The crypto industry has a history of experiencing hacks and attacks, with numerous incidents occurring over the years. These attacks seldom go unnoticed. While some have had significant and negative impacts on many individuals, there have been a few instances that can be regarded as amusing. One such bizarre incident involved an arbitrage bot exploiting MakerDAO’s flash loan contract and making a dainty $3 profit.

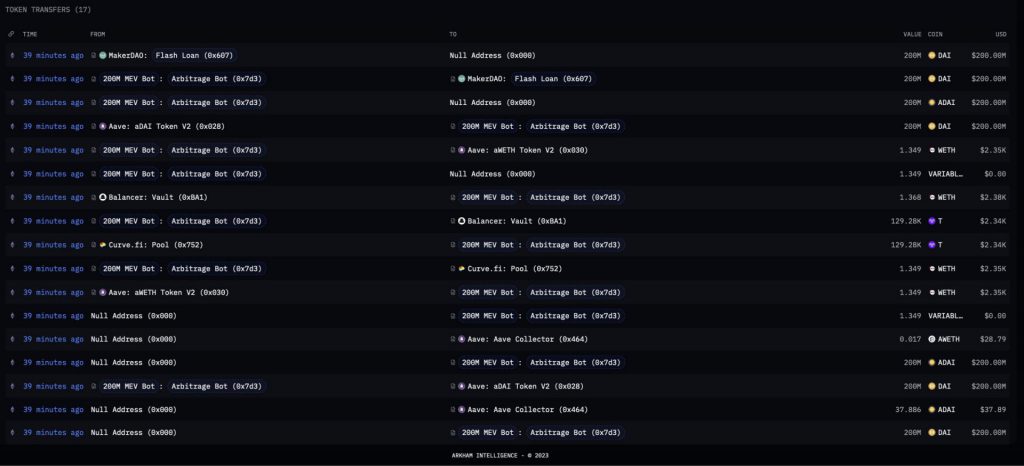

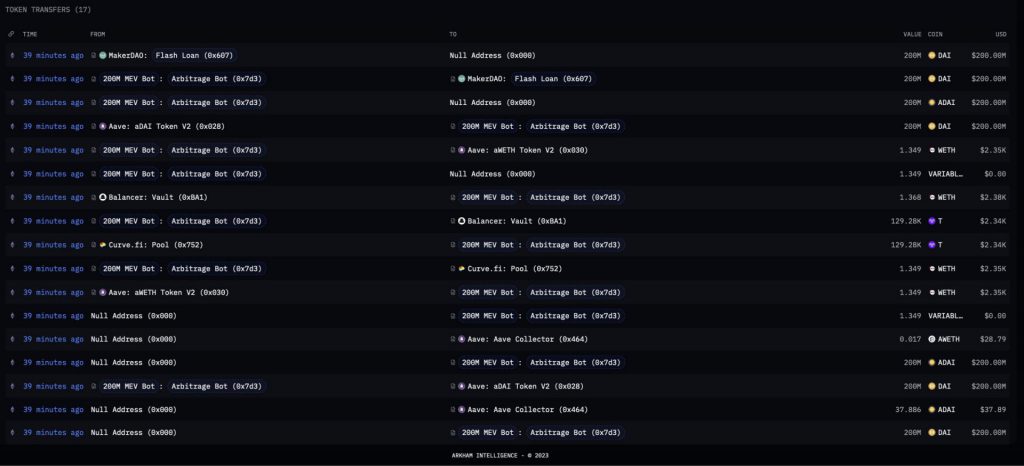

According to the report, the bot strategically exploited MakerDAO’s ‘DssFlash’ contract by borrowing a substantial amount of 200 million DAI. Taking advantage of the contract’s capability to borrow any desired amount of DAI, the bot opted for a large-scale loan. It employed a flash loan, which is a loan that is gained and repaid within a single block. This doesn’t require any initial collateral. In this particular case, the bot borrowed 200 million DAI tokens and utilized them in the Aave DAI market. The bot secured a loan of $2,300 worth of wrapped ether [WETH] against the collateral.

The bot’s well-coordinated attack moved according to plan. After successfully obtaining the WETH, it promptly executed the purchase of Threshold Network [T] on Curve. Subsequently, the tokens were sold on Balancer. This was done through a series of transactions that took place within a single block.

It is worth noting that the actual debt ceiling set by MakerDAO is $500 million DAI.

How did the bot end up with a $3 profit?

The crypto industry has witnessed several instances of flash loan exploits within the decentralized finance [DeFi] sector. However, these attacks have generally resulted in significant financial losses. In contrast, the particular case under discussion saw the bot make a mere $3.24 in profits, which is a modest amount in comparison.

Before factoring in fees, the total profit gained by the bot was $33 or 0.019 ETH. However, due to the deduction of $28.76 in transaction and protocol fees. An additional $1 was returned to the block builder. This further pushed the net profit to $3.24.