The national currencies of Argentina, Turkey, and Egypt have been consistently falling against the U.S. dollar. The Peso has not been able to cap its losses over the past year. In fact, on the chart, the trend is a consistent decline. The lira, on the other hand, did manage to cap its losses and trade horizontally during the end of 2022, and the initial few months of this year. However, that trend was too good to last.

Over the past few weeks, these currencies have registered a streak of long red candles. In fact, people from space have started addressing the Turkish lira as the ‘suppressed’ lira.

The Egyptian pound’s state, however, seemed to be better than the other two currencies. After registering a choppy H2 in 2022, and subsequently beginning 2023 on a bearish note, this currency is currently consolidating. The post-Covid implications, spiraling inflation, political woes, and other macroeconomic instability factors have played a role in eroding the value of these three currencies.

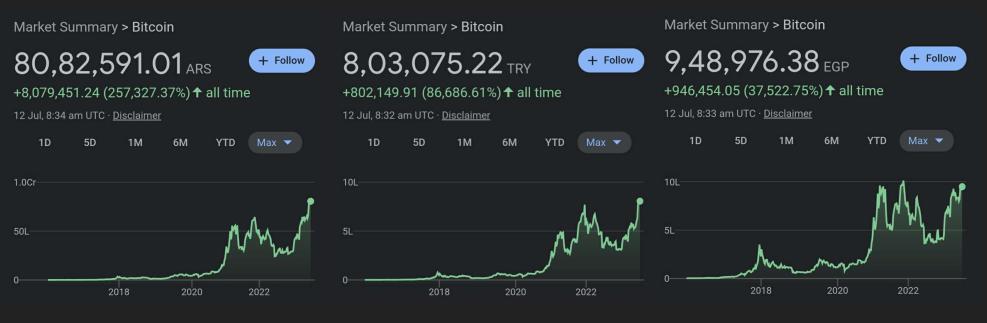

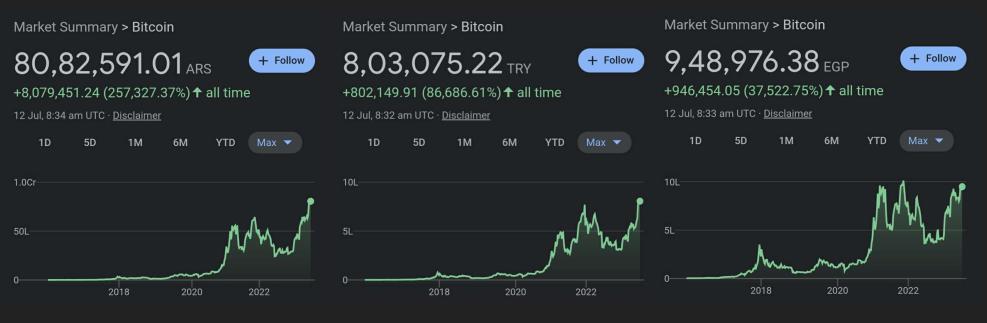

Amid the devaluation acceleration, Bitcoin’s price against the Argentine peso, Turkish lira, and Egyptian pound has bumped. In fact, in Argentina and Turkey, it is already trading at an all-time high value. Bitcoin was priced at 8,082,591 ARS and 803,075 TRY at press time. In Egypt, however, the price is still on the brink of breaching its previous high and creating a new peak. One Bitcoin was worth around 948,976 Egyptian pounds on Wednesday, June 12.

