Crypto asset prices are far from showing signs of recovery. Over the past day, the aggregate value of all cryptos from the market noted a mere 0.09% change and stood at $809.49 billion at press time. Bitcoin’s valuation also remained unaltered over the past day and was seen trading at $16.8k on Thursday.

The market has not yet fully recovered from the damage caused by FTX’s collapse. Fear is still lingering in the minds of market participants. In fact, the current reading of the F&G index [28] supported the said narrative.

Despite that, certain proponents feel that crypto and related sectors will eventually end up blossoming. A few hours back, for instance, Changpeng Zhao, the CEO of Binance tweeted:

Also Read: Binance’s CZ Tweets About Bitcoin “Brain Wallets”: What Are They?

What Are Bitcoin Investors Upto?

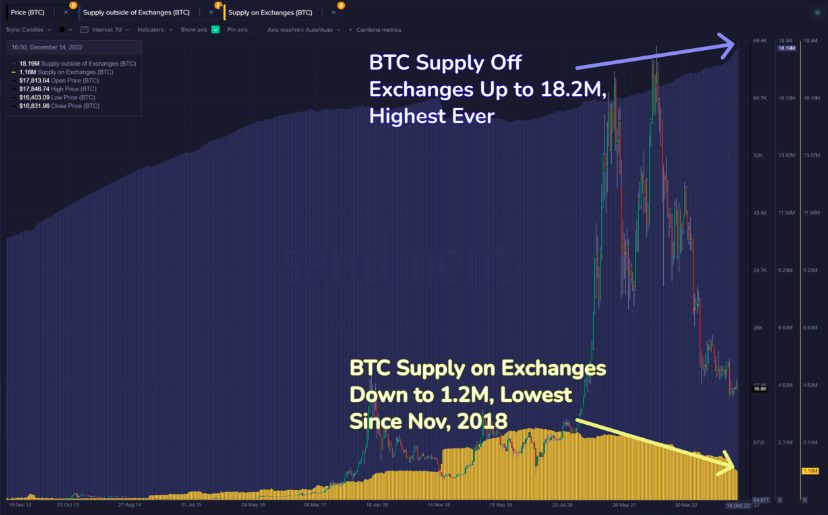

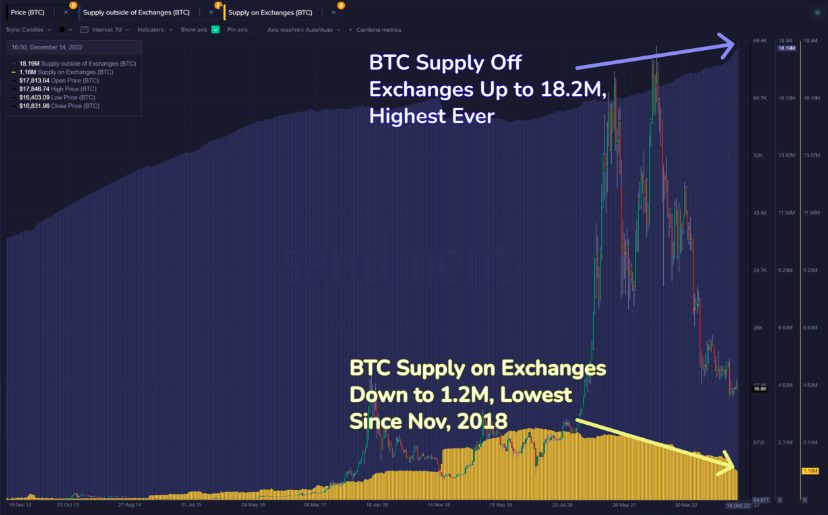

Even though there’s a lot of FUD at the moment, participants remain to be cautious. A recent tweet from Santiment revealed that investors have been moving Bitcoin to self-custody wallets. In fact, the number of coins in self-custody continues to create new all-time highs. Chalking out the current reading of the said metric, the analytical platform’s tweet revealed,

“The amount of coins in self-custody continues creating a new AllTimeHigh, now at 18.2M BTC.”

