Bitcoin has been creating back-to-back records of late. With a host of asset managers like BlackRock, WisdomTree and Invesco filing for spot BTC ETFs with the SEC, the market sentiment has been refining.

On Wednesday, June 21, Bitcoin spiked to a six digit valuation on Binance.US. As chalked out below [right], the BTC/USDT pair’s wick extended all the way up to $138,070 on the exchange. However, it did not sustain around the said high for long, and quickly deflated back. As of press time, the largest asset was exchanging hands at $28.8k.

Also Read: $1.5 Trillion Asset Manager Invesco Reactivates Bitcoin ETF Filing

Fear gradually evaporates from the BTC market

Binance.US has been in a fix over the past few days. Right after the SEC filed a lawsuit earlier this month, the exchange’s U.S. arm’s market depth started dropping. As recently anlyzed, it shrunk by around 78% in just a week. Parallelly, the exchange has also been losing market share. A recent analysis by Kaiko revealed that Binance.US currently commands a mere 1% market share.

Leaving aside the abrupt spike amid low liquidity on Binance.US, Bitcoin has been gradually inclining on all spot markets. From just hovering around 26k a couple of days back, the asset went on to claim $29k earlier today.

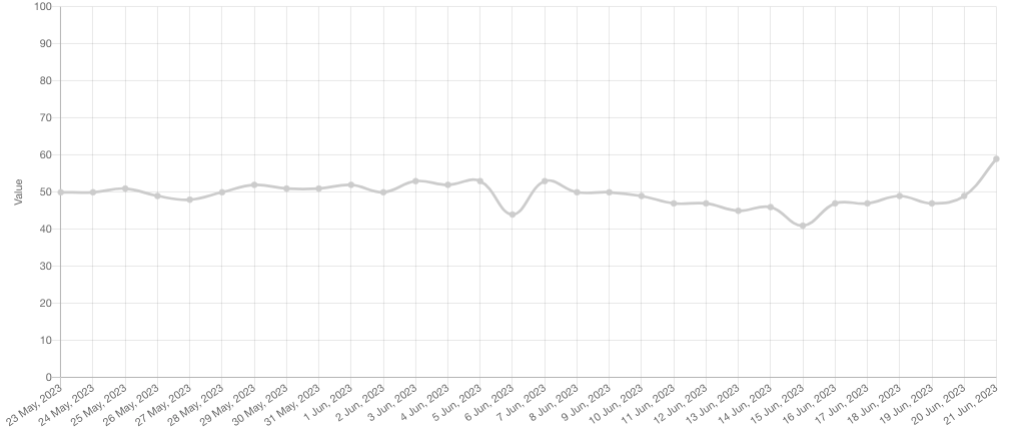

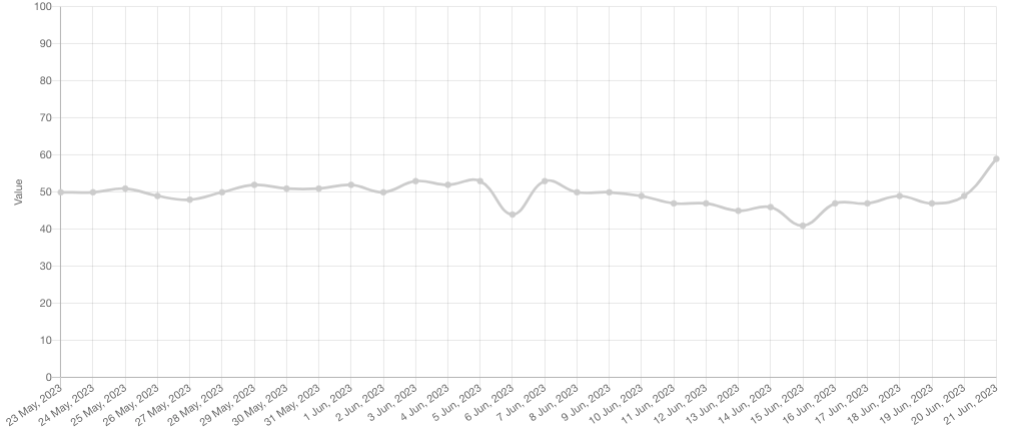

In fact, the fear in the minds of market participants is also gradually wearing away now. As shown below, the F&G index’s reading is currently at a 1-month peak. As of press time, it flashed a reading of 59, indicating greed. Thus, at this stage, investors can be expected to accumulate BTC. If buyers induce sufficient pressure, then BTC’s bullish streak could get renewed.

Also Read: Crypto: $56 Million Liquidated as Bitcoin, Shiba Inu, Dogecoin Rise Upto 6%