This year has been pretty good for cryptos so far. Right from Altcoins rallying to the aggregate market cap ballooning, a bunch of positives have been noted. On Thursday, Bitcoin was, yet again, the talk of the town. The market’s largest crypto broke above $18k, one of its most rigid psychological barriers.

After registering a 4.5% uptick over the past 24 hours, BTC was trading at $18.1k at press time.

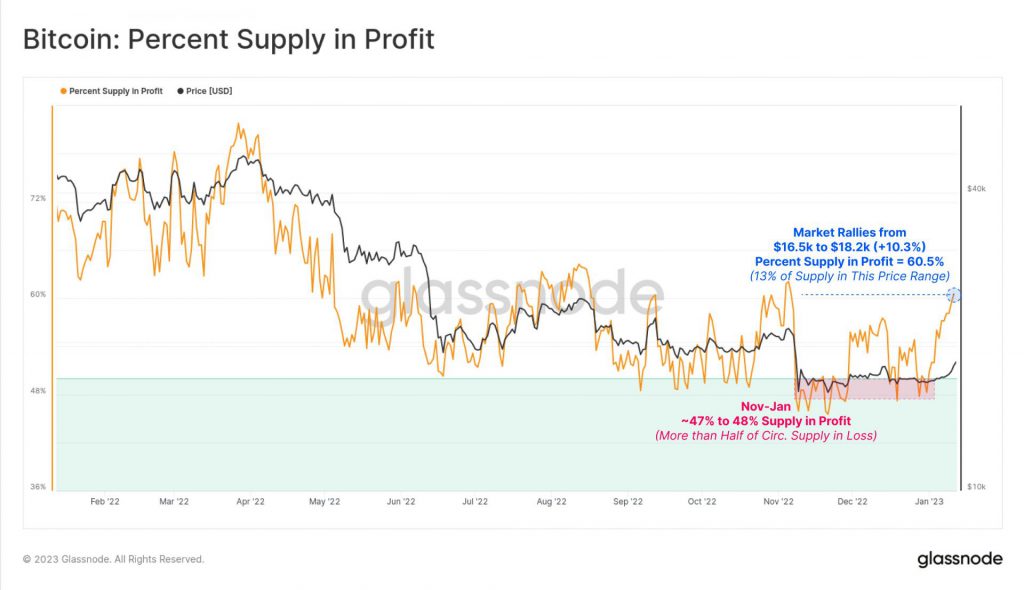

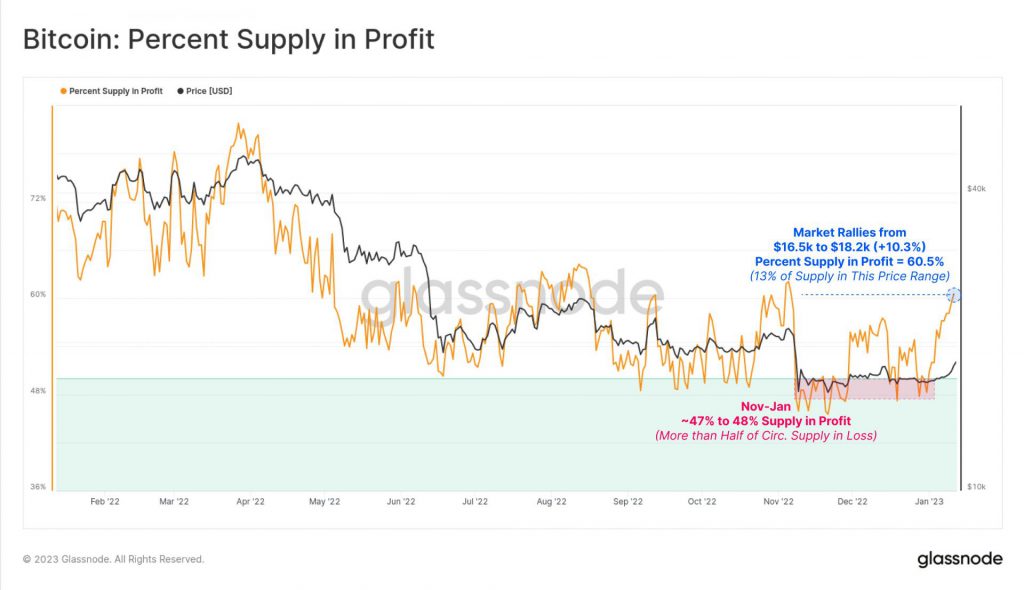

Now, according to the latest data from Glassnode, a fairly large volume of BTC was acquired between $16.5k and $18.2k. The sharp spike noted by the supply in profit metric justified the same.

