Bitcoin (BTC) is currently testing the $25,000. Since last week, the original cryptocurrency has made gains of nearly 12%. BTC is currently trading at a level not seen since mid-June 2022. Moreover, there is evidence that BTC might have reached its bottom. According to CryptoQuant, five on-chain metrics prove Bitcoin (BTC) has reached its bottom.

MVRV Ratio:

Firstly, CryptoQuant mentions the MVRV Ratio. This ratio determines if BTC is overpriced or undervalued by comparing its market cap to its realized cap. If the value goes high, it signals that the asset is overvalued, and if it goes low, it is undervalued. Furthermore, BTC’s current MVRV ratio is in the neutral zone, indicating a fair value.

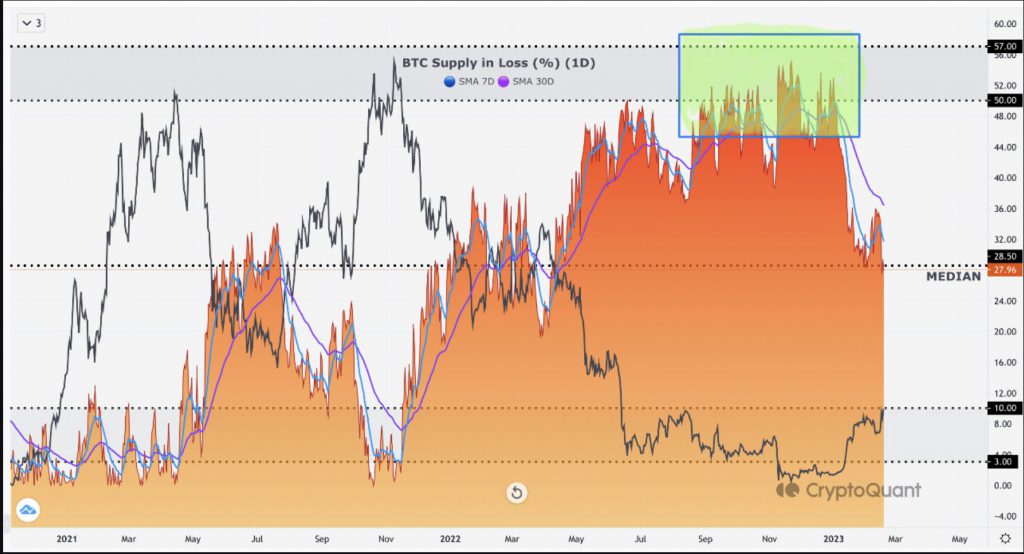

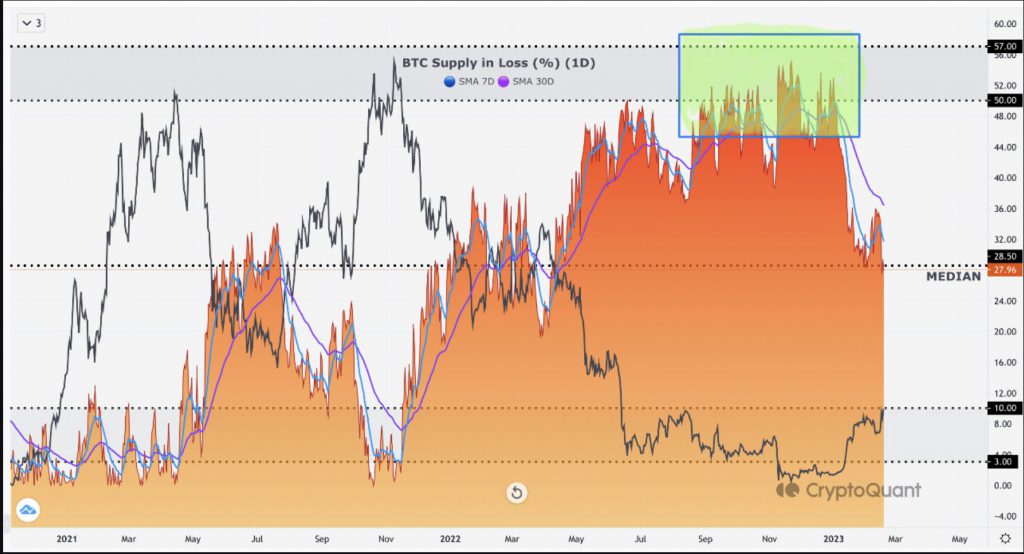

Supply in Loss:

The next metric is the Supply in Loss percentage. The metric helps in determining market sentiment. The amount of Bitcoin (BTC) held at a loss reached its peak from mid-July to late December 2022.

