Every indicator has had a different projection about Bitcoin’s bottom. However, they’re all mostly close-knit. The Puell Multiple, for starters, indicated that BTC might have already bottomed out at $19k. The Mayer Multiple band readings, on the other hand, suggest that a macro-flip is on the cards for BTC.

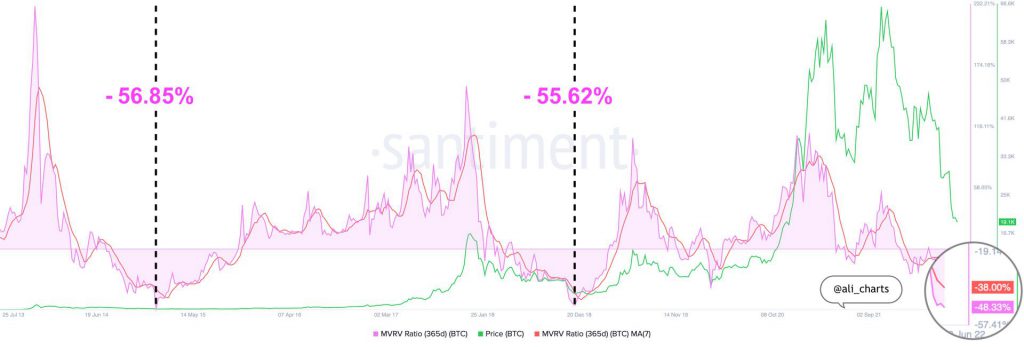

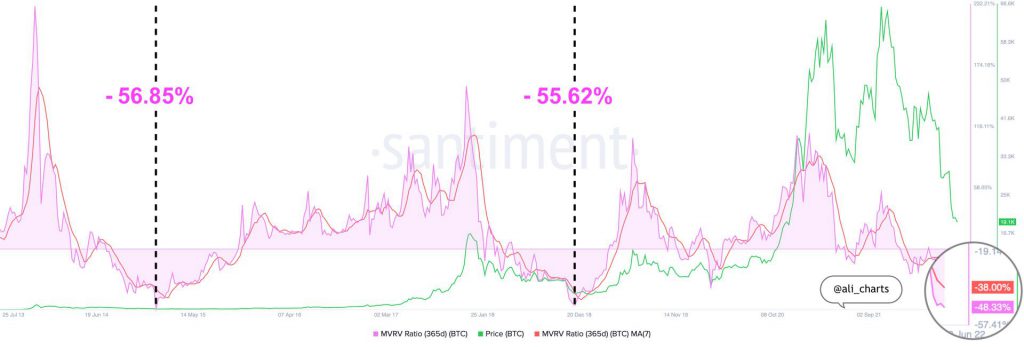

Another crucial indicator reading that can be relied upon is the MVRV. Basically, this ratio gauges an asset’s market capitalization relative to its realized capitalization. As a result, it helps in assessing market profitability and gives a sense of when Bitcoin’s price is above or below the fair value.

This indicator has pointed out the market bottom over the past two bearish cycles quite accurately. As observed in the below chart, in 2015, the MVRV dropped to -57%, and that marked the end of that season’s bear cycle. Similarly, after it dipped to -56% towards the end of 2018, Bitcoin stepped into a macro-bull run.

Now, in mid-June, the MVRV touched -50%, and has already started rebounding. Of late, it has been hovering around -48%. So, does this mean that Bitcoin has bottomed out already?

Weakness still persists for Bitcoin

To completely shrug off the bearishness and retain bullish momentum, Bitcoin will need other macro factors to chip in. However, at this stage, it lacks support.

