On the daily timeframe, Bitcoin has been trading below three crucial averages—the 50-day MA, the 100-day MA, and the 200-day MA—since 9 April. It managed to penetrate above them a couple of times by registering long upside wicks, but the body of no candlestick has been able to break above the said levels.

Over the past 24-hours, the crypto asset’s price has remained inert. Per data from CMC, the king-coin registered a negligible 0.02% uptick in the said timeframe and was priced at $39,510 at press time.

Bitcoin investors start booking profits

Despite registering horizontal movements over the past day, Bitcoin inclined by 7% from its lows of $37.7k on 26 April to $40.3k on 28 April. As a result, the mild-price rise triggered an investor profit booking spree.

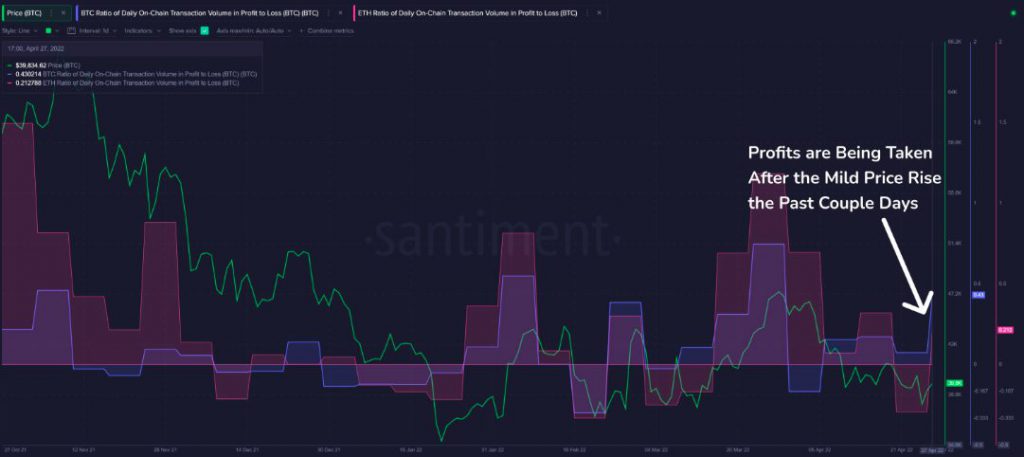

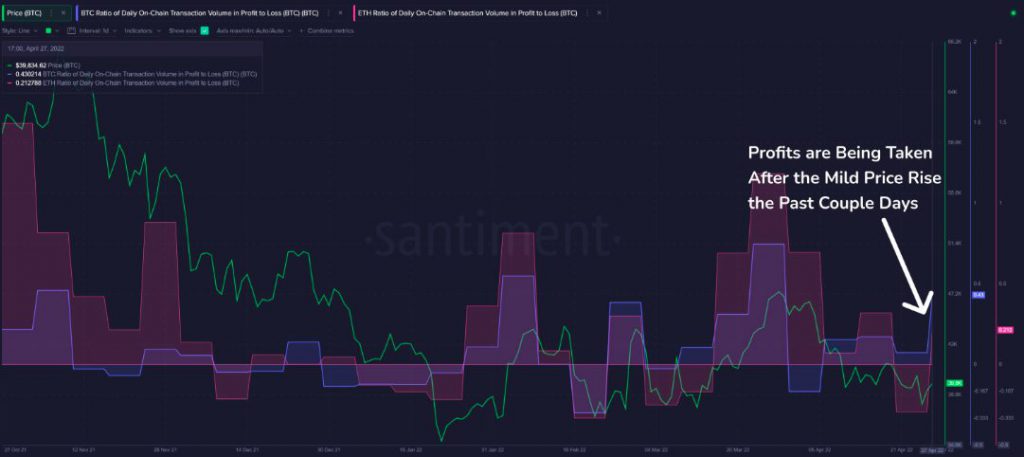

Highlighting the same trend, Santiment noted,

“Bitcoin’s ratio of transactions taken in profit vs. loss is increasing after the subtle rebound these past couple days.”

As illustrated in the chart below, Bitcoin has noted the highest ratio [0.43] of profit-taking in a month. Even Ethereum’s number [0.21] wasn’t that high at press time.

What to expect next?

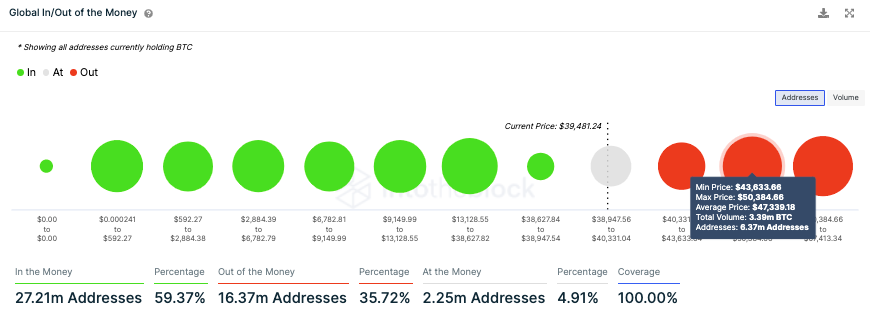

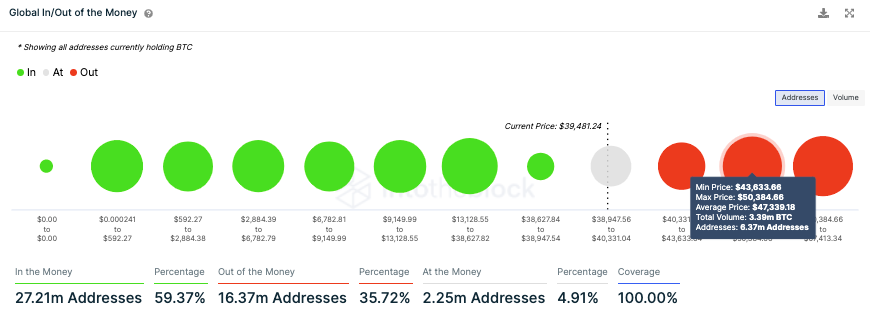

Here it is interesting to note that the next major resistance cluster for Bitcoin extends from $43.6k to $50.3k. In the said range, over 6.37 million addresses bought over 3.39 million BTC.

So, the next round of profit booking can be expected to happen as soon as Bitcoin steps into the said price bracket. Until then, it does have the room to sneak above $43k from its current $39.5k level.

Alongside, Bitcoin has the support of large market participants. Per data, the number of Bitcoin addresses has been increasing since mid-February. Santiment brought to light,

“Since then, there are 1,629 shark and whale addresses holding between 10 to 100k that are either new or have returned to this millionaire (or above) status.”

Millionaire addresses accumulating Bitcoin over the past two months have managed to keep the king-coin stay afloat above $35k. Even though weak hands have exited the market of late, Bitcoin’s price has not slumped, indicating the HODLer conviction. So, at this stage, market participants can expect Bitcoin to break above $40k and slide up over the weekend.