The crypto market has seen a widespread decline, with altcoins leading the downward movement. Even Bitcoin [BTC] has not been immune to the downturn, currently affected by the negative trend. At press time, Bitcoin’s price stood at $28,603, reflecting a daily dip of 1.95%. In the midst of this situation, individuals who were betting big on the asset were experiencing the impact of this drop.

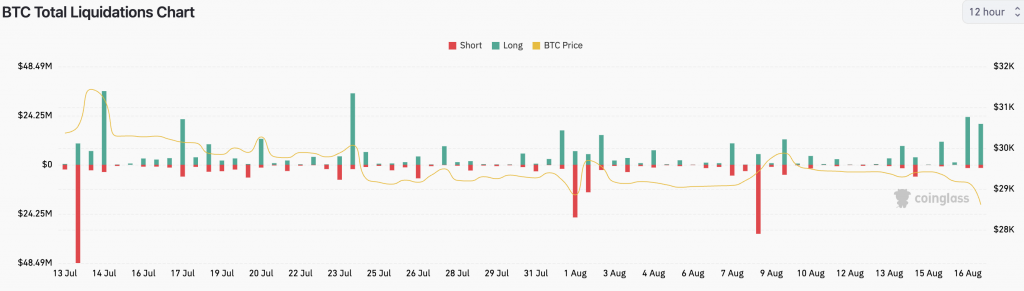

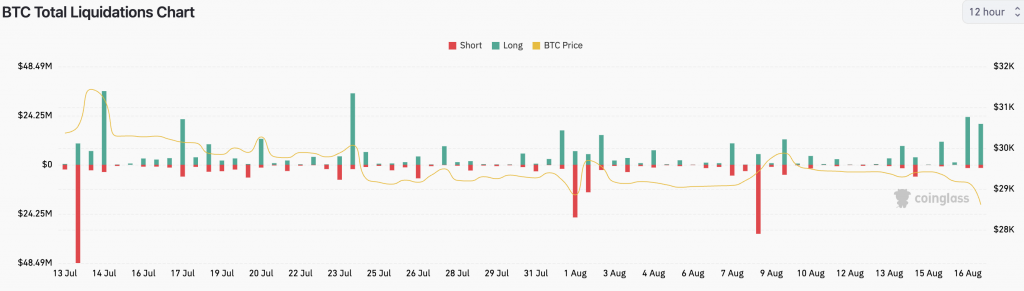

Coinglass data revealed that 90% of total liquidations stemmed from long trades, representing anticipations of price increases. Liquidation transpires when an exchange compels the closure of a trader’s leveraged position due to a partial or full depletion of the trader’s initial margin. Over the span of 24 hours, liquidations amounted to $47.39 million, out of which long liquidations constituted $44.22 million. Short liquidations were at a dainty $3.17 million.

After the recent liquidation event, Bitcoin traders appeared to be adopting a cautious approach. Traders were engaging in short positions rather than initiating long positions. Data sourced from Coinglass indicated that short positions comprised 52.82% of the total, surpassing long positions, which accounted for 47.16%.

Also Read: PayPal UK to Halt Bitcoin and Crypto Purchases

Will Bitcoin bounce back?

