As cryptocurrency prices reach new lows and the increasing cost of electricity keeps eating away at profitability, Bitcoin miners are stepping off the gas and reducing production.

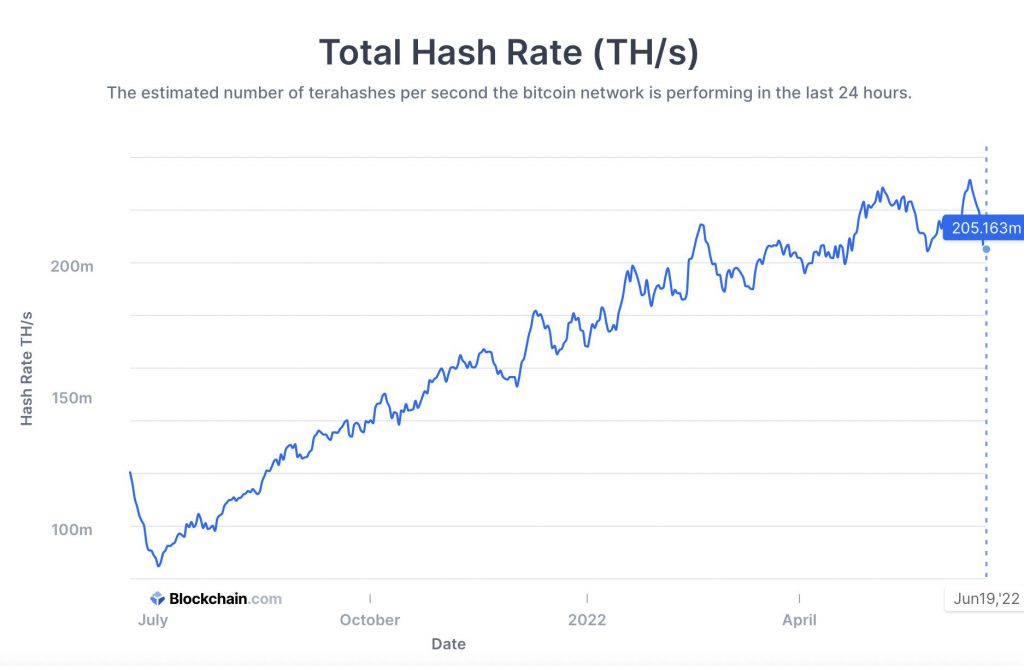

According to the data available on blockchain.com, Bitcoin’s hash rate peaked on June 12th at 231.428m, then tanked to 205.163m on June 19th. Additionally, the price of graphics processors has also tumbled as miners are selling their gear in the second-hand market.

The decrease in hash rate and the rise in GPU availability suggest that some miners may be giving up on the Bitcoin mining industry because they no longer find the high energy expenses for the relatively meager payout worthwhile.

According to Yuya Hasegawa, an analyst at Bitbank,

“Supply and demand regarding bitcoin mining has not been favoring the price this year.”

Hasegawa cautions that if the scenario persists, miners would likely sell their Bitcoins when the market recovers, slowing the recovery rate and perhaps causing Bitcoin to fluctuate in a range-bound fashion for some time.

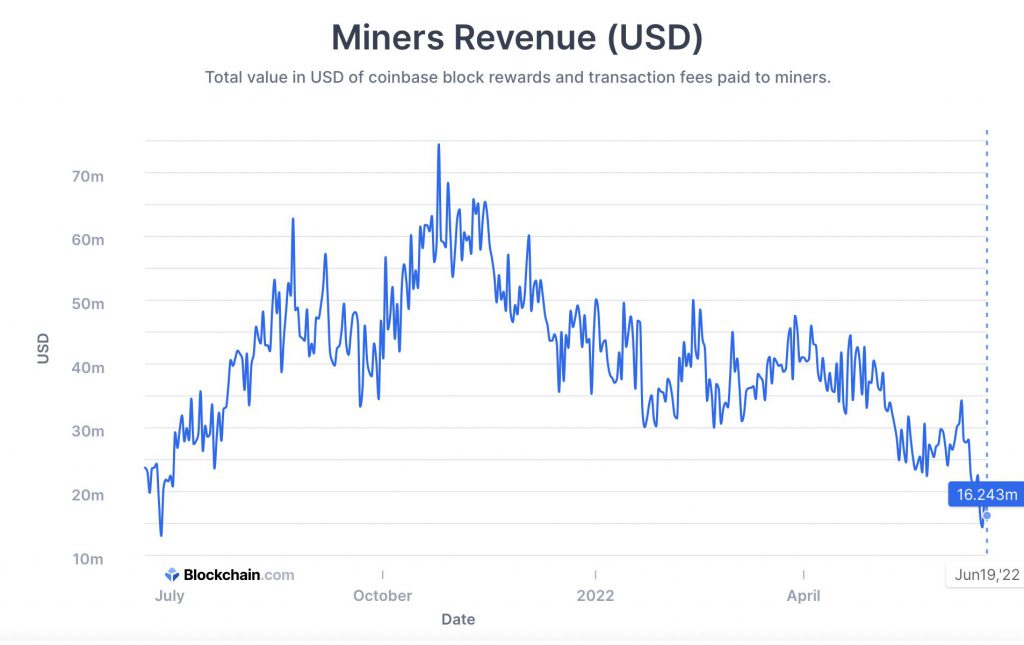

More data from blockchain.com shows that revenue for Bitcoin miners (and other currencies) has dropped to new lows. The recent fall in Bitcoin value to nearly 2017 levels can be the reason for the fall in revenue. Bitcoin had dropped below the psychological level of $20,000 but has now inched a little above that mark again.

Additionally, the cost of electricity is reaching its pinnacle, implying that miners are now suffering from high costs and lesser revenue per Bitcoin produced.

Apart from miners, crypto mining firms are also facing the brunt of the situation. Marathon Digital and Hut 8 Mining, two listed miners, both had a 41% decline in share prices during the last month.

Nonetheless, Marathon Digital Holdings declares that it will continue to try to amass the most valuable crypto asset, despite the practice being unprofitable to the average miner. With the hope that the cryptocurrency asset would continue to increase in value over time, the corporation has been concentrating more on producing Bitcoin and acquiring more of it.

Bitcoin (BTC) was trading at $20,134.18 at press time, up by 10.1% in the last 24 hours. It noted a downtrend of 24.8% over the past week.