Quantum computing Bitcoin threat warnings have escalated as BlackRock quietly updated its iShares Bitcoin Trust filing in May 2025, and this marks the first direct SEC institutional warning about quantum technology potentially breaking Bitcoin’s cryptographic security. The world’s largest asset manager now officially acknowledges that advanced quantum computing could undermine Bitcoin’s viability, also adding urgency to cryptocurrency discussions alongside Bitcoin halving countdown live events and currency substitution debates with the United States dollar.

Also Read: BlackRock Bitcoin ETF Soars as Abu Dhabi and Hong Kong Investors Pump Over $1 Billion

Can Cryptocurrency Survive a Quantum Leap That Breaks Bitcoin?

The quantum computing Bitcoin threat has moved from theoretical to documented institutional concern, and BlackRock’s filing specifically states that quantum computing could “undermine the viability of many of the cryptographic algorithms used across the world’s information technology infrastructure, including the cryptographic algorithms used for digital assets like bitcoin.”

Source: SEC.gov

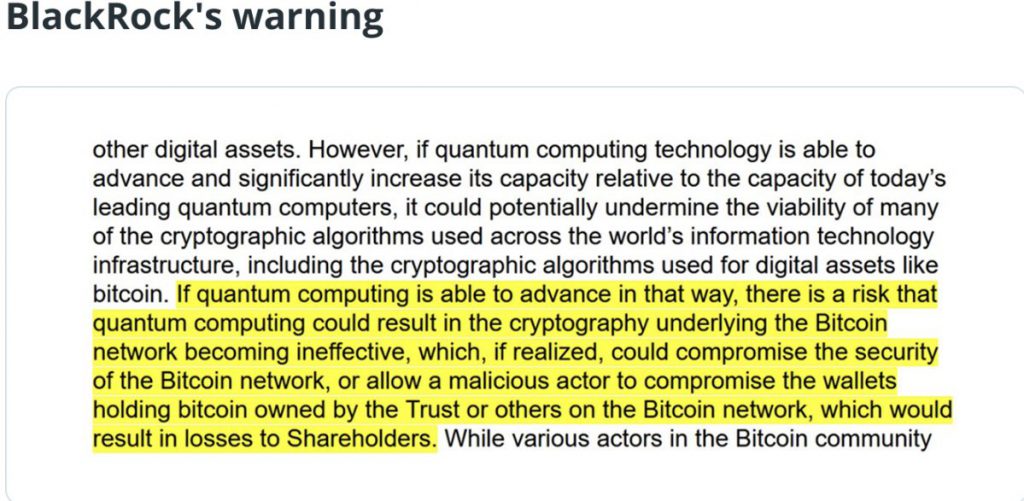

BlackRock stated in their filing:

“If quantum computing is able to advance in that way, there is a risk that quantum computing could result in the cryptography underlying the Bitcoin network becoming ineffective, which, if realized, could compromise the security of the Bitcoin network, or allow a malicious actor to compromise the wallets holding bitcoin owned by the Trust or others on the Bitcoin network, which would result in losses to Shareholders.”

Also Read: UK Tests Offline CBDC Payments—What This Means for Bitcoin and Privacy Coins

