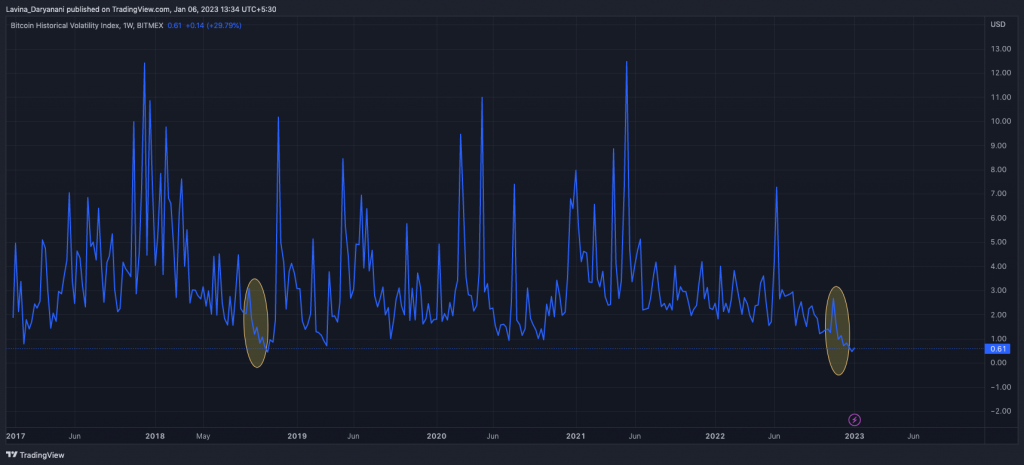

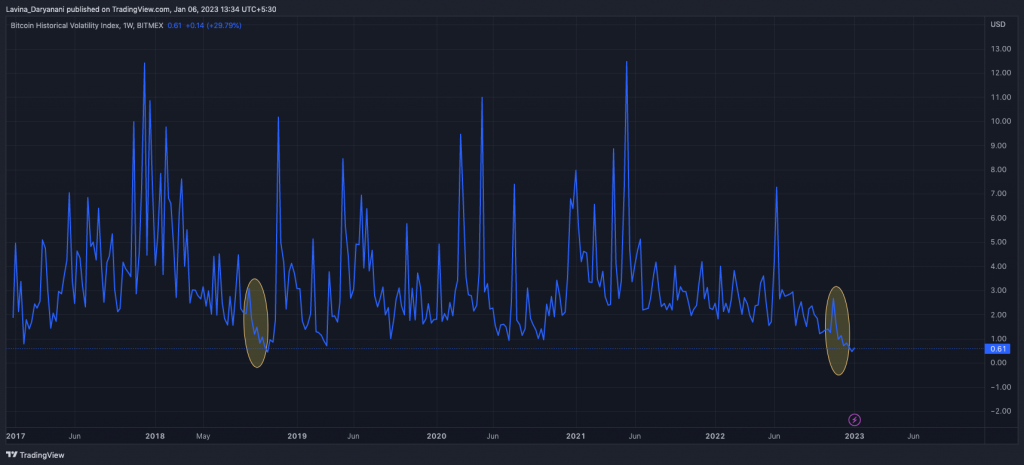

The Bitcoin market has been devoid of momentum for quite some time now. Around Christmas last year, the asset’s volatility was at its all-time low. There has hardly been any recovery since then. Owing to the extended horizontal movement phase, the current period is “pretty close” to becoming the least volatile period ever for Bitcoin.

However, all hope is not lost. As illustrated below, the ongoing dry spell for Bitcoin is quite similar to what was noted in 2018. The volatility index’s deviations have more or less been replicas of each of other. Post creating a low in ’18, the volatility noted a sharp spike in the weeks that followed. Assuming that the level visited on 25 December was the low this time, a volatility influx can be expected in the weeks that follow.

