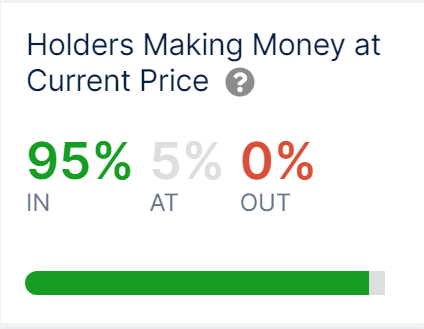

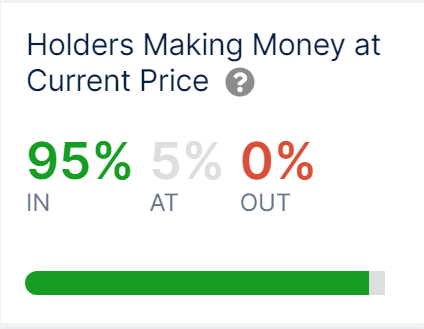

A significant development has emerged within the cryptocurrency realm. About 95% of Bitcoin [BTC] addresses are now showing profitability. This signifies a noteworthy milestone reflective of the prevailing bullish sentiment surrounding digital assets. This achievement coincides with a robust rally witnessed across the cryptocurrency market. The total market capitalization surged by approximately 8% within the past 24 hours, surpassing the $2 trillion mark.

Bitcoin Leads the Charge

Leading the charge is Bitcoin, whose impressive performance has been instrumental in driving up total market valuations. The cryptocurrency surged by approximately 11%, reaching the $57,000 mark. BTC market valuation surged past the $1.1 trillion level, representing over half of the entire crypto market capitalization. Currently trading around $56,500, BTC stands just 18% below its all-time high of $68,789.63, recorded on Nov. 10, 2021.

The prevalence of profitable Bitcoin addresses harks back to a phenomenon observed during the peak of the 2021 bull market when prices soared above $60,000. The resurgence of profitability among BTC holders reflects renewed optimism and confidence in the cryptocurrency’s long-term potential.

Also Read: MicroStrategy Bitcoin Investment Now at $4.65B Unrealized Profit

Peter Brandt’s Bullish Bitcoin Prediction

Renowned trader Peter Brandt has offered his bullish prediction for Bitcoin’s future trajectory. He envisions a potential surge to $200,000 by the culmination of the ongoing bull market cycle. This is expected around August or September 2025. Furthermore, Brandt emphasizes the importance of maintaining momentum and cautions that deviating from the $50,521 threshold could jeopardize this optimistic projection.

Laser Eyes: A Quirky Market Indicator

Injecting a touch of humor into his analysis, Brandt amusingly references the prevalence of “laser eyes” in social media profile pictures as a quirky indicator of market sentiment. According to Brandt’s tongue-in-cheek methodology, an excessive proliferation of “laser eyes” imagery could indicate an overheated market, posing a potential risk to Bitcoin’s upward trajectory.

In conclusion, the surge in profitability among Bitcoin addresses, combined with bullish forecasts from industry experts like Peter Brandt, underscores the growing confidence and optimism in the cryptocurrency market. While Bitcoin continues to exert dominance and the broader crypto market experiences renewed momentum, investors must remain cautiously optimistic and exercise prudent risk management amidst the inherent volatility of the cryptocurrency landscape.

Also Read: Retail Traders Missing: Can They Push Bitcoin’s Price to New ATH?