Bitcoin is one of the most recognizable crypto assets in the world. Countries are adopting Bitcoin, and billion-dollar companies are adding it to their balance sheets. It is clear that Bitcoin has value. But where does this value come from? We look at the most critical factor driving Bitcoin’s value up – scarcity.

Gold Vs. Bitcoin: The Scarcity Race

Gold is scarce. Similarly, Bitcoin rides on the scarcity wild card. By this point, we all know that scarcity creates demand. However, something else is at play here. In a similar fashion to Gold, Bitcoin’s total supply cannot be altered.

READ ALSO: Morgan Stanley Funds Is Increasing Bitcoin Exposure

This is not true for gold. While gold is scarce, it is also in plentiful supply on the earth. Much of gold’s value comes from its complicated extraction process. In the race for scarcity, Bitcoin wins because there are only 21 million BTC in existence.

The Bitcoin Halving Event

Like gold, Bitcoin has ‘ores’ called blocks. Every block produces a certain amount of Bitcoins. As of the time of writing this article, one block produces 6.25 BTC.

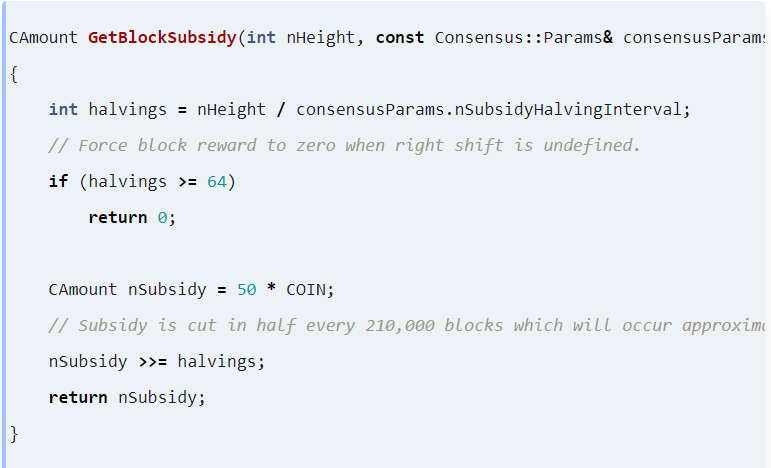

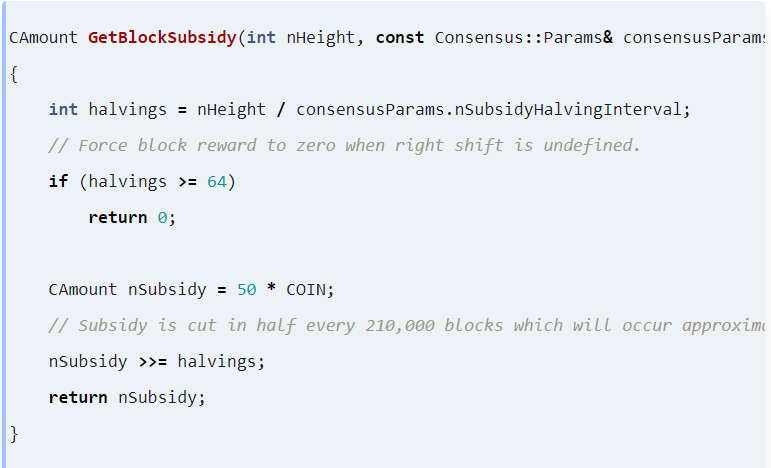

However, this was not always the case. When Bitcoin was invented back in 2010, one block would produce 50 BTC. It turns out that the Bitcoin contract was programmed to cut supply in half after every 210,000 blocks. This amounts roughly to every four years.

How Many Bitcoin Halving Have Occurred?

For the nerdy turtles out reading this, the GetBlockSubsidy() function can be found here.

READ ALSO: Celsius Lending Firm Will Invests $300 Million Into Their Bitcoin Mining Operations in North America

To know how many halvings Bitcoin has had, we divide the current block height by 210,000. Bitcoin has a current block height of 711066. Dividing this by 210000 gives you 3.386. However, a halving is an event and therefore cannot have fractions or decimals. This means that BTC has had approximately three halvings.

The Future of BTC Supply

There are many platforms that track the supply reduction of Bitcoin. For example, Buy Bitcoin Worldwide tracks BTC halving metrics, including blocks and time remaining to the next halving. According to this platform, the next Bitcoin halving will take place on March 26, 2024. This is 852 days, 23 hours, and 57 minutes away as of the time of writing.

The platform also records that there are 128,844 blocks remaining until the next halving. Remember, a halving takes place after every 210,000 blocks. The next halving is scheduled to happen at block 840,000. Hence, doing quick mathematics, we discover that BTC is only 61% to the next halving – How time flies!

After the March 2024 halving, one block of BTC will produce 3.125 BTC. Consequently, this will drive BTC availability even lower since the amount of new BTC entering the market reduces. The forecasts of Bitcoin’s price are heavily pegged on its supply.

As the supply diminishes, the demand for Bitcoin remains not only steady but also organically grows. For example, nations like El Salvador have adopted Bitcoin, increasing its demand. Also, multi-national companies like Tesla now own Bitcoin.

If you are a Bitcoin enthusiast, this information should help you keep track of Bitcoin halvings.