The last couple of weeks were rough for Bitcoin. Between 15th August to 28th August, the digital asset lost close to ~20% in price valuation. Corrections caused its market cap to drop below $400 billion at press time, and the current structure looks exceptionally bleak.

The above chart shows that Bitcoin is consolidating just above its 2017 high. BTC reached $19800 in December 2017 before facing steep correction ins January 2018. Acting as a form of support at the moment, losing this range could be catastrophic for Bitcoin as the next significant support lies around $13970, i.e., 2019 high.

To an extent, Bitcoin’s heavy correction last week was correlated to Powell’s Jackson Hole speech as well, where he suggested a continued rise in interest rates to curb inflation.

Are Whales plotting Bitcoin’s recovery?

According to Santiment analytics, the Bitcoin ecosystem has witnessed a surge in Whale addresses over the past 30-days. Lessons from 100-10,000 BTC have jumped to 15,847, with 103 added over the past 30-days. Strong correlations have been identified in the past where whale accumulation has led to BTC recovery, and the current sentiment remains the same.

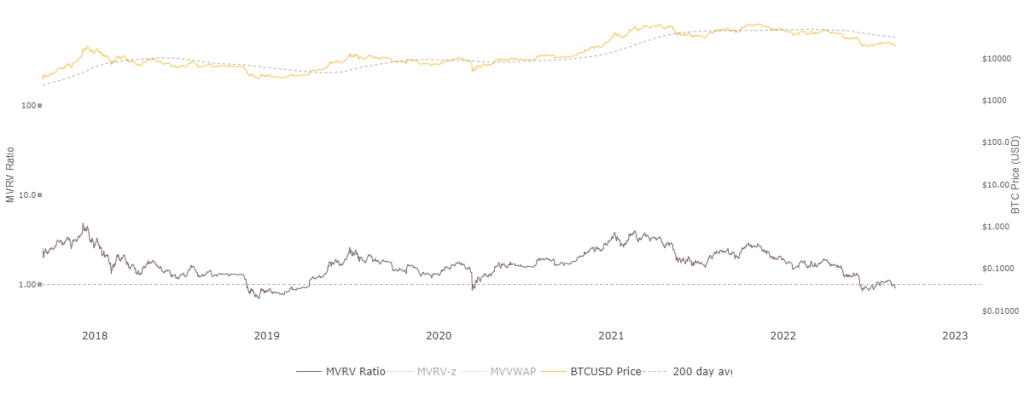

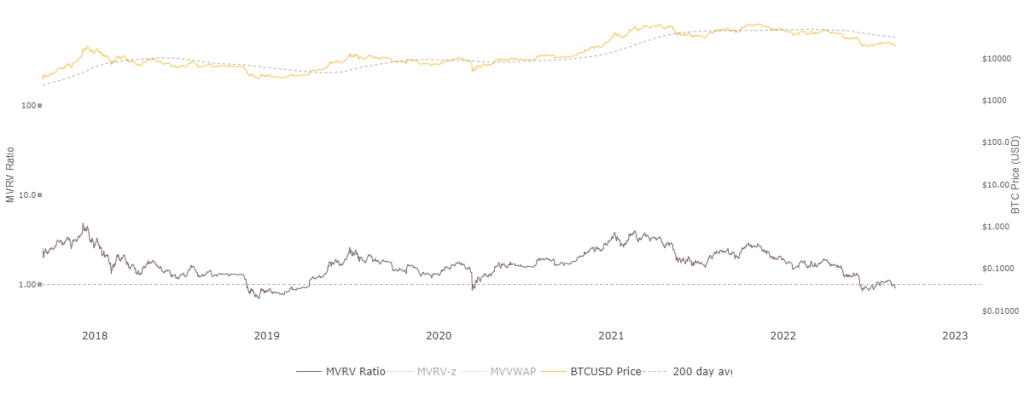

Additionally, there was added support for Bitcoin’s MVRV ratio as well.

The Bitcoin Market-Value to Realized Value continues to remain under 1. The MVRV ratio is an excellent indicator to identify the long-term recovery cycle, as consolidation below 1 suggests a potential recovery in the future. The same was observed during 2019, 2020, and now 2022. Yet, it is essential to note that volatility remains a powerful facet of BTC’s current market. So while recovery could be on the cards, it isn’t smooth sailing.

Considering the more significant financial ecosystem, recession fears and increasing interest rates will also play a factor. The crypto markets have been heavily correlated to the collective financial market, which is unlikely to un-correlate anytime soon.