When Bitcoin halving underwent in May 2020, there were a lot of fears about whether a reduced BTC supply would impact miner profitability. The asset was still valued under $10,000 so there were significant concerns. Eventually, a significant surge in value put those worries behind, and in 2021, mining profits spiked up in the industry. However, according to a recent report, profitability is currently slipping since the beginning of November.

In this article, we will analyze the current Bitcoin mining and miner situation, to estimate whether it can lead to more trend shifts.

China Crackdown and Bitcoin Market Crash?

The Bitcoin mining situation has been under a lot of uncertainty in 2021 and the first bit of trouble surfaced in May 2021. China’s crackdown on miners led to a massive drop in hashrate and the computing power dropped down almost 50%. While it was temporarily seen as a problem, miners were able to quickly re-locate and due to a decrease in competition, active miners were able to cultivate massive growth.

However, according to Arcane Research, the situation has changed since November.

Data indicated that between the 2nd week of November to 22nd December, cash flows for Bitcoin mining drastically dropped in the industry. Bitmain’s Antminer S19 profits dropped by 36% whereas the S9 model faced 50% reductions. It was added that the profitability of the S19s had dropped down to July levels.

Now, it is not an immediate problem per se but according to Jaran Mellerud, Arcane Researcher, the price of Bitcoin needs to be high in order to for profitability to remain consistent.

Are Miners turning into Hodlers?

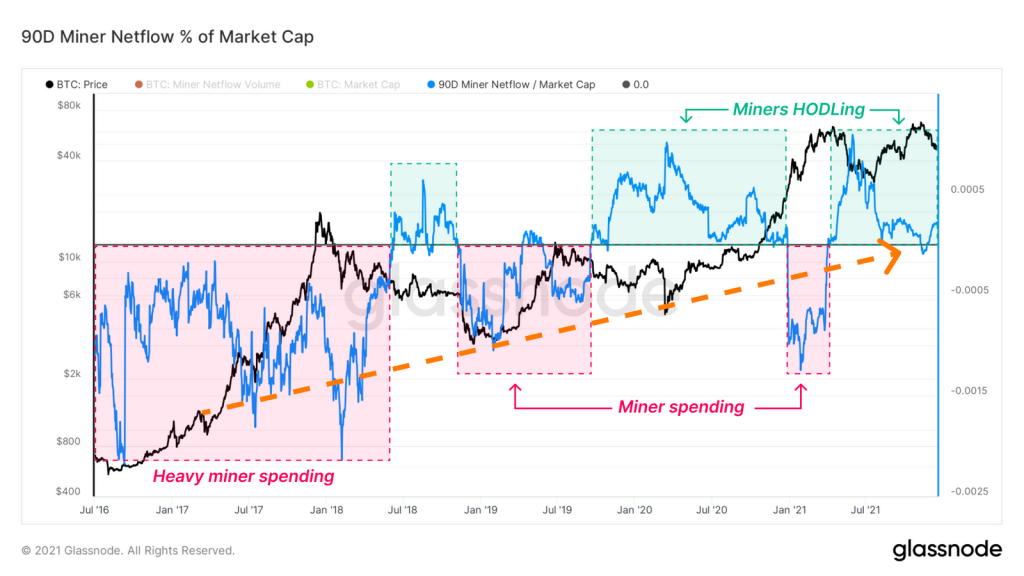

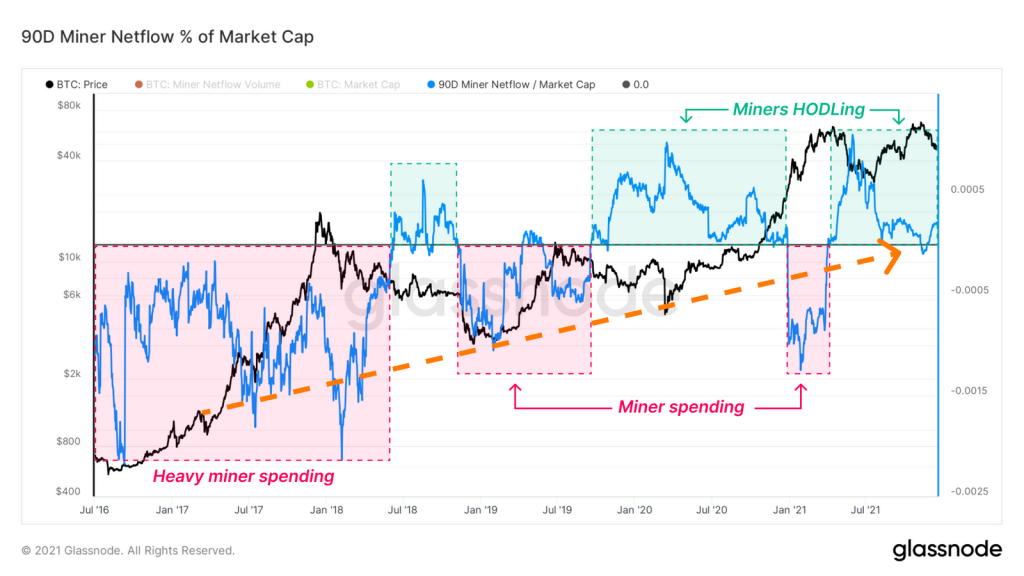

In the past, Bitcoin miners were known to be notoriously weak-handed. They have been a consistent source of spending pressure when BTC’s network weakens but the narrative has largely changed in 2021. According to data, miners are now depositing more minted supply into their treasuries than before. The chart above displays the 90-day sum of Miner Netflow Volume (in USD) as a percentage of Market Cap, and the multi-year rise is evident.

This is a strongly positive improvement from BTC’s perspective. If miners turn into HODLers, the supply for Bitcoin will drop even further in the future as demand would strategically improve.