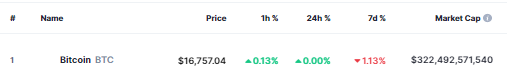

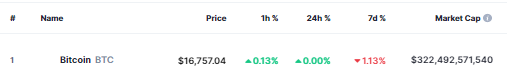

The market’s crypto assets had quite a dull weekend, and so did Bitcoin. Over the past day, the BTC’s valuation noted a net 0% change and was priced at $16.75k at press time. Over the past 7 days, however, the $322.49 billion market-capped asset noted a 1% downward deviation.

Leaving aside the short term, the state of affairs has similarly been monotonous over the mid-term too. It has been more than 6 months since the returns of the average active 5-year traders have been hovering in the negative territory. Data from Santiment revealed that this metric is currently hovering around a historically low level of -34%.

As illustrated below, the MVRV [Market Value to Realized Value] Ratio stepped into the negative return territory on June 9, 2022, and has been hovering there ever since.

At the first glance, the number might seem to be discouraging, but when viewed from the other perspective, it implies that this set of participants has no incentive to sell at the moment because the asset’s price is undervalued.

Also Read – Bitcoin Up 114,000% Since 2013: US Stocks Trail, But Is it a Justified Comparison?

Momentum Check

The buyer-seller trade difference data from ITB further put things into perspective. Over the past 12 hours, the number of BTCs sold was greater than the number bought.

The overall trading/investing intent has, however, seen a slowdown. While exchange net-flows, by and large, continue to remain negative, the amount net value has been shrinking in size. On December 13, for instance, this metric’s reading stood at 31.5k BTC. At press time, however, it stood at a subsided level of 1.7k.

Evidently, insufficient momentum has hindered Bitcoin’s price from climbing up on the charts. Until things on this front do not improve, it’d be difficult for the asset’s valuation and market participants’ RoI to recover.

Also Read – Bitcoin: Nigeria Considering To Legalize Crypto Usage