Bitwise has officially filed an S1 form with the SEC for a Chainlink (LINK) ETF. This is the only LINK ETF application submitted to the financial watchdog. Crypto-based ETFs have become increasingly popular over the last year. The number of crypto ETFs is only expected to surge over the coming years.

Will The SEC Approve Bitwise’s Chainlink ETF Application?

The SEC is currently reviewing several crypto-based ETFs. The agency made history last year when it approved Bitcoin (BTC) and Ethereum (ETH) ETFs for the US market. Bitcoin and Ethereum hit new all-time highs earlier this month, largely due to high ETF inflows.

The SEC is now led by Paul Atkins, a pro-cryptocurrency candidate. There is a high chance that the SEC will approve most of the ETF applications they have received, given that there aren’t any issues with the applications. The Chainlink (LINK) ETF could be one of many to be approved by the SEC.

Will LINK Rise To a New All-Time High?

An ETF approval will likely lead to a surge in institutional money for LINK. Institutional funds are key to an asset’s price movements. BTC has hit never-before-seen price levels after its ETF approval. A similar pattern could emerge for LINK as well.

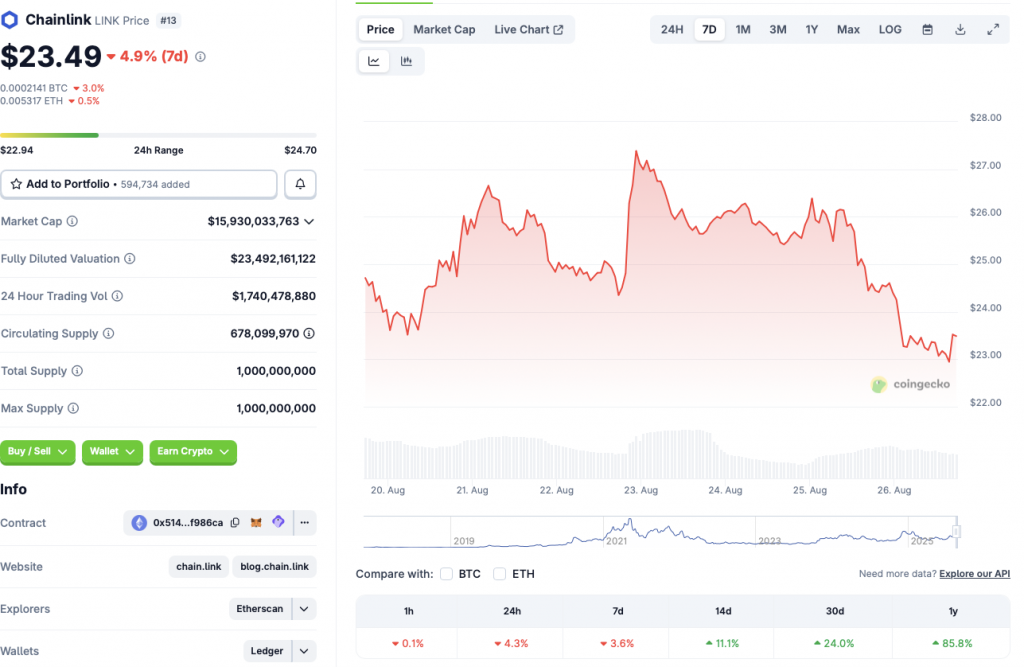

Chainlink has faced quite a correction over the last few days. According to CoinGecko’s LINK data, the asset is down 4.3% in the daily charts and 3.6% over the previous week. LINK’s price is also down by 55.6% from its all-time high of $52.70. LINK hit its peak in May 2021, more than four years ago.

Also Read: Chainlink Price Prediction: Can LINK Hit $40 Between Sept–Dec 2025?

It is still unclear if and when the SEC will approve Bitwise’s Chainlink ETF. President Trump has stated that he wants the crypto industry in the US to thrive. ETFs may be one of the ways in which the US dominates the crypto space. How things unfold are yet to be seen.