The crypto industry started out as an entity that was free from the shackles of centralized systems. However, the rising fraudulent cases in the market forced regulators to veer into this unregulated market. While one part of the industry focuses on profits, losses, and network developments, another facet of it is flooded with lawsuits.

Regulators like the Securities and Exchange Commission [SEC], Commodity Futures Trading Commission [CFTC], and Department of Justice [DOJ] have played a vital role in the crypto market. Most hacks or scammy projects are called out by these regulators and put forward before the court. Commercial law firm Morrison Cohen LLP with its new crypto litigation tracker brought to the community’s attention that there were a total of 300 cases crypto-related cases.

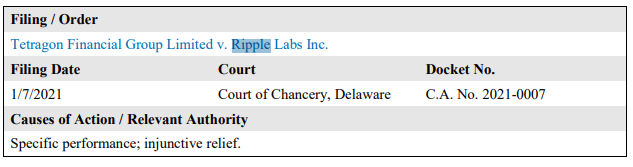

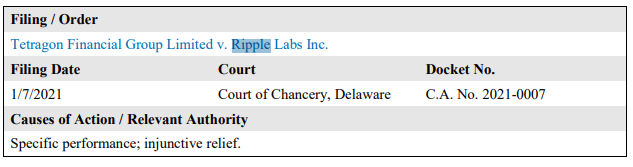

These cases ranged from those that were resolved in court and the active ones since 2013. The list was divided according to cases related to each regulator. Each case file entailed details like the name of the Filing/Order along with the date of the filing. The court involved in the case as well as the causes of action and relevant authority were also mentioned. Details pertaining to the ruling and the orders of note were also highlighted in the list.

Notable crypto cases on the list

Ripple’s tiff with the SEC cannot go unnoticed. The SEC has been trying hard to accuse Ripple of selling “unregistered securities”. Sticking to its stance, Ripple is nowhere close to label XRP as a security. The case that started in 2020 is still underway and is expected to attain closure this year.

Another high-profile crypto case that was brought to light this year was the Bitfinez hack in 2016. The infamous couple, Ilya Lichtenstein and Heather Morgan were charged by the DOJ for conspiring to launder funds acquired from the hack. The report detailed,

“Lichtenstein and Mogan have been charged with conspiring to launder $4.5 billion in stolen bitcoin (119,754 bitcoin) from a 2016 hack of Bitfinex. The government has seized approx. $3.6 billion (94,000 bitcoin).”

Despite being fairly new, SafeMoon managed to fall under the purview of the regulators and was hit with a class-action suit. The network allegedly carried out a pump and dump scheme and found itself in troubled waters.

Similarly, the list entailed an array of high-profile as well as smaller crypto cases. Only 17 of these cases were resolved or presented before the court this year.