Bitcoin’s (BTC) mining difficulty will increase by 2.5% on May 31, reaching over 50 trillion for the first time ever. According to the data on Blockchain.com, BTC’s current difficulty is at 45.5 trillion.

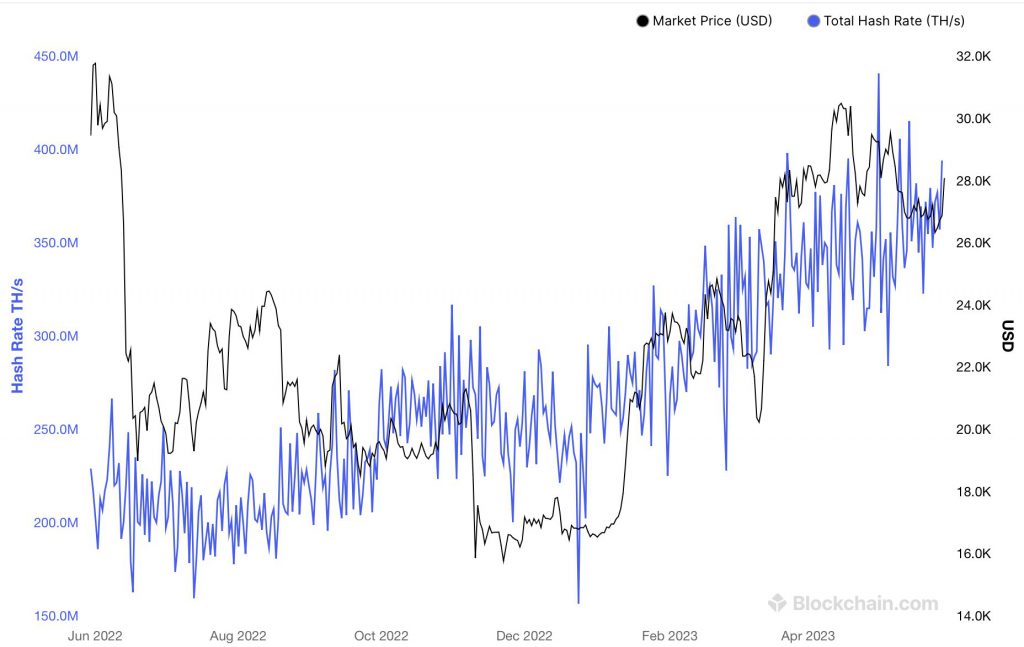

Additionally, BTC’s hashrate is also close to its highest levels. According to the data on Blockchain.com, BTC’s current hashrate sits at 394,100,656.812 TH/s. Both, the mining difficulty and hashrate, together pointed to the fact that the Bitcoin (BTC) network is the most secure it has ever been.

Will Bitcoin (BTC) prices reflect the increased security?

Apart from the increase in hashrate and difficulty, miners have also begun hodling on to their BTC. Glassnode data indicated that miners are holding onto more coins than they sell. According to Glassnode,

“Miners (excluding Patoshi and early unlabelled Miners) have expanded their balance sheet by +8.2K BTC, increasing their holdings to a total of 78.5K BTC.”

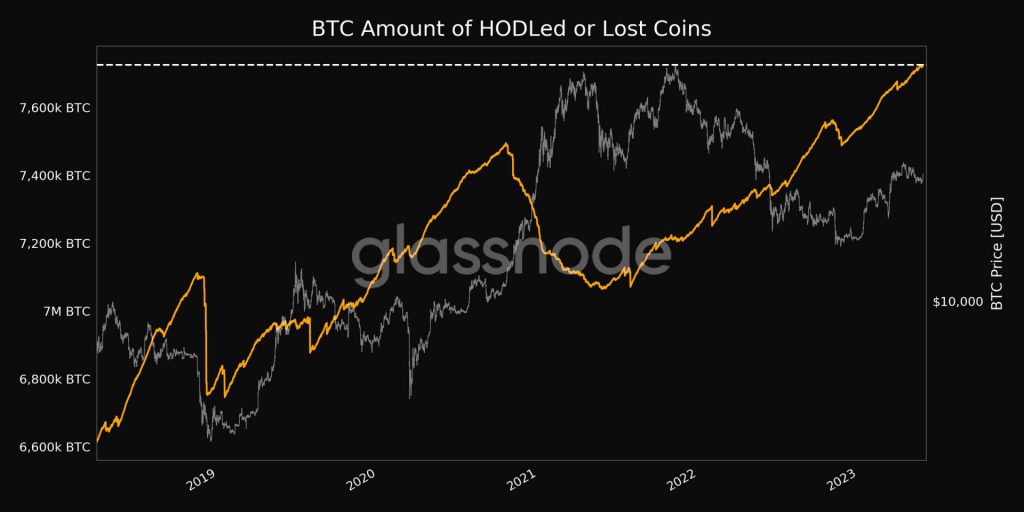

Furthermore, apart from miners, investors are also holding on to their BTC. Glassnode data further showed that long-term investors are refusing to sell. HODLed BTC is also increasing at a high rate. These “Hodled and Lost Coins” now represent 7,725,079 BTC, which is a higher amount than at any point since May 2018.

Additionally, the U.S. debt ceiling talks have reached an agreement. The deal could give a boost to investor sentiment. Therefore, we may see a rise in investments in risky assets such as Bitcoin (BTC). On the other hand, William Clemente, CEO of Reflexivity Research, compared the present pattern in hash rate versus spot price with the rise in Bitcoin’s price in 2019. According to Clemente, BTC did not see a surge in hashrate in 2019 until BTC prices tripled. Moreover, Litecoin’s (LTC) halving event is set to take place in less than three months. The event could steer attention away from BTC and towards LTC. At press time, Bitcoin (BTC) was trading at $27,905.46, up by 2.7% in the last 24 hours.