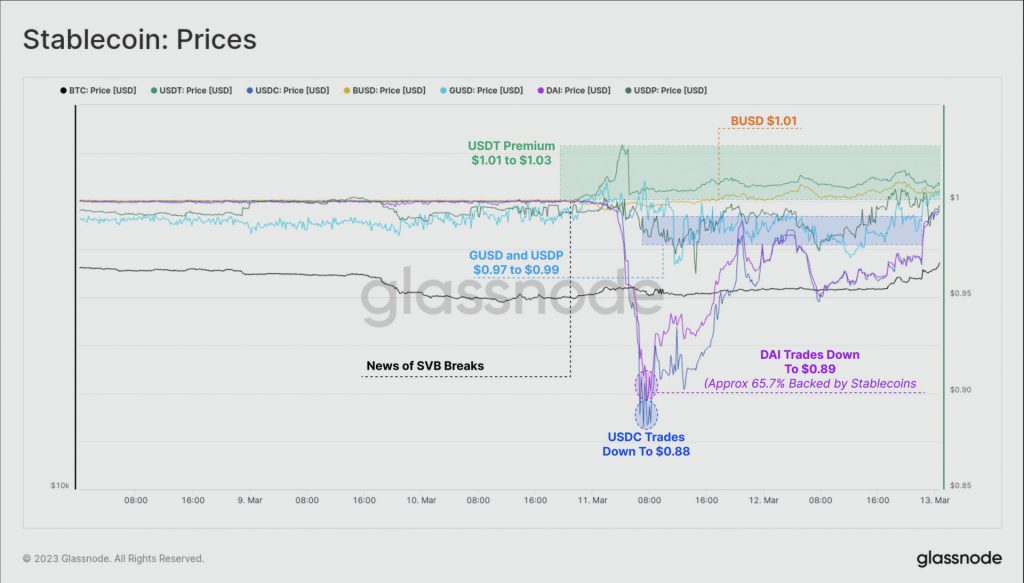

This week, stablecoin prices were volatile for the first time since the failure of the LUNA-UST project. This was driven by worries that USDC was partially un-backed. USDC fell as low as $0.88, with DAI just behind at $0.89.

While GUSD on Gemini and USDP on Paxos both traded at a tiny discount to their $1 peg, BUSD and Tether prices traded at a premium. Throughout the majority of the weekend, a premium between $1.01 and $1.03 emerged for Tether in particular.

Ironically, Tether is being viewed as a safe haven amid concerns about a bigger contagion coming from the strictly controlled U.S. financial industry.