Yuga Labs’ metaverse land mint event was highly awaited by the community. The NFT sale affair, undoubtedly, was a huge success, but it did manage to create chaos alongside.

To begin with the positives, the sales figures went on to register record-breaking numbers within the initial few minutes itself.

Within the first 45-minutes, it had already sold digital real estate worth $100 million. The number ballooned up to $245 million at the stroke of the second hour.

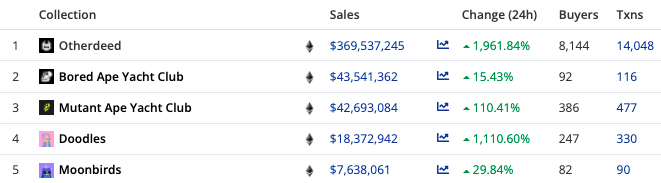

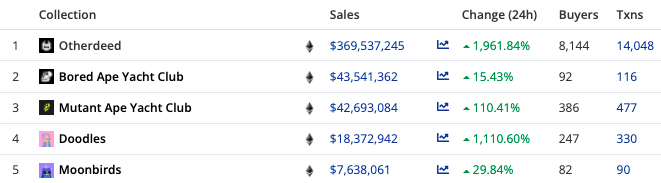

At press time, Otherside’s “Otherdeed” NFT sales topped the rankings chart. Its sales had noted an upward incline of close to 2000% in the past 24 hours. In the said timeframe, 8.1k buyers had indulged in 14k transactions.

Other prominent collections like MAYC and Moonbirds had noted merely 15%-110% sales growth.

The Ethereum factor

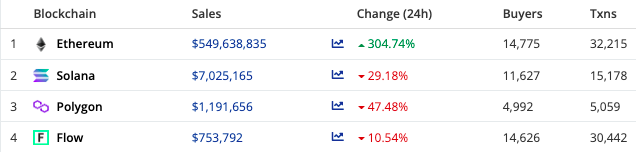

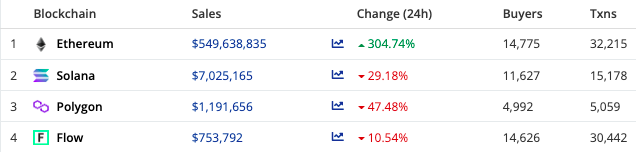

Owing to the traction gained and the towering demand, the sales on the Ethereum blockchain had soared by 304%. In the same time one-day period, the other blockchains like Solana, Polygon, and Flow noted a drop in their respective numbers.

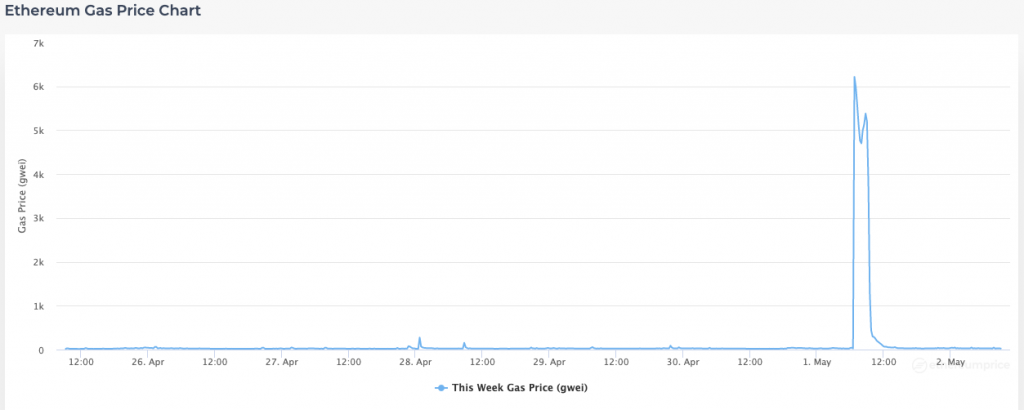

As a result, the Otherdeed mint—that began at 9 pm EST Saturday night—immediately triggered an Ethereum gas war. As can be noted below, Ethereum’s gas price had shot up beyond 6k gwei at one point in time.

A particular user, in fact, ended up forking out 16 ETH or $43k [15,640,647,350.26 gwei] in gas fee to mint 2 Otherdeed plots.

Commenting on the gas chaos, Yuga Labs noted,

“This has been the largest NFT mint in history by several multiples, and yet the gas used during the mint shows that demand far exceeded anyone’s wildest expectations. The scale of this mint was so large that Etherscan crashed.”

As an effective solution, Yuga Labs said that it would need to migrate to its own blockchain in order to properly scale.