Alongside, it is interesting to note that the exchange supply has stooped down to a fresh 4-year low. Conventionally, lower values of the exchange reserve metric indicate that participants have been buying BTC. And at this stage, it perhaps seems like they are buying fresh crypto to HODL them for the long term by transferring them to cold storage.

Chalking out the current balance on exchanges, Santiment noted,

“Meanwhile, coins on exchanges is at just 1.2M BTC, a 4-year low.“

Re-affirming the Long Term Narrative

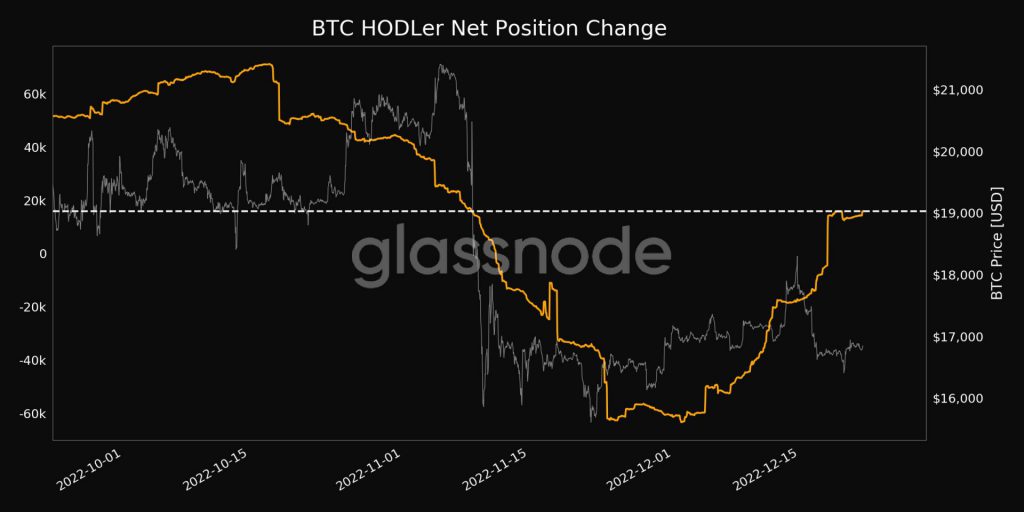

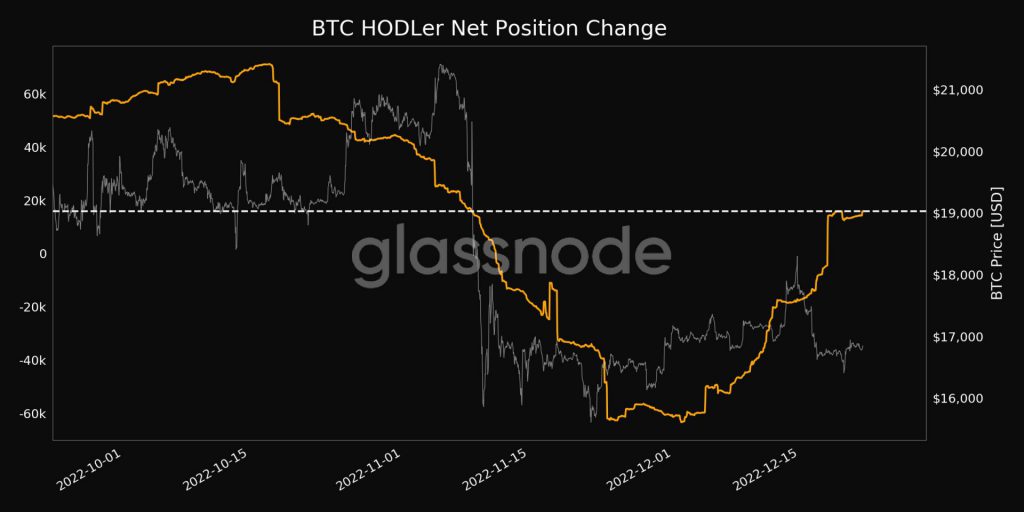

Wobbly periods like these test the conviction and grit of market participants. The scanty selling has managed to stop Bitcoin’s price from falling further. Parallelly, the long-term HODLers, a.k.a. the diamond hands, haven’t given up.