Understanding the Quantum Computing Bitcoin Threat Right Now

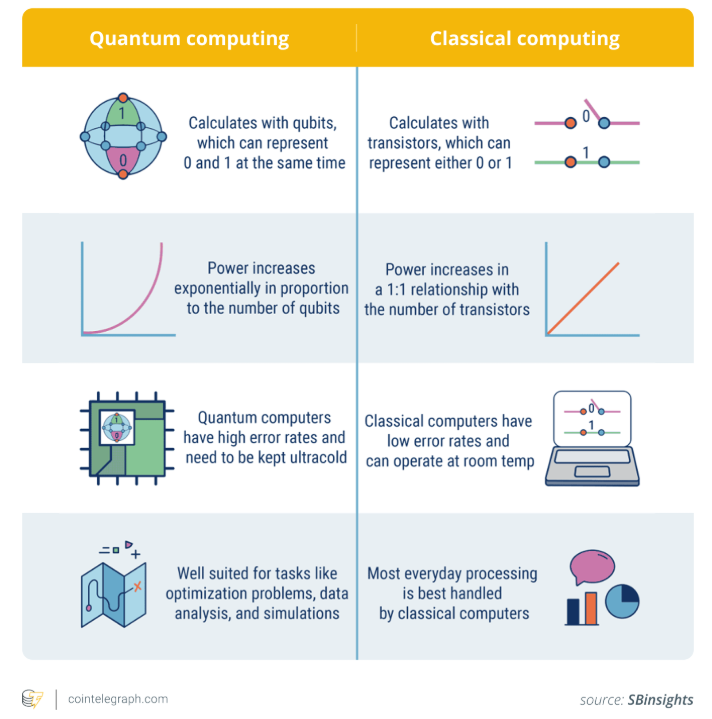

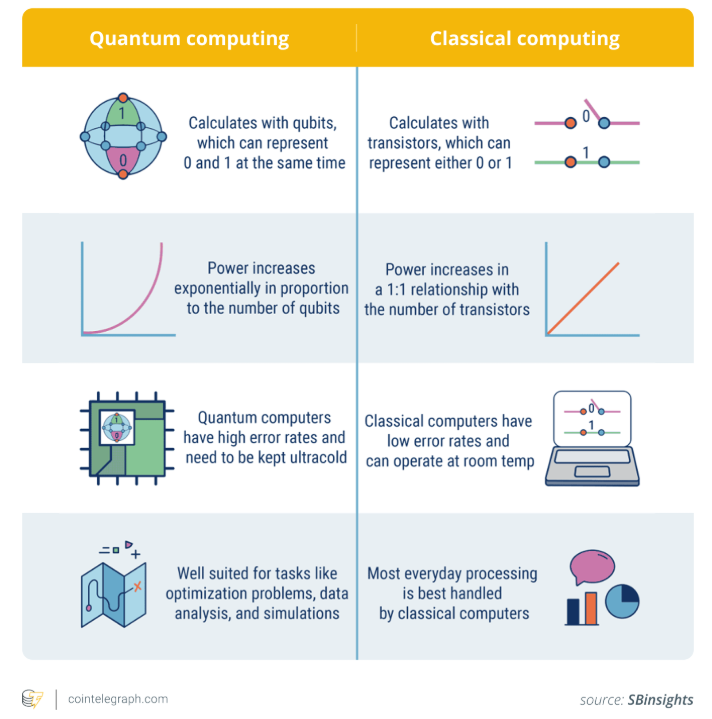

Current quantum computers process multiple possibilities simultaneously, and this is unlike traditional systems that work one calculation at a time. Bitcoin’s security relies on SHA-256 and also ECDSA cryptographic systems that have protected the network for years. However, powerful quantum machines could potentially reverse-engineer private keys from public addresses during transaction broadcasts.