Even though this might seem to be a positive, there is a gray lining to it. More than half the circulating supply was in loss in the period between November 2022 to early January 2023. Thanks to the current rally, over 13% of the said supply has now returned to profit.

Like shown below, whenever this metric has seen a sharp rise, it has been succeeded by dramatic fall. In most cases, the price has followed the same downtrend suit. Thus, there are high odds of a similar scenario materializing in the coming days.

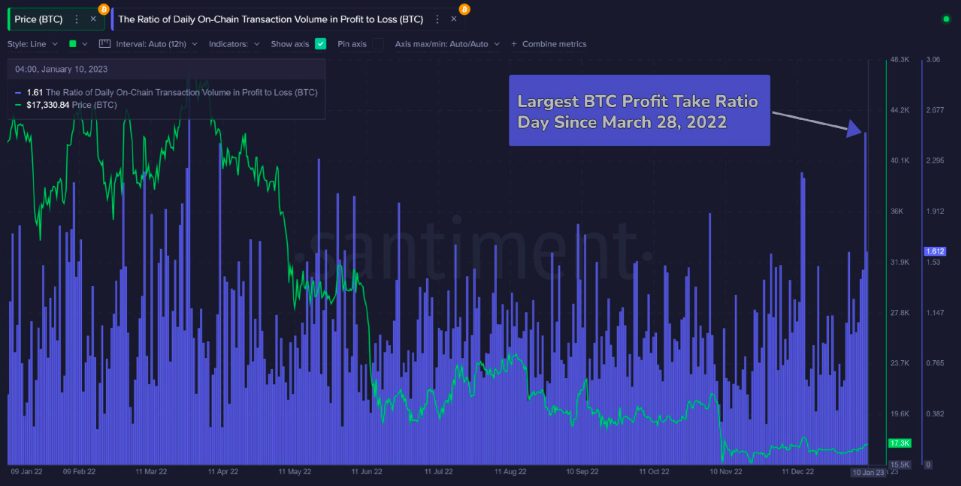

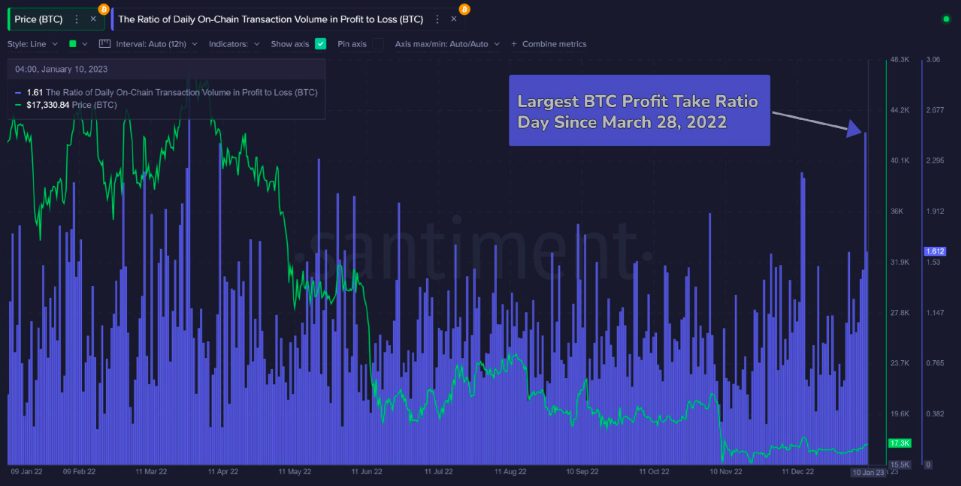

Data from Santiment revealed that participants have already started booking profits. Bitcoin, quite recently, reached its highest daily profit-taking ratio since March 2022, justifying the said narrative. So, if such a behavior pattern persists, the path for a retracement would automatically be paved.

Also Read: 5 Cryptos To Keep An Eye On This Week

Hope Glimmers

Apart from profit booking, another interesting trend was spotted at press time. Large market participants were seen accumulating Tether. According to Santiment,

“Tether, the top stablecoin by market cap, is continuing to see growth from shark and whales who are loading up for the next bullrun. There are now 21,459 addresses that hold $100k or more USDT, just 1% from a new All Time High.”

The afore-highlighted behavior evidently points towards the fact that participants are accumulating dry powder by adding Tether to their bags to eventually divert it towards Bitcoin. Doing so would hep in fuelling the largest crypto’s recovery and help it attain higher highs.

The same would, however, not happen overnight, and at this stage, patience is the only key.

Also Read: Will Bitcoin face a ‘bull-trap’ post-December CPI Numbers?