Data from Glassnode revealed that the BTC HODLer Net Position initiated a change in trend in December. The downtrend flipped to an uptrend and this metric went on to claim a 1-month high of 15,967.248 on Thursday.

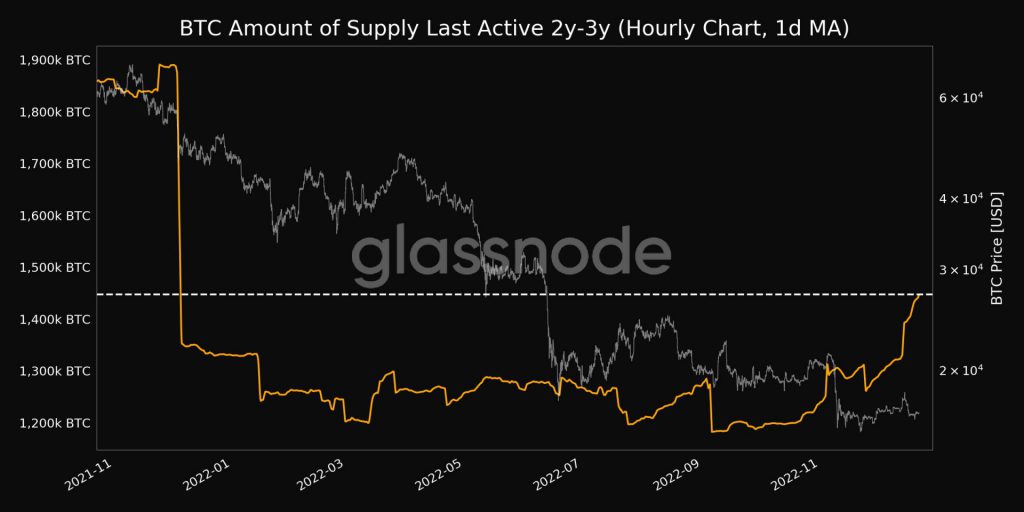

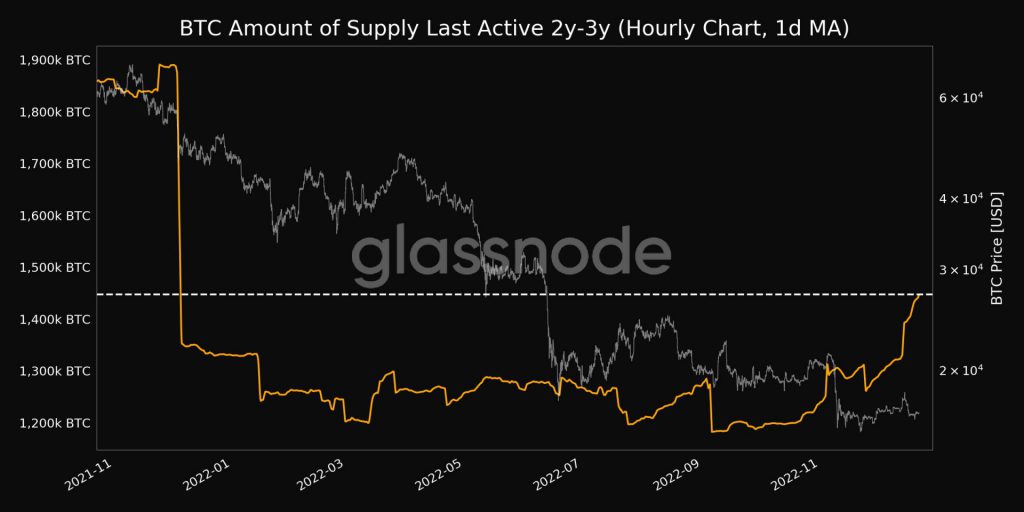

Parallelly, dormancy has also been on the rise. As shown below, the amount of supply last active 2y-3y just reached a 1-year high of 1,447,479.093 BTC, justifying the said narrative.

Thus, in all, on-chain data indicated that investors haven’t succumbed to the FUD as of yet and are making calculative and rational moves.

Also Read: Bitcoin, Ethereum, XRP, Cardano: Which Crypto Ranks No.1 in 2022?