With the economic alliance still committed to its de-dollarization efforts, the BRICS $5 billion exports could threaten the US dollar in 2024. Indeed, the bloc is set to continue building on those figures into the new year. Moreover, with expansion and currency agreements in place, it could have massive implications on the greenback.

In 2022, China was far and away the leader in exports with a massive $3.6 billion recorded through Statista. Subsequently, Russia, India, and the United Arab Emirates (UAE) featured in the top 20 export nations. Although the United States is still in second with $2 billion exported, the reality of a shifting global perspective remains the same.

Also Read: BRICS Offers Bonds Worth $28 Billion in Local Currency, Not US Dollar

BRICS Exports Could Continue Dethroning the US Dollar in 2024

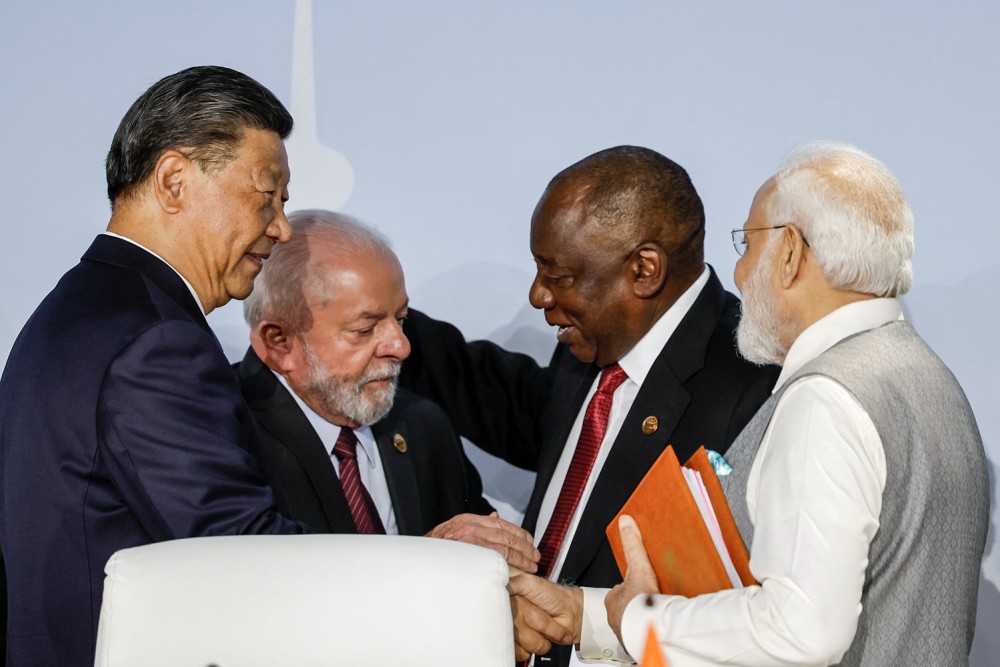

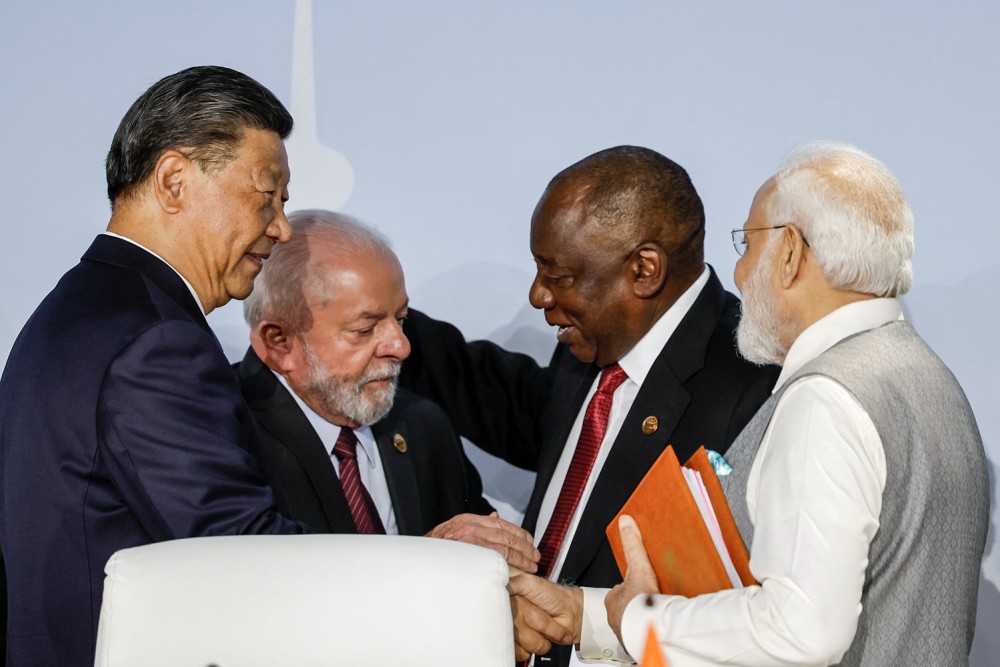

Throughout the past year, the BRICS alliance has fully committed to its reformation project of the global economy. The bloc spent 2023 embracing de-dollarization on a scale that had not yet been seen. Subsequently, its expansion plan continued to fuel those fires and drive the expectation of success from those efforts.

Now, in the earliest days of 2024, those initiatives are continuing. Although many have voiced their disagreement with the effectiveness of the policies, one avenue could have an unexpected effect on the Western currency. Specifically, the BRICS bloc is poised to build on its $5 billion in exports to severely threaten the US dollar in 2024.

Also Read: Vivek Ramaswamy Calls BRICS Common Currency a Threat to US

The United States is still a dominant export nation, but it is second to China. Moreover, it is quite a distance second. Additionally, the expanded presence of the bloc increases the unilateral trade activity available to China. Therefore, it can only expand its exportation practices.

The five-nation expansion, featuring the UAE, Saudi Arabia, Iran, Egypt, and Ethiopia is an undeniable aspect of the development. Being made official at the start of the year, these countries have already shown an interest in increasing cooperation. Moreover, they have done so by committing to one of the alliance’s foundational principles as of 2023; local currency promotion.

There is little argument to be made against the US dollar’s dominant status in global finance. However, the process is still in its infancy. De-dollarization was not a crucial aspect of the BRICS alliance until Western-imposed sanctions. Subsequently, the continued evolution of these initiatives will have long-standing effects. Moreover, they should continue to gain steam throughout this upcoming year.