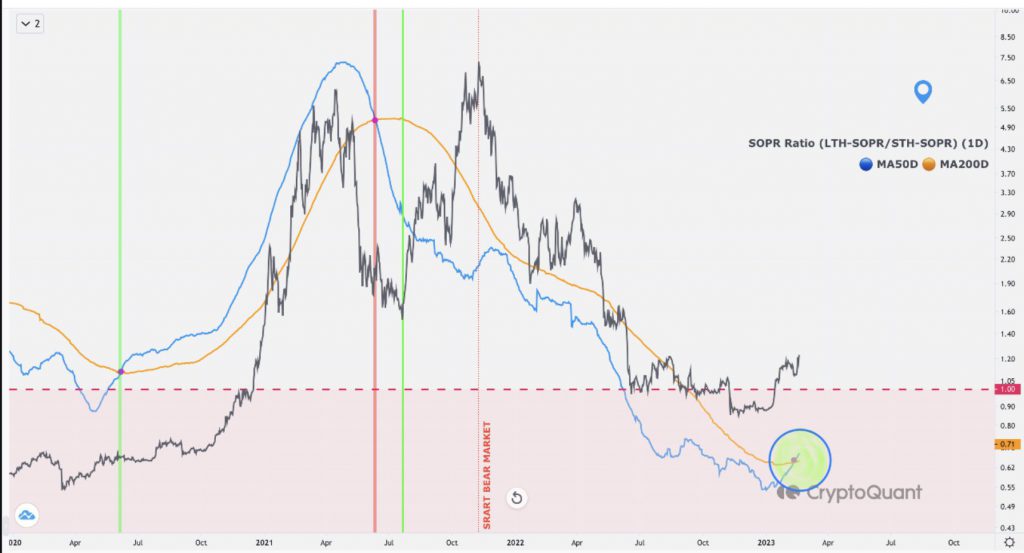

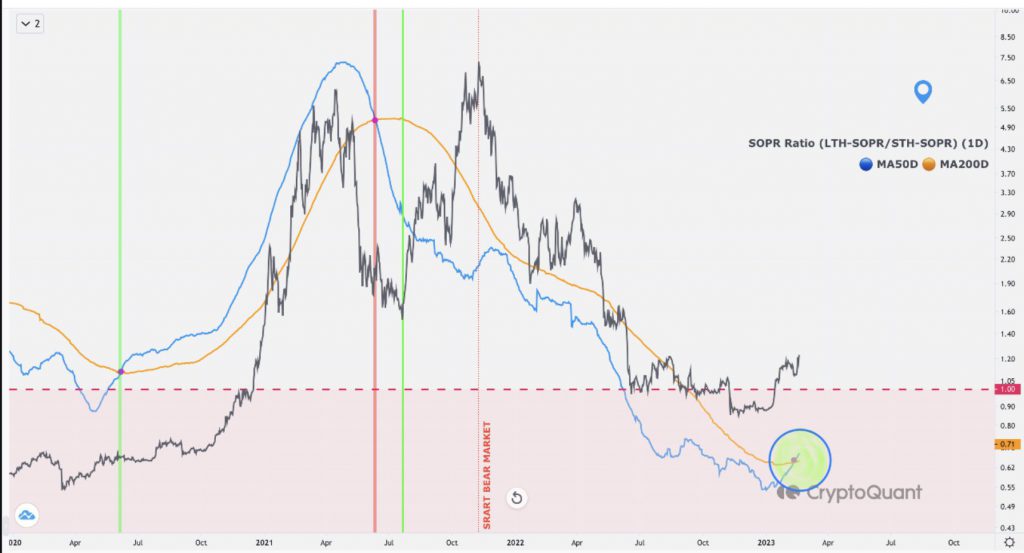

SOPR Ratio (Spent output Profit Ratio):

This ratio calculates the profit and loss of traded coins and provides information on short-term market trends. If the value is less than 1, the present sellers are losing money, which frequently slows down transactions and establishes a support zone. SOPR was at its lowest from early November to January 2023. Moreover, the current SOPR is 1.00523609.

Bitcoin’s Net Unrealized Profit/Loss (NUPL):

This measure displays the average profit and loss of every Bitcoin (BTC) in use, providing insight into the state of the market.

Any figure over zero denotes a net profit for the network, whereas any value below zero denotes a net loss. In general, the market tends to move closer to peaks and bottoms the more NUPL deviates from zero. Currently, the value stands at 0.1812501, signaling that the bottom may have been reached and crossed.

