Bitcoin’s CME gap pullback concerns are intensifying right now as a fresh gap formation threatens the $111K support level. The CME futures gap Bitcoin traders have been monitoring closely opened when futures markets resumed trading, and this created a price discrepancy between spot and also futures prices. This Bitcoin price pullback risk actually has historical precedent, as CME gaps tend to get filled in approximately 77% of cases, which makes the current technical setup particularly significant for Bitcoin technical analysis.

Analyzing Bitcoin’s $111K Support Amid CME Gap Concerns

Understanding the Bitcoin CME Gap Pullback Pattern

Bitcoin futures resumed trading with a gap between $111,000 and $109,700, triggering the latest CME pullback. This Bitcoin formation CME futures gap came as the asset is currently trading at spot exchanges over $112,000, which forms a technical magnet that would potentially drag Bitcoin prices down. The gap is one of the key turning points to monitor the possibility of Bitcoin price pullback.

Historical trends show that gaps like this often reopen. In March 2025, a $6,000 gap widened before price action eventually filled the zone. Traders have seen this pattern repeat many times over the years.

Also Read: Gemini Says XRP 5‑Year ROI Beats Bitcoin, Ethereum

Crypto trader Dann said on the topic:

“$BTC Has opened up with a CME gap and has continued higher since the futures open. It has been quite a while since we did open with a gap, like this. These used to close quite quickly. If that were to happen here then the entire structure would look pretty bad in the short term given we’re nearly at those very few gaps that basically never closes or not until months later.”

Critical Support Levels and Bitcoin Technical Analysis

The $111K support zone has become essential for Bitcoin technical analysis, as it aligns with both the CME gap and even psychological resistance. The Bitcoin CME gap pullback events often precede short-term corrections, particularly when gaps remain unfilled for extended periods. Traders across various platforms are actively watching this level at the time of writing.

Dann is also convinced about the fact that:

“Don’t think it’s generally in play until BTC starts trading below $111K.”

This threshold represents the activation point where the Bitcoin price pullback risk becomes more immediate and also more concerning for traders. According to the CME futures gap pattern of Bitcoin, the inability to maintain above the $111K might actually increase the downward momentum toward the gap fill area. Market players remain divided on whether the gap will close soon or stay open.

Also Read: Tim Cook Owns Bitcoin and Ethereum, But Apple Rejects Crypto

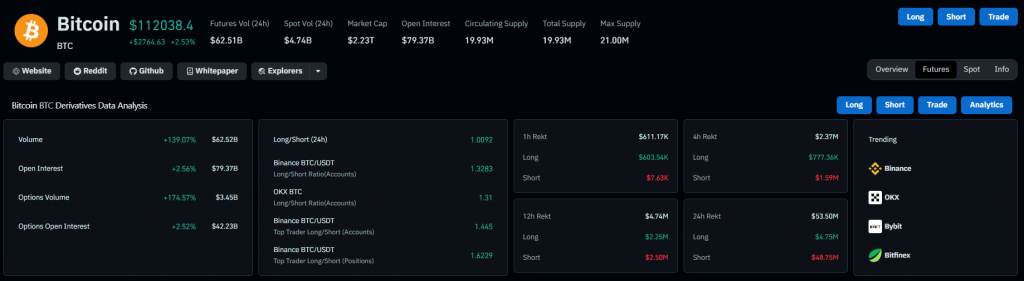

Traders have pushed open interest higher in derivatives markets, while mixed long and short positioning reflects uncertainty over whether the CME gap will close soon. Bitcoin analysts now identify $111K as the key battleground—either the pullback materializes, or continued strength above this level invalidates the gap risk.