Bitcoin has gone from being held only by the cyber community, to it being held by nation-states and Wall Street. The original cryptocurrency has come a long way to being globally recognized as an alternative to traditional finance.

According to Arcane Research, with the institutional adoption of Bitcoin (BTC), the on-chain analysis will become less and less useful over time.

Arcane Research has released their March data in regards to Bitcoin (BTC) as an Exchange Traded Product (ETP).

Takeaways in March

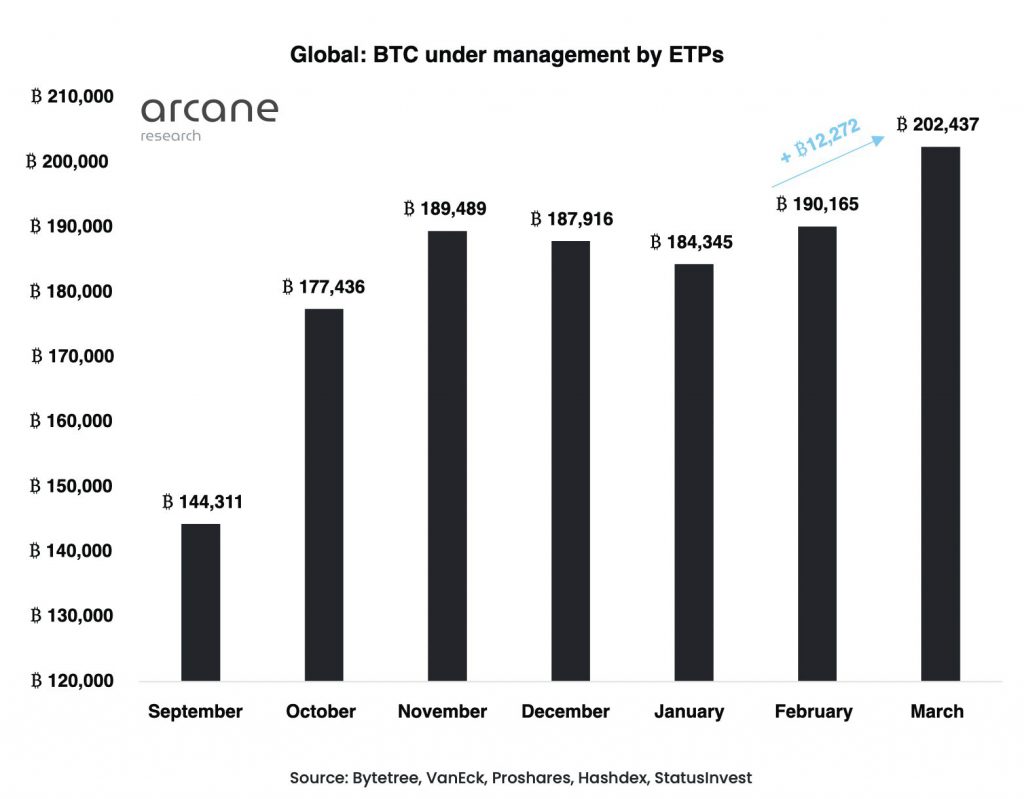

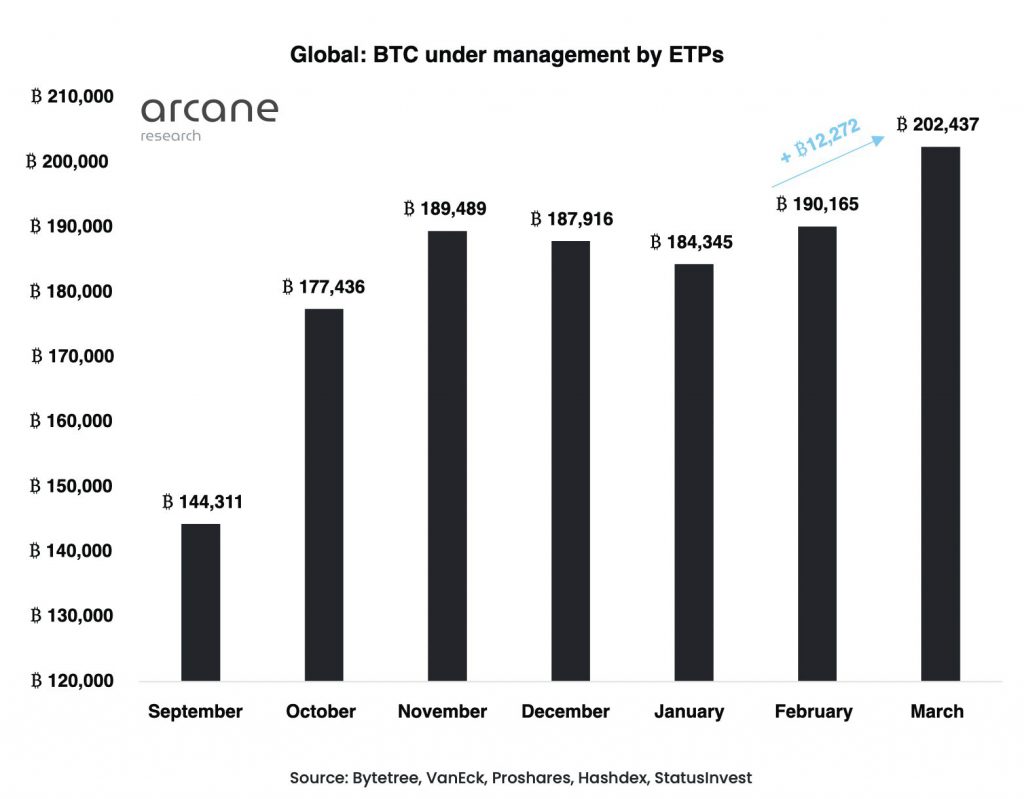

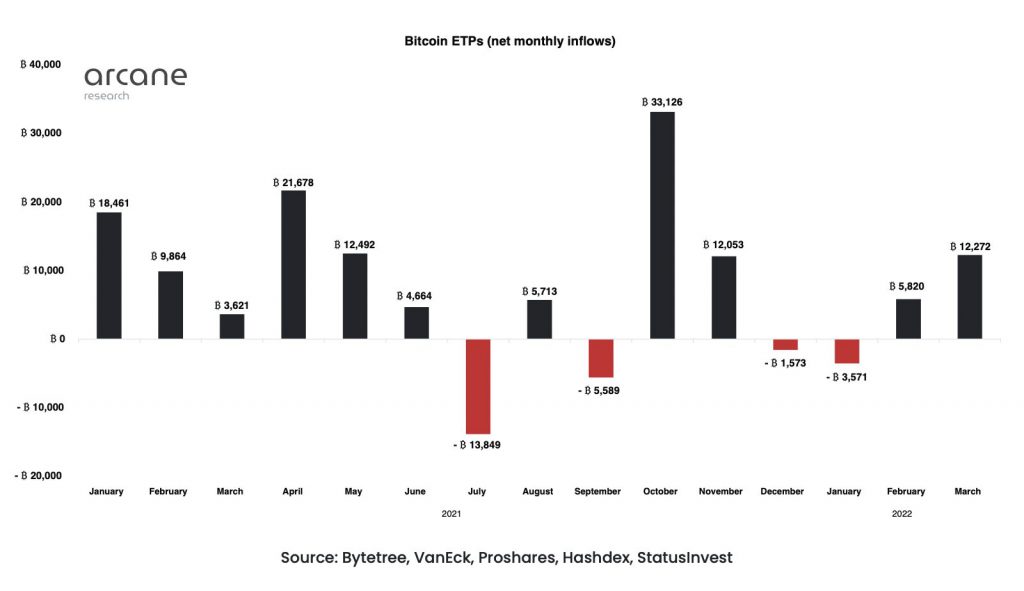

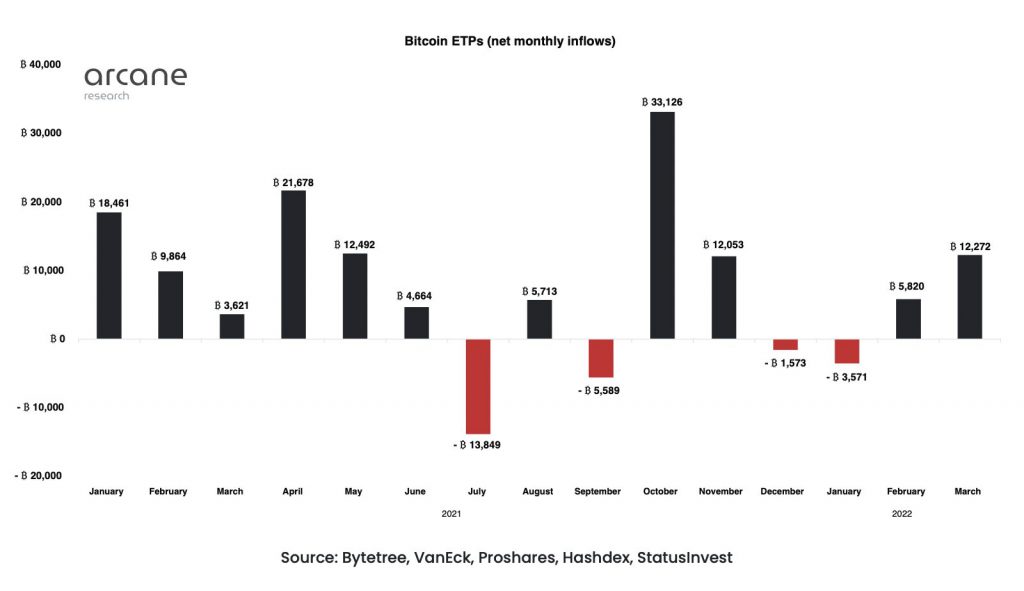

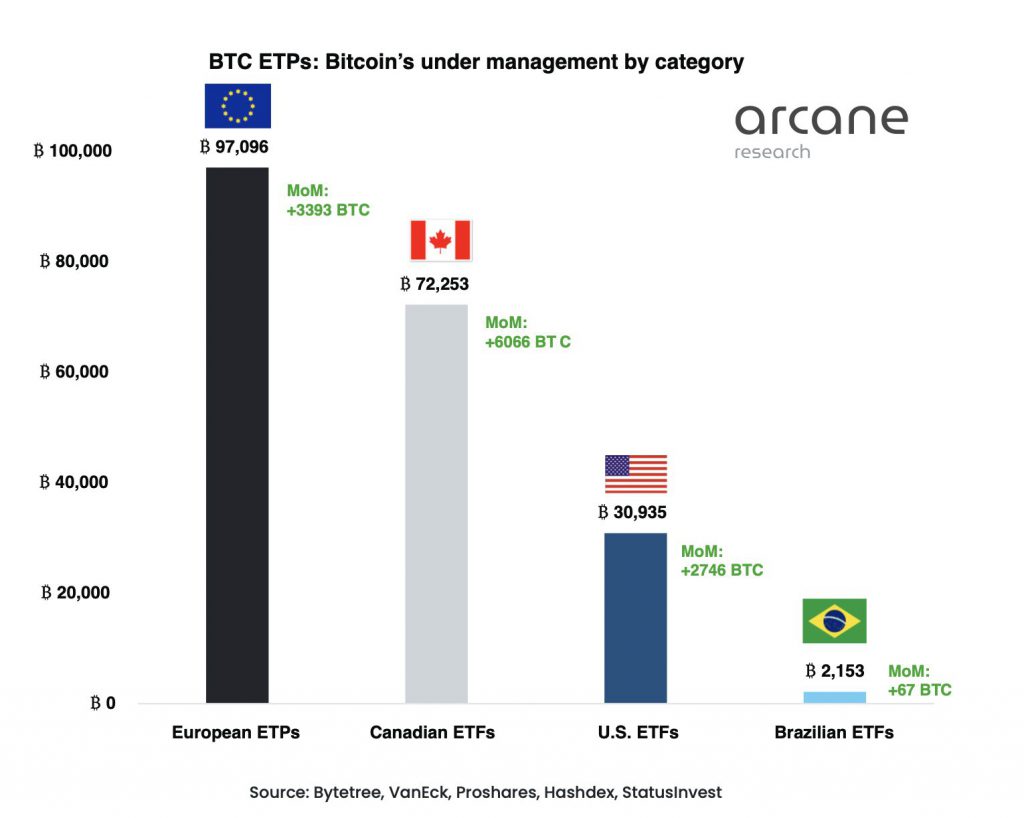

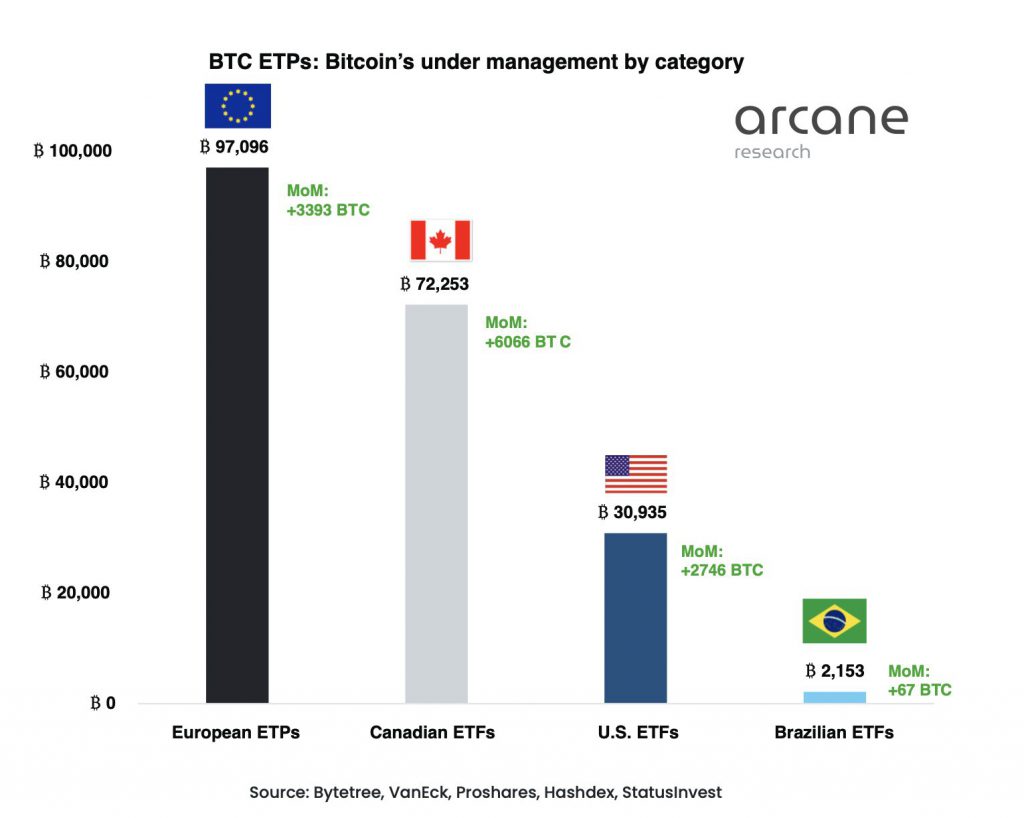

March saw net inflows of 12,272 BTC, making it the best month for ETP inflows since November last year. In March, the AUM of BTC ETPs crossed 200,000 BTC, setting a new all-time high. Since June 2020, the AUM of Bitcoin ETPs has grown by 136,641 BTC or 151 days of mining rewards. In March, all ETP regions had positive net inflows, with Canadian ETFs seeing the most rapid growth, boosting their AUM by 6,066 BTC.