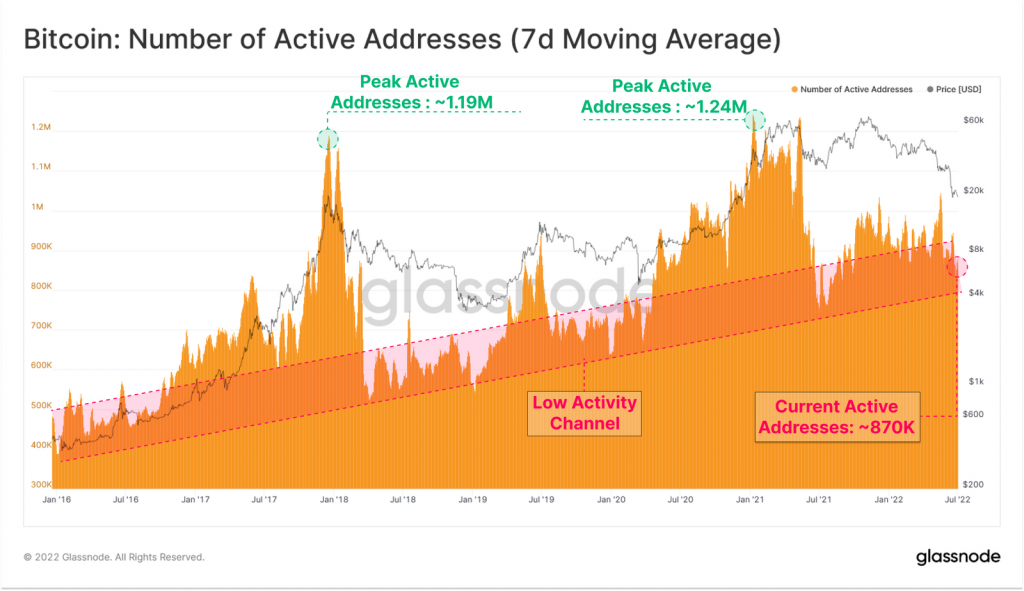

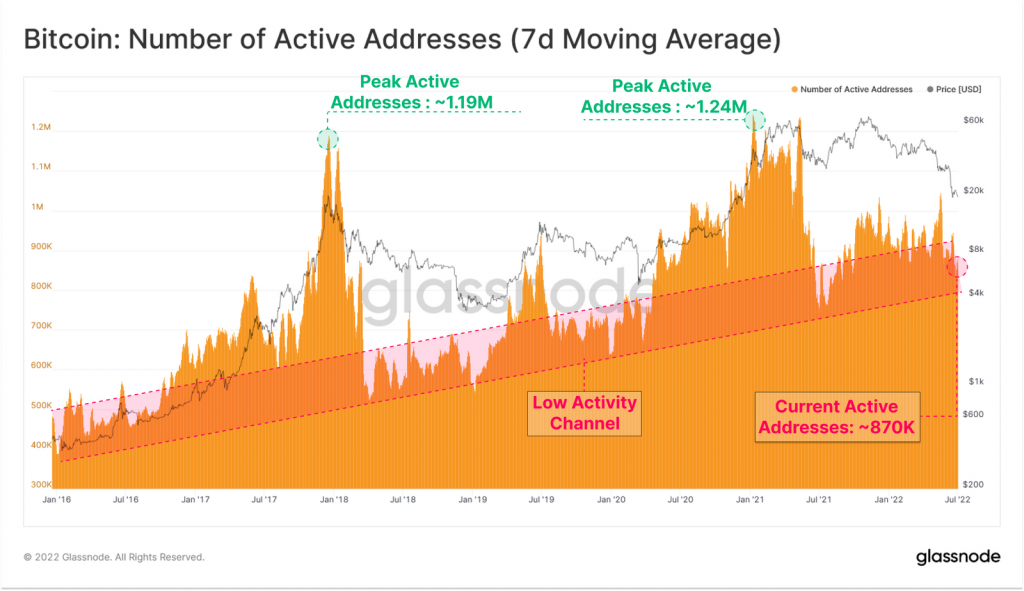

The on-chain landscape seems to be quite unstable. User growth, for instance, remains to be stunted. The latest data brought to light indicates address activity has declined by 13% from over 1 million per day in November to just 870k per day in July. Outlining the implication of the same, Glassnode’s weekly newsletter noted,

“This suggests little growth in new users and even a struggle to retain existing ones.”

