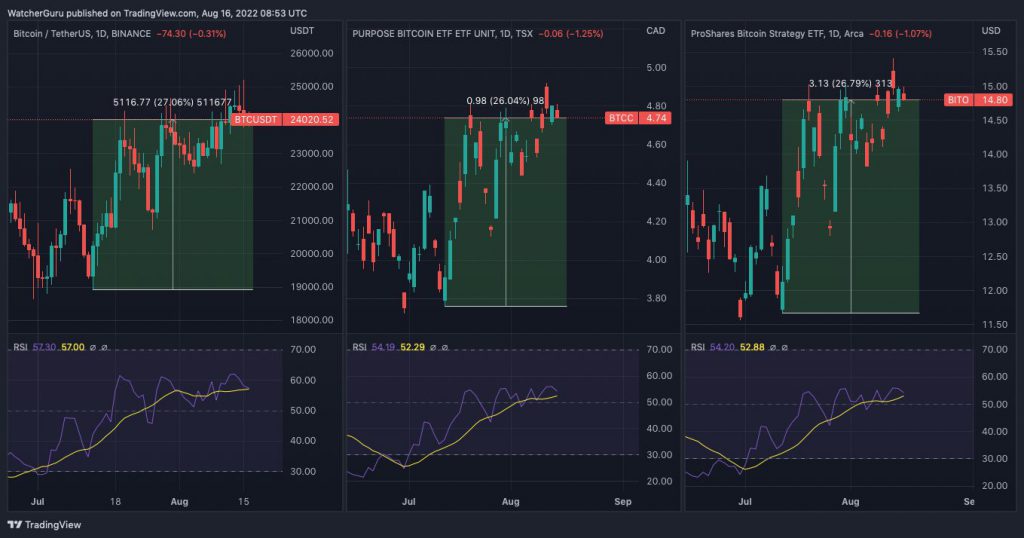

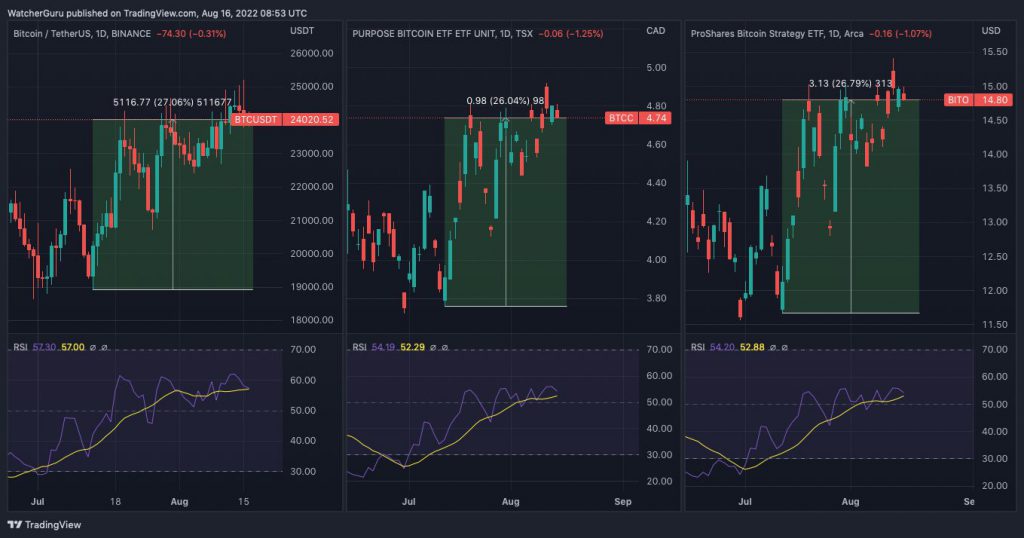

Bitcoin has been recovering of late. Alongside, funds providing exposure to the asset have also started faring well. Take the case of Canada’s Purpose ETF itself, for instance. In mid-July, BTCC was trading at its local lows around 3.7 CAD. However, now, its price stands at 4.7 CAD.

US’s ProShares Bitcoin ETF has also increased from $11.6 to $14.8 in the same period. When viewed in conjunction, BTC, BTCC, and BITO have all inclined by the same 26%-27% over the past month.

