Coinbase stock rally has been gaining significant traction right now, with shares actually jumping 7.45% to reach $371.97 as the cryptocurrency exchange is benefiting from a combination of bitcoin-backed loans, a USDC UBI pilot program, and also some emerging crypto regulatory clarity around stablecoin legislation. These three catalysts converging at once are reshaping how investors view the company’s future.

Coinbase Stock Rally Fueled by Bitcoin Loans, UBI Pilot & Regulation

Bitcoin Lending Creates New Revenue

The current coinbase stock mania is fuelled by several initiatives that are being launched simultaneously. The bitcoin-backed loans feature of the company now allows users to take a loan of up to $1 million by pledging their Bitcoin collections as security to the loan, which provides the company with a new source of income through lending. Crypto holders in need of liquidity use this service without selling assets or triggering taxes.

At the time of writing, the lending program has been rolled out across several U.S. states and is seeing strong demand. This also positions Coinbase to compete with traditional banks that have been hesitant about entering the crypto lending space.

Stablecoin Pilots and Regulatory Progress

Cryptocurrency regulatory transparency has been getting better than ever in recent years, with top Coinbase executives even talking about how the changing regulatory environment can work in their favor in the future. The attention to stablecoin laws in Congress specifically is especially critical at this time because it might give institutions the legal infrastructure they require to become more widespread.

WorldCoin and USDC launched a UBI pilot program that demonstrates stablecoins’ use beyond trading. This initiative is testing universal basic income distribution through USDC payments, and it showcases real-world applications that could strengthen arguments for clearer stablecoin legislation.

Also Read: Coinbase Offers 10.8 Percent APY on USDC via Morpho Protocol

Market Outlook and Financial Strength

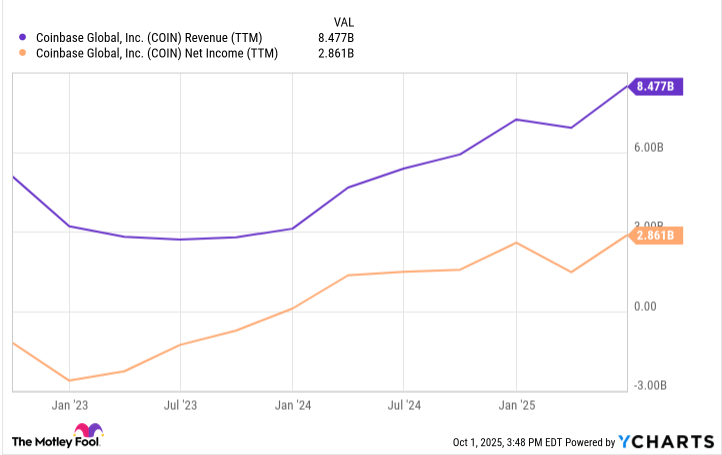

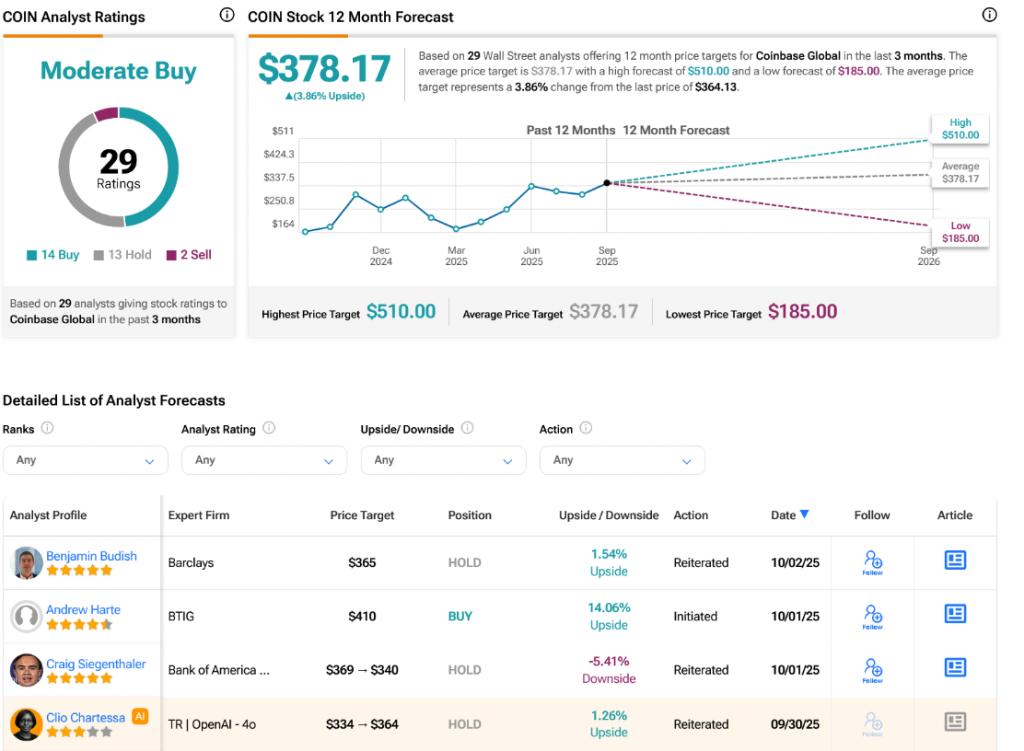

Based on 29 Wall Street analysts who have offered their 12-month price targets for Coinbase Global recently, the average target is sitting at $378.17, with forecasts ranging from $185.00 all the way up to $510.00. The company’s revenue has actually climbed to $8.48 billion, and net income has reached $2.86 billion, which demonstrates Coinbase’s ability to capitalize on renewed interest in cryptocurrency markets.

Concrete business developments are driving the current Coinbase stock rally, not mere speculation. Bitcoin-backed loans, the USDC UBI pilot, along with improving crypto regulatory clarity around stablecoin legislation are creating multiple pathways for growth at the exchange right now.

Also Read: Coinbase Explores Native Token for Base as Layer 2 Race Heats Up