At the beginning of the year, Bitcoin [BTC] kicked off with positive momentum. Despite its present state of unpredictability and inactivity, there has been a continuous influx of optimistic speculations regarding the leading cryptocurrency. Anthony Scaramucci, the founder and managing partner at SkyBridge Capital, has now joined the ranks of those making bullish forecasts. He envisions a remarkable increase in Bitcoin’s value. He suggested it could surge by an impressive 2,662% from its current market capitalization of around $543 billion.

In a recent podcast, Scaramucci calculated that based on BTC’s fixed supply of 21 million coins, the cryptocurrency’s market capitalization suggests a price of more than $700,000 per Bitcoin. This stands in contrast to the current price of the asset, which is $27,747.01. He added,

“I think bitcoin could easily be a $15 trillion asset. Bitcoin in many ways is more valuable than gold. We own a lot of Bitcoin here.”

Although acknowledging the ascendancy of Bitcoin, he expressed his skepticism about it evolving into a universally accepted form of currency, as fervent Bitcoin proponents envision, at least within his lifetime. However, he did entertain the notion that unconventional scenarios might unfold. This could lead to situations where nations at odds with the United States could consider trading in Bitcoin. This is in addition to denominations linked to gold, thereby moving away from the U.S. dollar. This potential shift could be driven by concerns over how the U.S. has employed the dollar to assert its geopolitical influence over other countries, according to Scaramucci’s perspective.

Also Read: Bitcoin ETF 90% Shot at Approval by SEC in January 2024

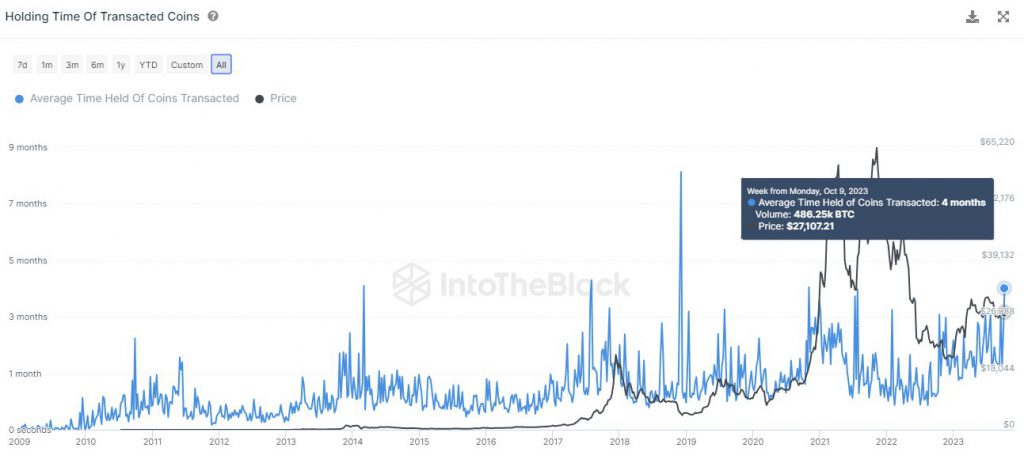

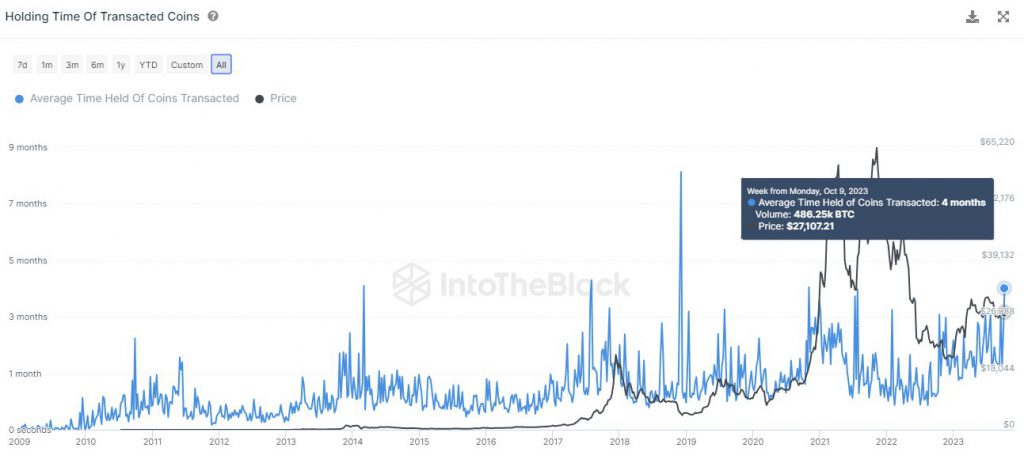

Bitcoin’s Average Holding Period Extends to 4 Months

In the BTC market, a notable development occurred last week when the average holding duration for transacted BTC reached a 4-month milestone. This indicates a notable increase in activity among BTC holders with a long-term outlook. The last time such an extended holding period was observed was back in January 2022, following the end of a bull market.

Also Read: Bitcoin: Grayscale’s GBTC Discount Falls to 15%, 2-Year Low

A similar trend was also noted in July 2021. Throughout Bitcoin’s history, these prolonged holding periods have frequently coincided with significant market moments, including capitulation events. The recent data suggests a potential shift in sentiment and behavior among BTC investors. It showcases a growing inclination towards a more extended investment horizon and