The rolling period from March 21st to March 25th saw positive inflows by ProShares. Sluggish flows have accompanied all past rolling periods, probably due to the associated rolling costs. The strong BTC against the backdrop of LFG’s Bitcoin Reserve Strategy may have produced favorable flows during the rolling week in March.

In March, Europe saw significant inflows after three months of net outflows.

Overall, BTC ETPs had a very good month in March, indicating that there is a growing demand for BTC exposure in legacy markets.

Bitcoin sees strongest inflows of ETP’s since November 21’

In March, the positive ETP flows from February persisted and intensified, resulting in net inflows of 12,272 BTC, bringing the worldwide BTC exposure of Bitcoin ETPs to over 200,000 BTC. In March, Bitcoin ETP inflows reached their highest level since November of last year. Overall, investors wishing to gain BTC exposure through traditional vehicles have increased their appetite in all jurisdictions, reflecting a more favorable sentiment among investors looking to allocate for additional upside.

In 11 of the 15 months since January 2021, BTC ETPs have had net inflows. Since January 2021, March 2022 has been the 5th best month for inflows. However, it’s worth noting that the strength seen in April and May of last year was fueled by the introduction of many new products in Canada, whereas the inflows in October and November were fueled by the introduction of several futures-based ETFs in the United States. The debut of any new items, on the other hand, had no impact on the March flows, which were produced by organic inflows.

The global AUM (Assets under management) of Bitcoin ETPs has increased by 136,641 BTC since June 2020, equivalent to 151 days of BTC reserves. Strong ETP inflows in the last two years have played a role in absorbing BTC supply, but they are far from the only factor. Grayscale’s closed-ended BTC fund GBTC received enormous inflows from June 2020 to February 2021, rising by 294,000 BTC from 360,000 BTC to 656,000 BTC. Furthermore, roughly 225,000 BTC has been amassed by publicly traded corporations. The Luna Foundation Guard is currently on target to acquire 60,000 BTC. We also have the effects of supplies being absorbed by other hodlers in addition to all of these effects.

In March, the European Bitcoin ETPs also had net inflows after three months of outflows. The net inflows totaled 3,393 BTC, bringing the total AUM of the European BTC ETP to 97,096 BTC. This is the greatest monthly net inflow in European ETPs since October and the fourth-highest since January 2021.

Overall, March was a very successful month for Bitcoin ETPs, with AUM reaching new all-time highs and pushing past 200,000 BTC in an organic growth phase. The rising desire for BTC exposure through traditional investment vehicles in bitcoin indicates that market sentiment is improving, particularly among investors seeking exposure through legacy markets.