El Salvador’s Bitcoin (BTC) bond, also called Volcano Token, has been long overdue. Initially planned for an early 2022 launch, the much-anticipated project was pushed back to mid-March, before being postponed indefinitely. However, according to Bitfinex and Tether CTO (Chief Technology Officer) Paolo Ardoino, the token may be rolled by late 2022.

The delay is most likely due to the lack of investor interest, according to the head of emerging market sovereign research at Stifel Financial Corp., Nathalie Marshik. Furthermore, Bitfinex is not available to American users, further distancing the project. The falling price of Bitcoin (BTC) also may have had a hand to play in the delay.

Nonetheless, while speaking to Fortune, Ardoino did say that the El Salvador government has a final draft ready. Additionally, the governmental officials told him to expect a passage by September. If that were to happen, Ardoino says it would be another two or three months before the Bitcoin bond (or Volcano Token) could be rolled out. This would mean that the sale could go live towards the end of 2022.

How essential is El Salvador’s Bitcoin bond?

The success of El Salvador’s Bitcoin bet has long been correlated with the debut of the Volcano token. The project will also finance ambitious initiatives like President Nayib Bukele’s proposed “Bitcoin City.” Moreover, many analysts believe that the Volcano token campaign will allow the government to avoid debt problems before a potential default.

The anticipated Volcano token issuance and the government’s ability to pay its debt, according to William Snead, an analyst at BBVA, have made El Salvador’s traditional bonds one of the region’s glaring underperformers. Snead expressed skepticism that the Volcano token will go live due to the turbulence in the cryptocurrency market.

However, the success and interest in the project are closely tied to the performance of BTC. The original cryptocurrency did see some relief in August, reaching $24k, but only to fall below the $20k mark once again.

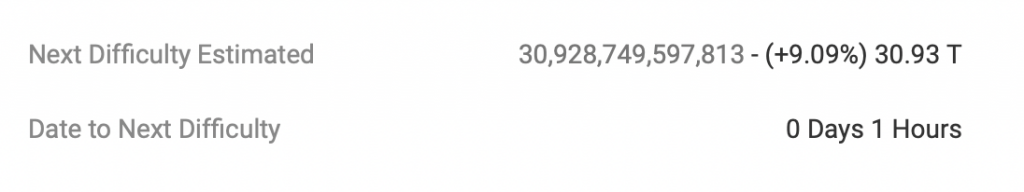

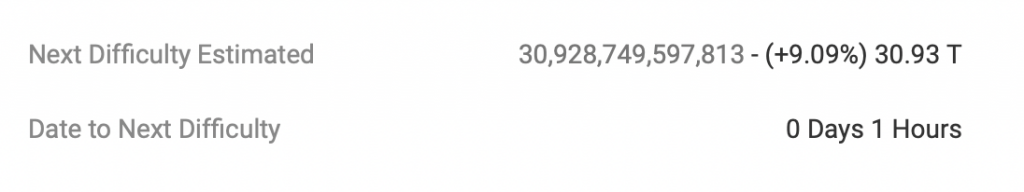

Furthermore, Bitcoin’s next difficulty adjustment is due today. As per estimation, it is expected to rise by 9.09%, the highest in 7-months. This would lead to better security of the asset.

According to President Bukele, El Salvador has purchased 2,301 Bitcoins since last September for a total of about $103.9 million. These coins are currently worth roughly $45 million. The most recent purchase was made on July 30 when the nation purchased 80 BTC for $19,000 each.

At press time, BTC was trading at $20,403.97, up by 0.6% in the last 24 hours.