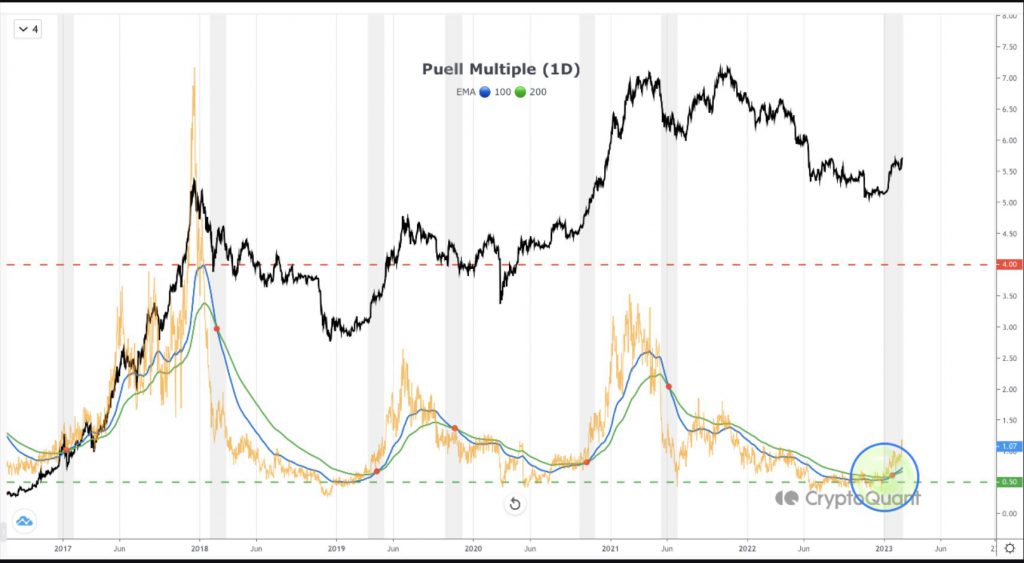

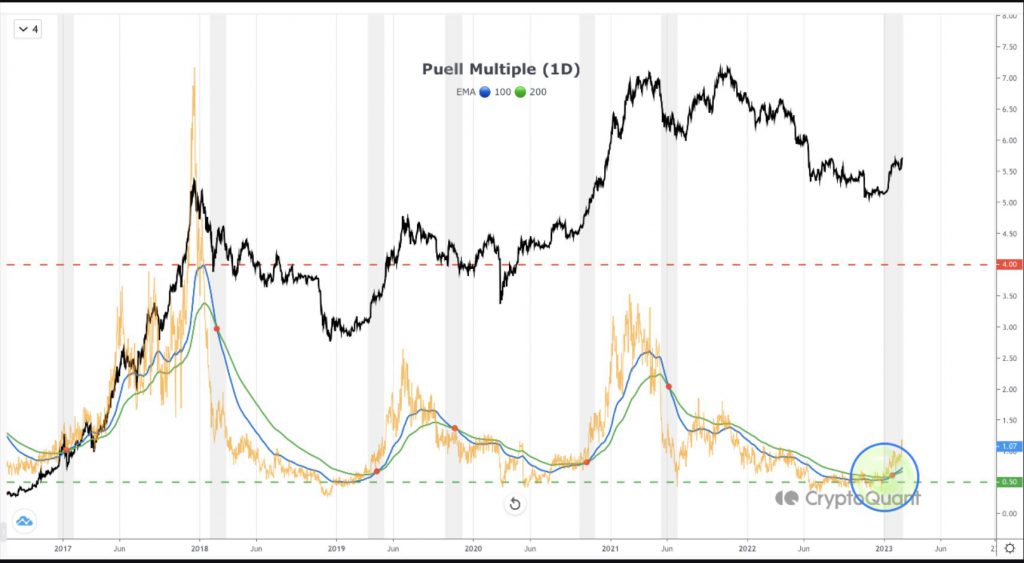

The Puell Multiple:

This multiple determines if Bitcoin (BTC) is overvalued or undervalued in comparison to past issuance rates by comparing the ratio of daily issuance to the moving average of daily issuance. High numbers show that relative to the annual average, current miner profitability is high. Currently, the value seems to be on an uptrend.

According to CryptoQuant, the metrics mentioned above may suggest that Bitcoin (BTC) has reached its bottom. Moreover, investors may have access to sizable opportunities.

At press time, BTC was trading at $24,813.6, up by 0.8% in the last 24 hours.