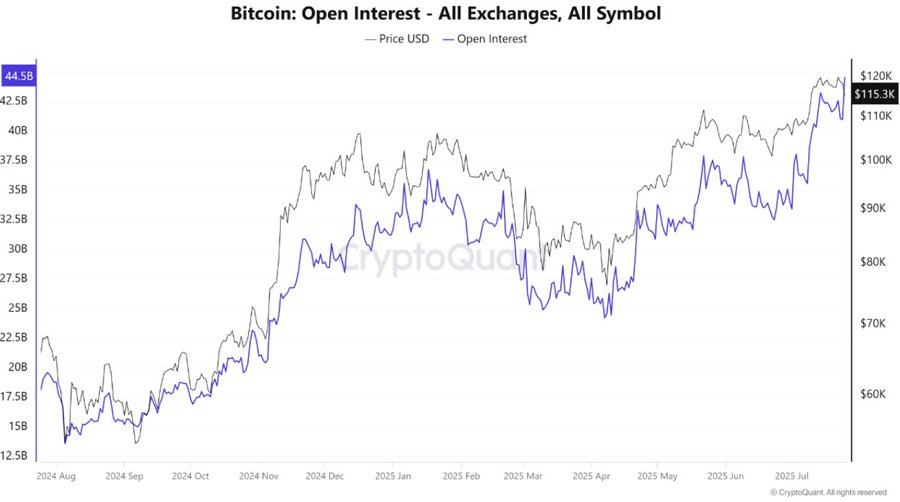

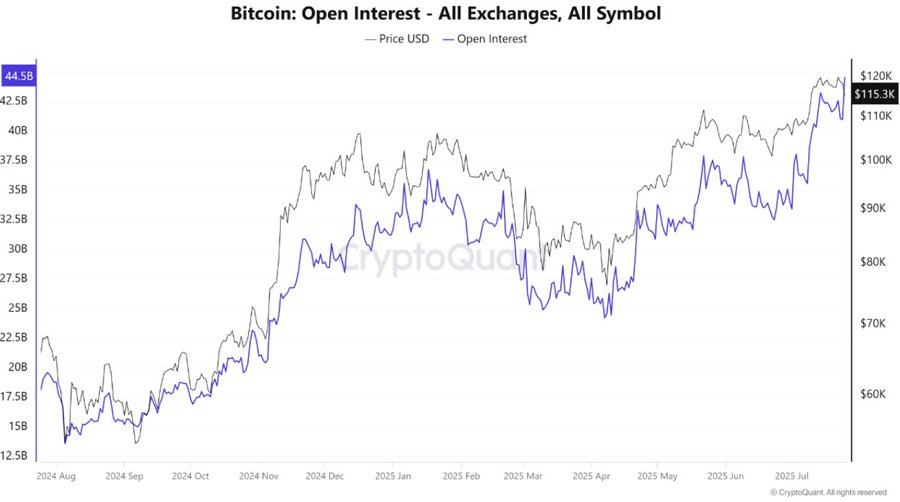

According to CryptoQuant data, Bitcoin (BTC) open interest has climbed to a new all-time high of nearly $44.5 billion. The rise in BTC’s open interest came amid a price dip, which has raised some concerns about the asset’s performance. The development could signal a rise in leverage and higher risks of volatility and price swings. A 2021 study found that a rise in open interest amid a price dip could introduce a 30% rise in volatility. A similar pattern was observed in 2017, when BTC experienced a rise in open interest and was followed by a 70% correction within weeks. Exchanges could automatically sell off collateral to cover their losses.

Will BTC Face A Correction?

While historically, Bitcoin (BTC) has faced corrections when similar events have taken place, a lot has changed over the last year. The ETF products have brought a lot of institutional money into BTC. This aspect of the equation was absent during the 2017 dip. BTC’s recent rise to a new all-time high could be attributed to increased ETF inflows.

Despite the changing times, there is still the possibility of fresh volatility entering the market. Bitcoin’s (BTC) rising open interest could become a point of worry for market participants. It remains unclear how the market may move over the coming days. The FOMC (Federal Open Market Committee) meeting on the 29th will likely give clues on the Federal Reserve’s stance on the US monetary policy. A hawkish stance could lead to another market dip. On the other hand, a dovish move could propel the market into another bullish phase.

Also Read: 14-Year-Old Bitcoin Whale Moves $1.6 Billion BTC: Another Dip?

Investors are still waiting for the Federal Reserve to announce an interest rate cut for 2025. A rate cut will likely lead to investors making more risky investments as borrowing becomes easier.