Bitcoin institutional flows revisit the negative territory

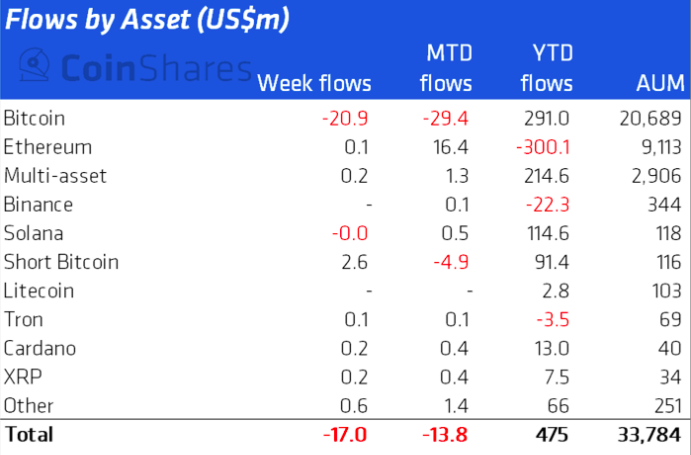

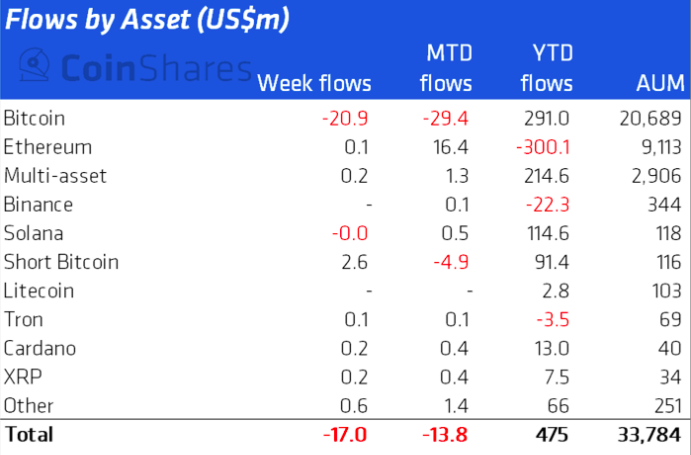

Even though the price landscape looks encouraging, it should be noted that institutions—on the whole—have been parting ways with their assets. The latest data from CoinShares revealed that Canada registered the most significant institutional investment product outflow last week [$25.7 million]. And Purpose, single-handedly, contributed $7 million to the same. ProShares also let go of assets worth almost $10 million last week.

As far as the asset-wise breakdown is concerned, Bitcoin-related investment products saw the most negative flows. Chalking out the same, the report noted,

“Bitcoin bore the brunt of the outflows which totalled US$21m last week, this being the second consecutive week of outflows bringing month-to-date outflows to US$29m. Short-bitcoin saw minor inflows totalling US$2.6m.”

Role of institutions

Well, all hope is not lost. Despite the negative flows registered, Bitcoin’s fundamentals remain “quite good.” The same will “create a demand shock” in the long term, per Skybridge Capital’s Anthony Scaramucci.

In an interview with CNBC, the executive said he’s optimistic because “two major things have happened on the institutional side,” which will likely generate demand for Bitcoin. Outlining the first happening, he said

“Fidelity is allowing for their 401k products to offer Bitcoin.”

Notably, FinServ company Fidelity Investments now allows companies to offer employees the option to invest up to 20% of their retirement and savings plan in Bitcoin. The same is a progressive sign and brings to light the rising adoption. A recent WSJ article also asserted that pension funds across North America remain bullish on crypto, despite the macro bear market losses incurred.

Furthermore, Scaramucci cited Blackrock’s offering of a private trust for clients to invest in Bitcoin as the other reason that will play the game-changer role. Notably, the investment management firm, which has about $8.5 trillion worth of AuM, recently announced a partnership with Coinbase that allows its institutional clients to buy Bitcoin.

Read More: BlackRock Launches Private Trust Offering Spot Bitcoin Exposure

So yes, with time, as the demand for these Bitcoin-associated investment products rises, the companies will be triggered to increase their AuMs. And when then happens, the fund flows will, of course, hover in the positive territory comfortably, and Bitcoin’s price will also be propelled. Over the short term, however, institutional sentiment will continue to be indecisive.