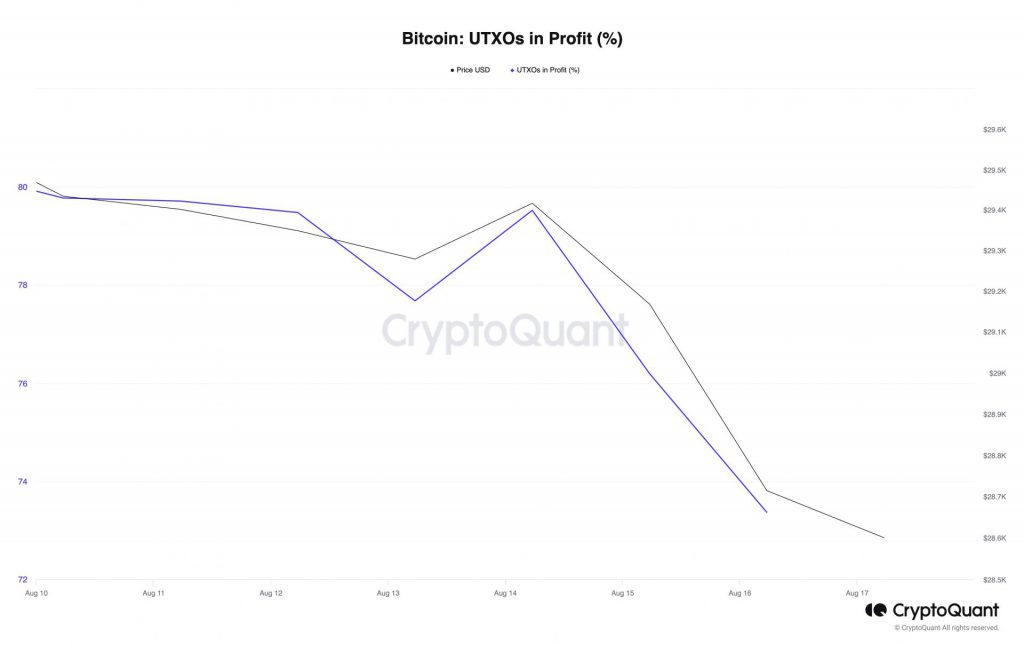

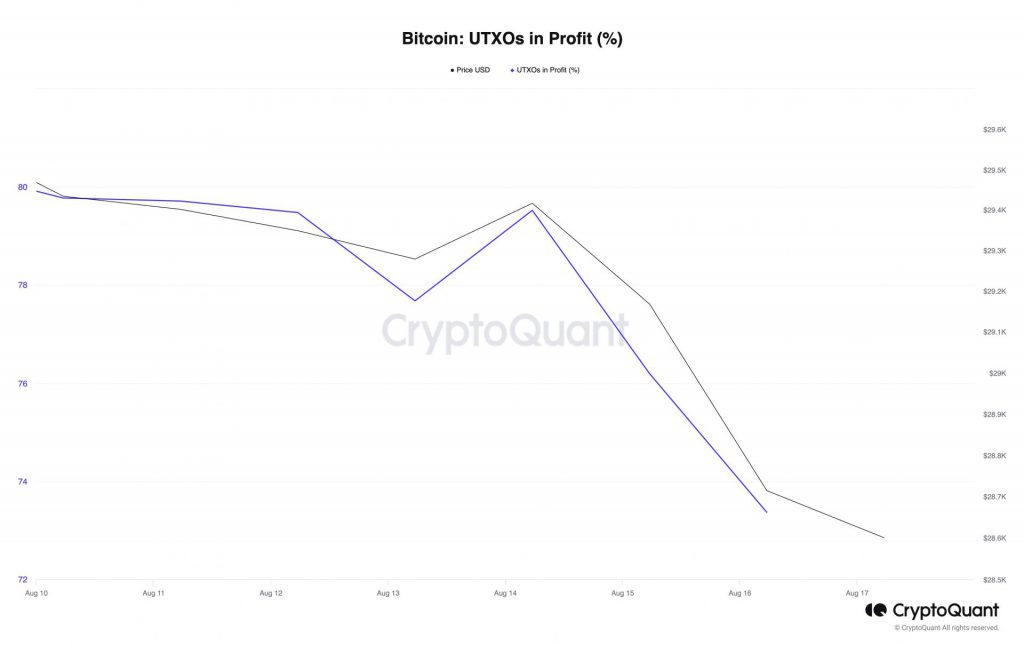

Earlier this week, an analyst named SimonaD shared her perspective on CryptoQuant concerning Bitcoin’s Unspent Transaction Output [UTXO]. UTXO highlighted the remaining cryptocurrency after a transaction has been completed. As per the analyst’s observations, the proportion of Bitcoin UTXOs that were in a profitable status had reached 79.53%. Nevertheless, when taking historical trends into account, a significant UTXO value may not always correlate with profitable price shifts. She further wrote,

“Usually, a high percentage of UTXOs in profit it may suggest that we have a risk of sell-off in the next period. When it acted as resistance, we had a price pullback.”

The recent decrease in Bitcoin’s price can be linked to this factor and the broader market sentiment. However, there has been a decrease in the portion of Bitcoin’s UTXO that are in a profitable state. Presently, this figure rests at 73%. This shift might suggest the potential for a resurgence in Bitcoin’s value.

Nonetheless, it’s crucial to recognize that numerous other elements have the potential to influence the value of Bitcoin, carrying the possibility of either negative or positive impacts.

Also Read: Europe Launches First Spot Bitcoin ETF