The cryptocurrency market sits at a 2 trillion US Dollars market cap, with Bitcoin occupying $1.18 trillion. This is a 600% growth as of 3 November 2020. The overall increase in the crypto market has made analysts believe that Bitcoin might grow to a $200T market cap soon.

BTC Price Live Data

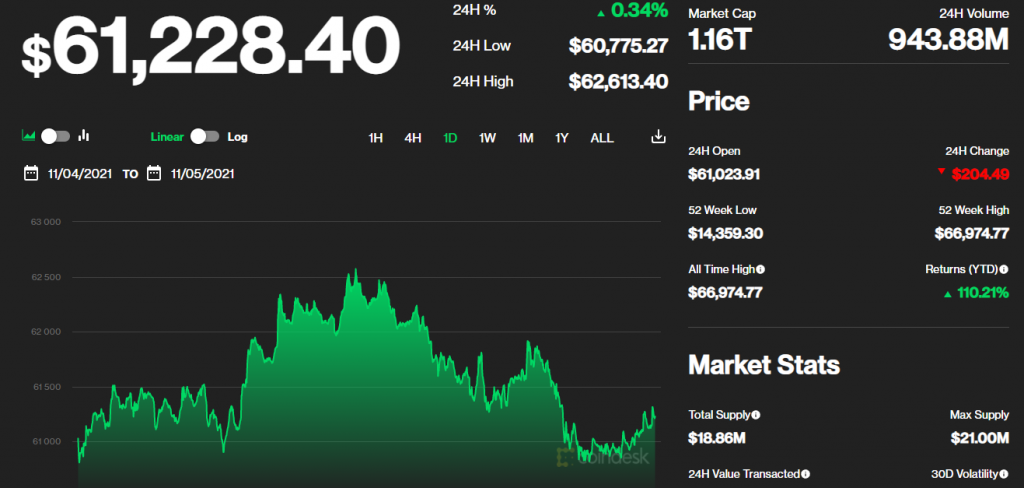

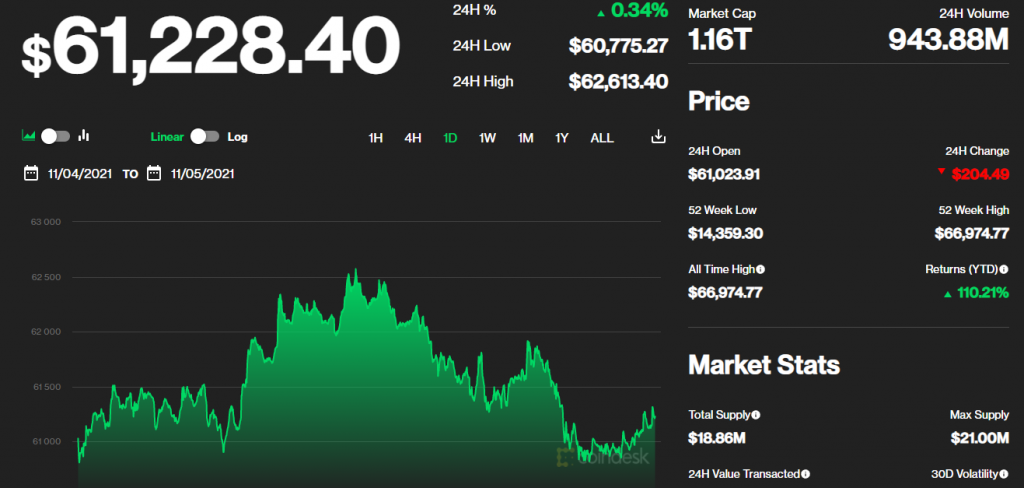

Before looking at Bitcoin’s potential market cap, it is important to know its current live data and trading volume. Bitcoin’s live price is $61,546.58, trading with a $32,073,823,086 24-hour volume when writing this article.

The crypto coin is down by 0.88% within the last 24hours, with a total market cap of $1,161,049,807,536. The maximum supply of the coin is always 21,000,000 BTC, and the total supply in circulation is 18,864,568 BTCs.

Reasons for the Bitcoin $200T Market Cap

Top exchanges listing Bitcoin and large firms looking to it as a means out of inflation make the coin’s market cap experience exponential growth. The coin has been stable even in bear markets, with whale holdings increasing over the years and reaching its highest in 2021.

Large firms like MicroStrategy buy the dips. El Salvador has validated the currency in the country, and Tesla sold no coin in the bear market. New technologies are building on top of Bitcoin.

Therefore, the coin is digital gold with its potential slowly unmasking. Some of the top exchanges that list Bitcoin include Binance, OKEx, Uniswap, and FTX.

What Makes Bitcoin Unique for the $200T?

Bitcoin is the pioneer of cryptocurrencies, and its creator is unknown. It affects the rise and fall of the crypto market because of this. The currency has managed to make ordinary people Billionaires, redistribute wealth and create a global community.

It has also inspired other projects like it, such as Ethereum, Matic, and Solana. Anyone can conduct a p2p transaction globally, simply with access to the internet. The market cap is 1.18 billion us dollars, which means the currency has a high use case.

Bitcoin’s Path to a $200T Market Cap

Bitcoin is no doubt on a path to $200T. Assessing the total value assets investors have in Bitcoin holdings is inevitable. Comparing other asset holdings store value in translation to Bitcoin holdings, here is the :

- Gold: It has a total addressable market worth $13T, 40% Bitcoin capture, and a 5.2 Trillion Bitcoin potential.

- Cars and other collectibles: It has a total addressable market worth $5T, 10% Bitcoin capture, and a 0.5 Trillion Bitcoin potential.

- Fine Art: It has a total addressable market worth $17T, 20% Bitcoin capture, and a 3.4 Trillion Bitcoin potential.

- Real Estate: It has a total addressable market worth $228T, 20% Bitcoin capture, and a 45.8 Trillion Bitcoin potential.

- Stock Market: It has a total addressable market worth $95T, 20% Bitcoin capture, and a 19 Trillion Bitcoin potential.

- Negative Yielding Bonds: It has a total addressable market worth $18T, 90% Bitcoin capture, and a 16.2 Trillion Bitcoin potential.

- Low yielding bonds: It has a total addressable market worth $235T, 50% Bitcoin capture, and a 117 Trillion Bitcoin potential.

Is it Possible?

Yes. The statistical data shows that Bitcoin’s $200T market cap is possible. Despite the rise of altcoins, Bitcoin has undisputed market dominance and remains the most prominent cryptocurrency in the market. With a recent $64,000 ATH, the coin i