Since the beginning of this week, the crypto market has been in its recovery mode. Top Altcoins like Cardano have fetched their investors double digit gains over the short term. Bitcoin and Ethereum, on the other hand, have been playing the slow and steady game.

Most assets flashed green numbers even on Wednesday. At press time, the global crypto market cap stood at $856.90 billion, up by almost 1% over the past 24 hours.

The buying and selling activity of market participants directly influences the price of an asset. Thus, keeping an eye out on trends, based on search volume, acts like a pre-cursor and reveals the coins on their radar.

Bitcoin, Shiba Inu, Solana Currently Trending

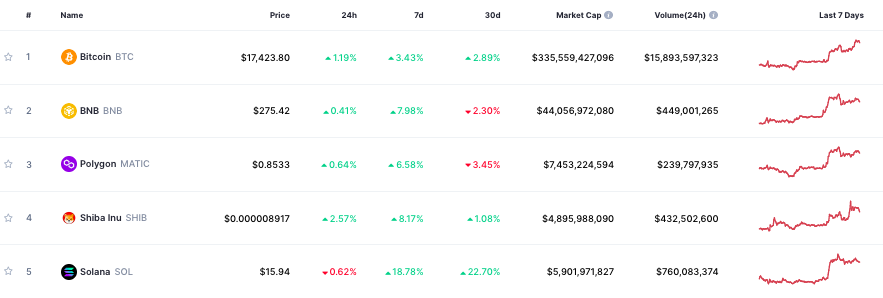

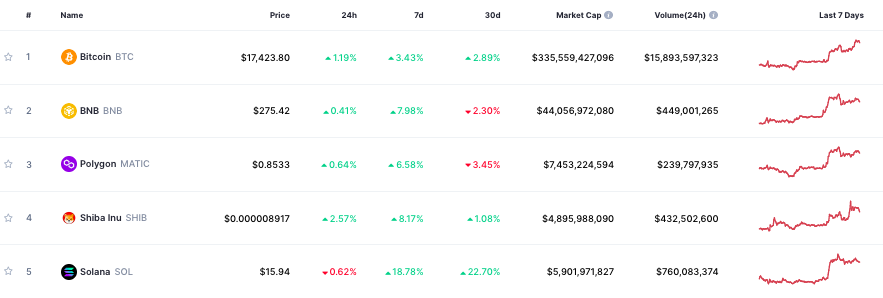

On Wednesday, Bitcoin, Binance Coin, Polygon, Shiba Inu and Solana were the top trending coins on CoinMarketCap. Over the past thirty days, three out of the five coins have fetched holders with positive returns, with Solana’s numbers being the most impressive.

On the weekly also, the baton was with Solana. Shiba Inu stood next in queue, thanks to its 8% pump. Binance Coin, Polygon and Bitcoin followed right after. On the daily, however, Solana was the worst performer, while Shiba Inu was the best.

Also Read: Why Is The Crypto Market Rallying Today?

At this stage, all the coins are mutually dependent on Bitcoin. Data from CryptoWatch revealed that SHIB, BNB, SOL and MATIC shared a high correlation [in the 0.71 to 0.81 bracket] with the largest crypto, justifying the said narrative.

Also Read: Bitcoin: ‘Tension’ To Likely Build Up By End Of January, Why?

If the buying momentum persists, then there are high odds of Bitcoin inclining to $18k before being tested by its 100 EMA. If that happens, then others would likely follow suit, given their high correlation.

However, if the largest crypto asset steps into its correction mode, it could drop down in the $15.5k to $16.6k range to collect liquidity. In such an event, a mass correction can be anticipated.

Also Read: Will Bitcoin face a ‘bull-trap’ post-December CPI Numbers?