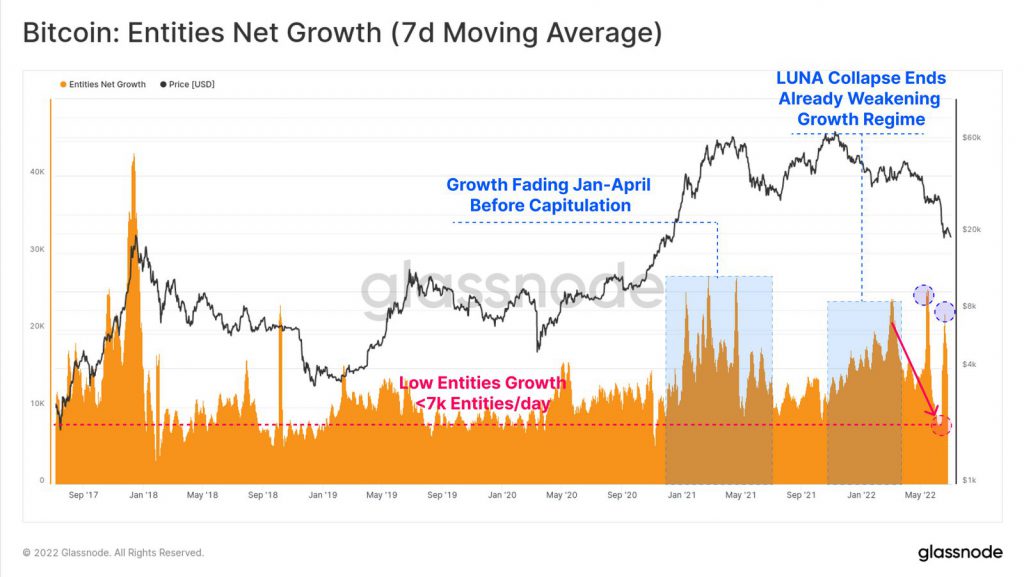

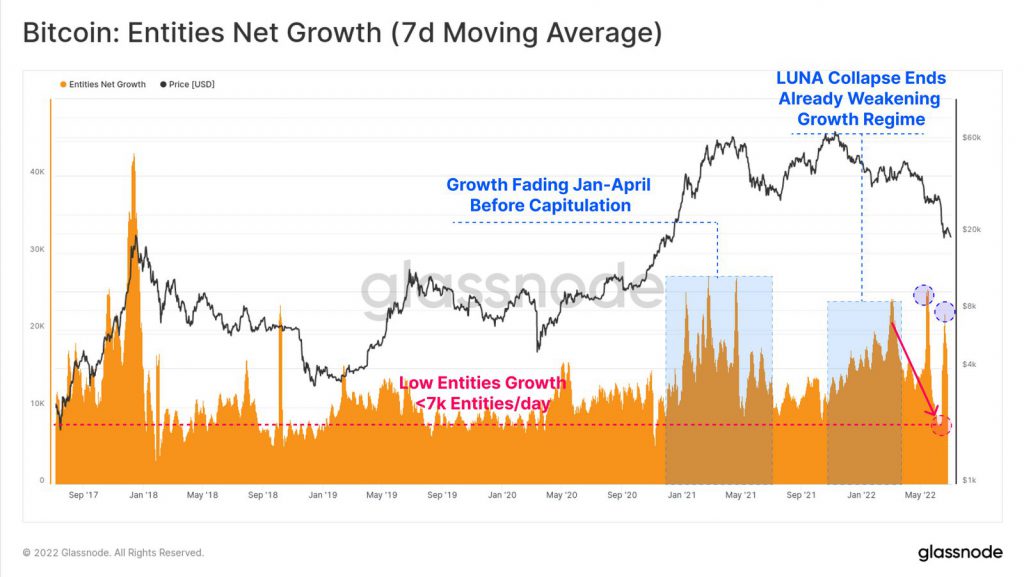

The difference between new, and leaving on-chain entities further suggested participant capitulation. The Entities Net Growth metric has collapsed, and the overall growth rates have lacked thrust. Glassnode highlighted,

“Most recently, the user-base growth rate has plunged to around 7k net new entities per day, which is similar to lows seen during the worst bear market levels in 2018, and 2019.”

Clearly, Bitcoin’s on-chain activity is in the bear market territory, and the afore-highlighted network utilization suggests that an “almost complete purge” of all market tourists has occurred. Their exit might be beneficial for BTC’s price over the short term. So, unless Bitcoin re-coils and picks up the pieces by on-boarding/retaining users, there is no warranty of a price rebound.