Michael Saylor’s MicroStrategy has been part of the crypto-verse for quite some time now. The firm is known for its bullish notion of Bitcoin [BTC] and massive purchases of the asset. MicroStrategy is currently the largest corporate holder of BTC as a balance sheet treasury asset. However, this has raised concerns about the position of the king coin in the event that the company sells its holdings to settle its debt.

MicroStrategy reportedly has $2.2 billion in debt. The firm has pledged 15,000 BTC since repayments are due in 2025. The business analytics firm currently owns 140,000 BTC worth around $4 billion priced at an average cost of $29,800. The fear around a potential sell-off is due to the above-mentioned amount of BTC that the firm entails. However, a recent research report by Bernstein, squash these worries.

According to the report, the position is not substantial enough to affect prices, however, it does pose a sentiment risk during a downturn. MicroStrategy holds about 0.7% of all Bitcoin currently in circulation. This is nearly 20% of the daily average traded volume in spot markets. Nevertheless, the firm will be dependent on the price of BTC. If Bitcoin maintains its hot streak and continues to perform well, MicroStrategy wouldn’t have to sell its holdings after all. Analysts Gautam Chhugani and Manas Agrawal suggest,

“High BTC prices mean a stronger balance sheet, higher stock prices, and easier debt repayment without selling its BTC holdings.”

Currently, MicroStrategy’s stock MSTR has been surging. It is up by around 140% YTD at $350 per share. This is the highest level it has reached since September 2022. As mentioned by the analysts, its stock price has mimicked BTC’s YTD profits. Therefore, MicroStrategy doesn’t really “pose a concentration risk.”

How did Bitcoin respond to MicroStrategy selling in the past?

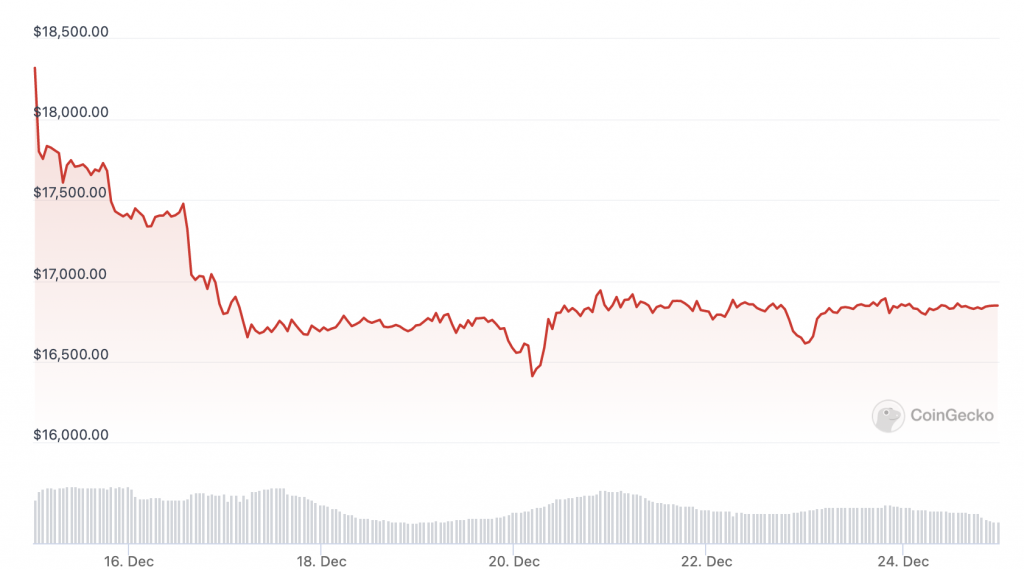

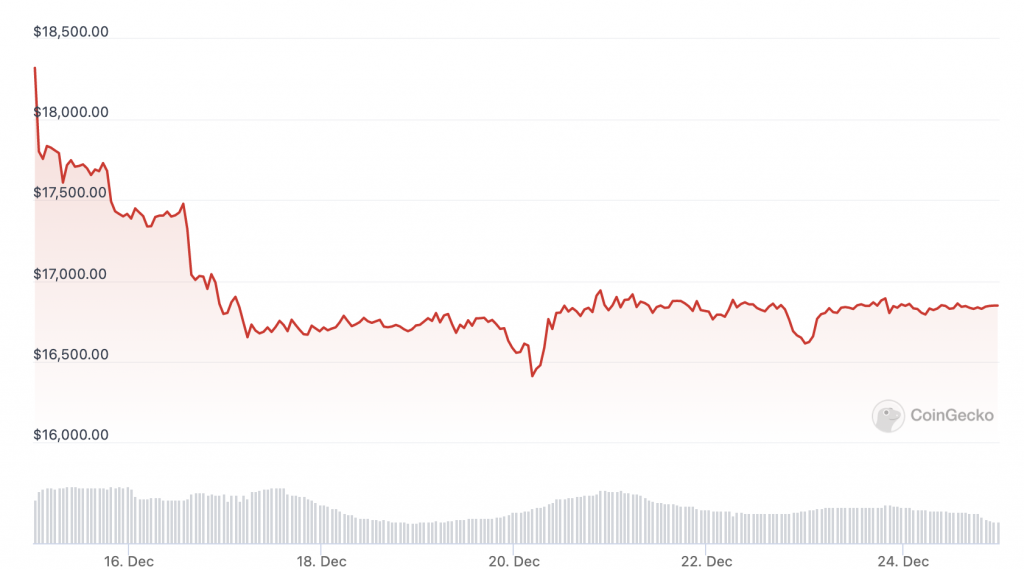

On Dec. 22, 2022, MicroStrategy sold over 704 BTC for an average price of $16,776. This was the first time the business had sold any of its Bitcoin holdings. As seen in the chart below, Bitcoin’s price barely dropped or even rose. As a result, it is safe to say that any potential sell-offs by the Michael Saylor-led firm wouldn’t gravely impact the king coin.