Bitcoin price surge activity is intensifying right now as traders focus on three critical U.S. economic signals this week. The Bitcoin price surge is being driven by Fed rate cut expectations, and also by potential US government shutdown impact, along with strong crypto ETF inflows as the asset tests Bitcoin all-time high territory.

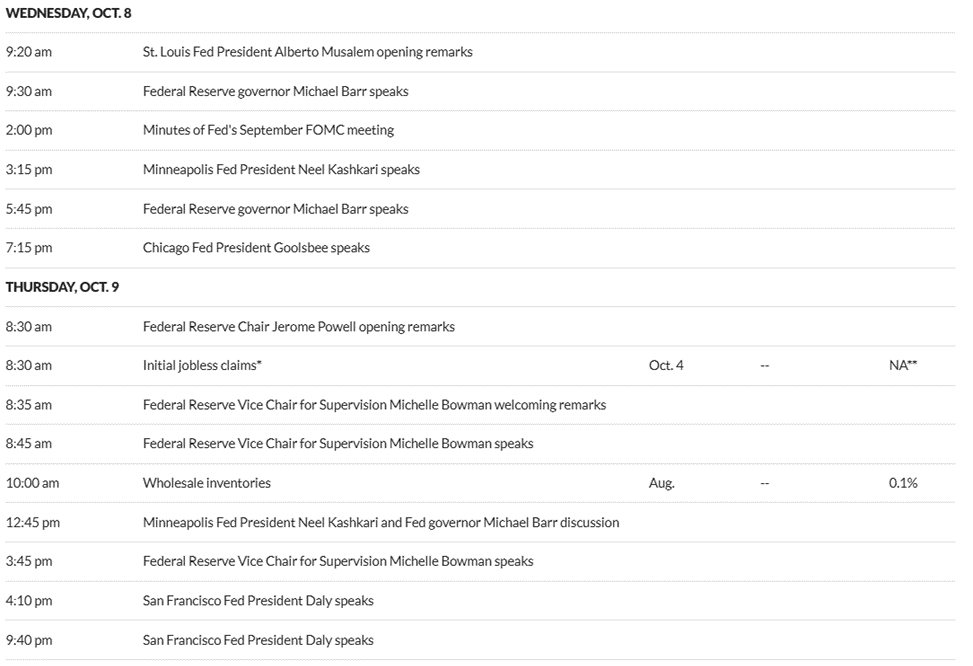

Federal Reserve officials are scheduled to speak throughout the week, and the FOMC minutes from September’s rate-cutting meeting are set for release on Wednesday at 2:00 pm. Market participants are analyzing how Fed rate cut expectations might actually influence the ongoing Bitcoin price surge, particularly as Bitcoin recently hit a Bitcoin all-time high of $125,506.00.

Key U.S. Economic Events Influencing Bitcoin’s Short-Term Outlook

The combination of traditional banking concerns and crypto market strength is creating some unique trading conditions right now. Traders are monitoring both the US government shutdown impact on data releases and also the continued crypto ETF inflows that have been supporting recent price action.

One analyst had this to say:

“Strong finish for crypto last week especially for BTC but also for ETH which closed above 4500! This week, fundamentally we have the FOMC minutes on Wednesday but these do not include economic projections so they will not impact the markets as much.”

Also Read: Stimulus Check 2025: IRS Denies $2,000 Trump Payout Rumors

Fed Speakers and Economic Data

Multiple Federal Reserve officials are speaking this week, and Chair Jerome Powell is set to deliver remarks on Thursday morning as well. Economists are closely watching the jobless claims data scheduled for Thursday as an early economic indicator.

Market analyst Kurt S. Altrichter stated:

“Jobless Claims are the early warning system for the economy. First alert: 260k – Recession risk: 300k+ on the 4-week average. Once claims cross these lines, the labor market has historically shifted from healthy to contracting, a key risk for stocks.”

The interplay between Fed rate cut expectations and crypto ETF inflows continues to support the Bitcoin price surge, and traders are also positioning for potential volatility around these scheduled events.

Bitcoin Price Action

Bitcoin’s recent Bitcoin all-time high has traders assessing whether the US government shutdown impact could actually affect momentum. At the time of writing, the asset is holding above $123,000, and crypto ETF inflows also remain strong as institutional interest continues even now.

Also Read: Coinbase Surges as $1B Bitcoin Loans, UBI, and SEC Clarity Collide