On-Chain Data Hints The Same Thing

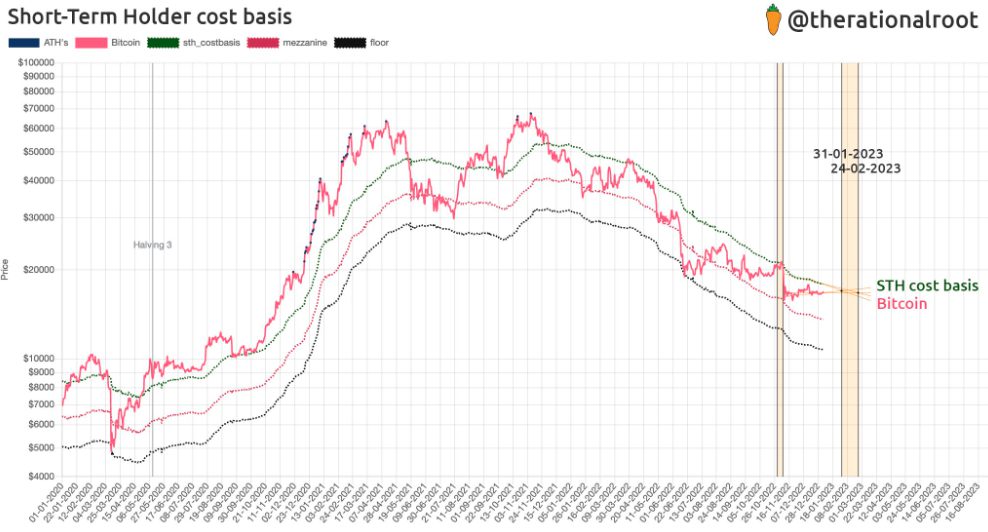

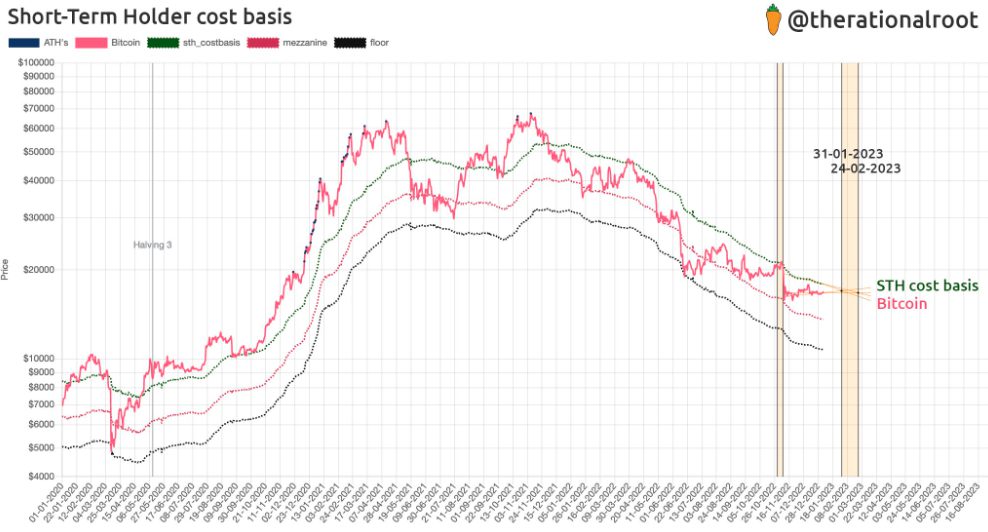

Short-term Bitcoin holders are currently on the verge of breaking even. If these holders come through, the market could possibly see a collective recovery. However, if they stick to their typical paper hands behavior, then things would go haywire. Either way, there will likely be a volatility infusion.

Confirming the same, pseudonymous Bitcoin on-chain and cycle analyst Root recently tweeted,

“Tension will build up towards the end of this month as we will encounter the Short-Term Holder cost basis once again. Bitcoin will either break or reject, but some volatility will likely be back.“

For context, the cost basis is the original price one pays to buy an asset. Along with the value paid to buy the asset, it includes the brokerage fee, transaction fee, etc.

Source: Twitter

Bitcoin Market Maturity

The Bitcoin market has matured over the years. Along with short-term holders, even the long-term holder action plays a key role in determining the fate of the asset. During periods of stress in the past, there have been times when such holders have given up and sold their holdings.

Leaving aside a slight hiccup noted recently, this group of investors, is in a “strong accumulation” phase. The almost-steady uptrend on the chart below justifies the same. Additionally, the same serves as a possible hint that a certain set of short-term holders (STHs) are evolving to become long-term holders (LTHs).

Thus, it is important for this trend to head in the same direction because LTHs help in putting a cap on the asset’s losses and provide stability to markets on the macro front.