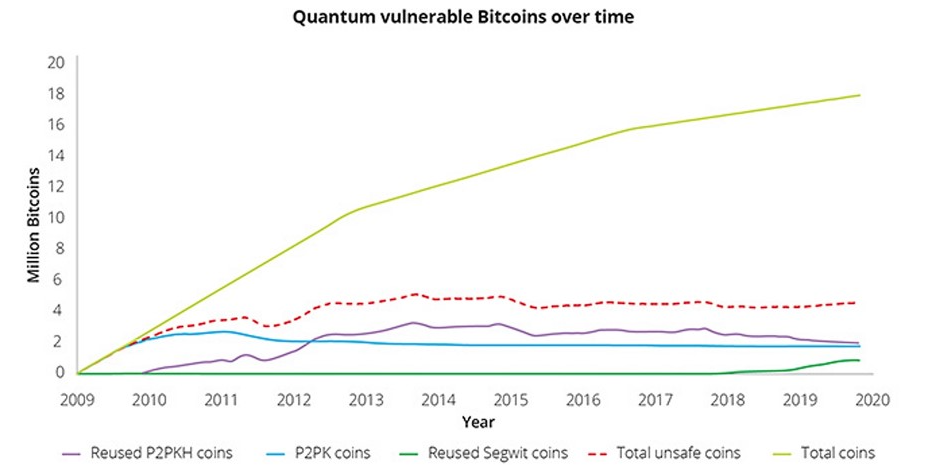

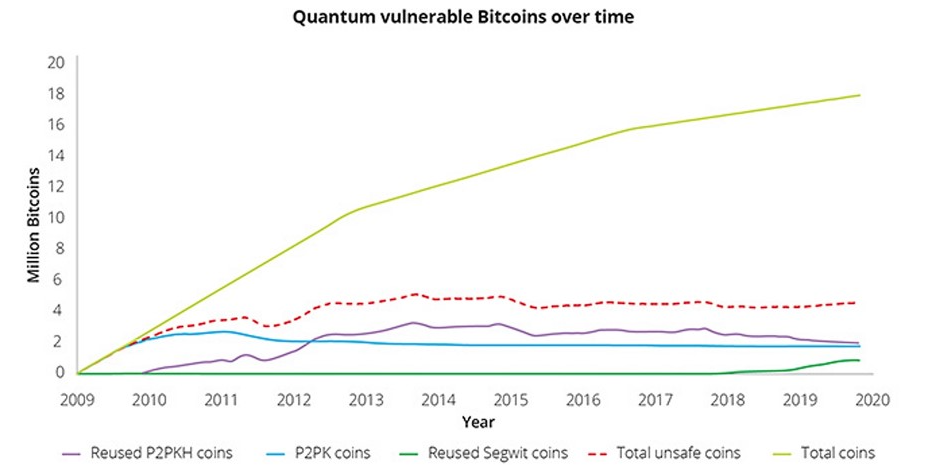

At the time of writing, researchers estimate quantum computing Bitcoin threat realization remains 10-20 years away, though roughly 25% of existing Bitcoin sits in older wallet formats that are more vulnerable to quantum attacks. This timeline has prompted serious cryptocurrency industry preparation efforts right now.

Industry Response to Quantum Computing Bitcoin Threat

The cryptocurrency sector isn’t waiting passively, and developers have proposed the Quantum-Resistant Address Migration Protocol (QRAMP) to migrate Bitcoin from vulnerable formats to quantum-safe algorithms, though this would require an extensive network hard fork.

Some blockchain networks already implemented quantum-resistant measures. Algorand integrated NIST-approved Falcon algorithms, and also the Quantum Resistant Ledger uses XMSS hash-based signatures designed specifically for quantum threats.

Also Read: CBDCs Pose Threat to Stablecoins, Not Bitcoin, Says COTI Co-Founder

Institutional Recognition of Quantum Risks

BlackRock’s quantum computing Bitcoin threat disclosure carries significant weight given their $11.6 trillion in managed assets, and including quantum risks alongside traditional cryptocurrency concerns like volatility signals institutional recognition that this threat requires immediate attention.

The warning affects cryptocurrency markets already navigating Bitcoin halving countdown cycles and also ongoing currency substitution discussions between digital assets and the United States dollar. For investors, this represents another complexity in cryptocurrency risk assessment right now.

Also Read: BlackRock Seizes $22.8B Panama Ports in Quiet Power Move

BlackRock’s formal quantum computing Bitcoin threat warning transforms hypothetical scenarios into documented institutional concerns. As cryptocurrency markets continue evolving through Bitcoin halving countdown events and currency substitution debates with traditional assets like the United States dollar, quantum computing adds critical urgency to Bitcoin’s long-term security planning at the time of writing.