Also Read: Bitcoin’s 2023 Correlation with Cardano, Shiba Inu, XRP Dips

Crypto demand in ATH regions

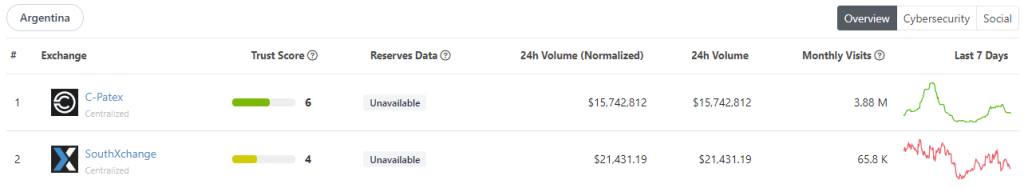

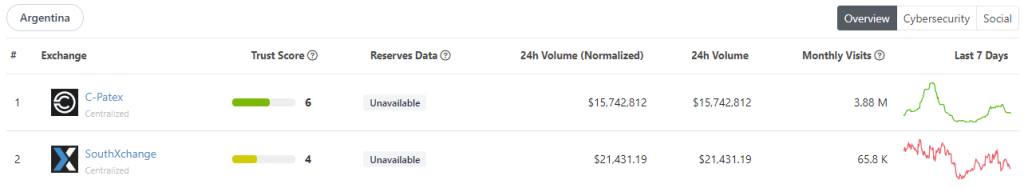

In Argentina, the volumes of crypto assets have slashed over the past week. During the initial few days, this metric peaked on the top-2 local exchanges but it gradually subsided. Over the past day, they managed to facilitate trade volumes of around $15.7 million and $21,400 respectively.

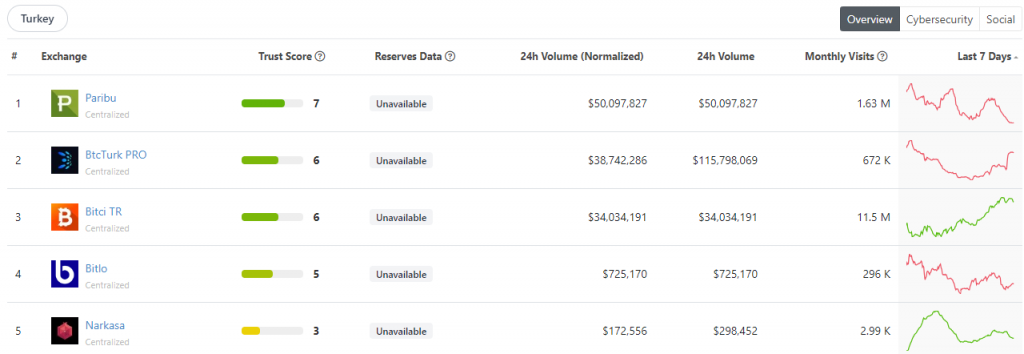

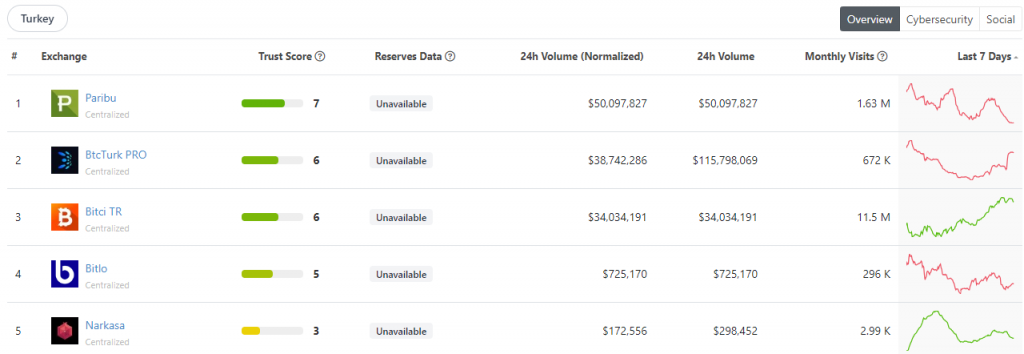

In Turkey, the other country where BTC hit an ATH, the trend was slightly different. On two native exchanges, volume improvements have been registered on the weekly front. While on the other three, the trend has not been that impressive, indicating that the community remained divided at this stage. Over the past day, volumes traded on these platforms ranged between $50 million to $172,500.

Also Read: South Korea Issues New Crypto Accounting Rules