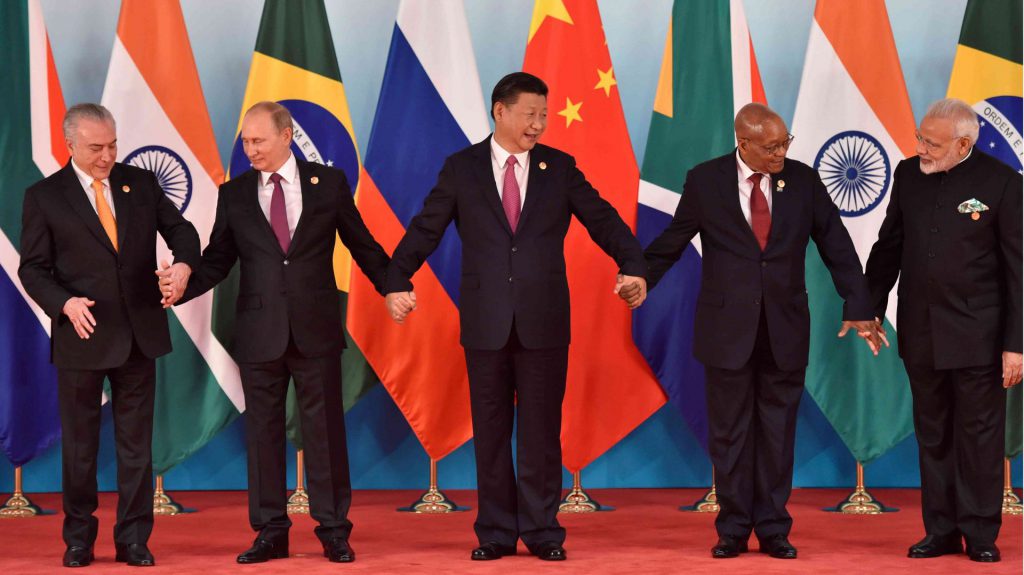

The BRICS Alliance welcoming Saudi Arabia could accelerate Chinese Yuan use for international settlements. Specifically, Professor Ashok Swain of Uppsala University’s Department of Peace and Conflict Research stated the potential economic implications of the nations joining the economic bloc.

Professor Swain stated that Saudi Arabia’s membership “would accelerate the bilateral trading being conducted using the yuan as the trading currency.” Conversely, Saudi Arabia is among the countries seeking membership in the collective.

Saudi Arabia Joining BRICS Could Impact Yuan

The growth of the BRICS alliance has been an interesting development over the last few weeks. Moreover, as the economic bloc grows, potential implications begin to be set in motion. Alternatively, one nation seeking membership could continue a global economic power shift.

Specifically, the BRICS Alliance welcoming Saudi Arabia could accelerate the Chinese yuan’s use as a trading currency. Specifically, Professor Ashok Swain stated the potential global economic implications of the alliance’s growth.

Swain stated, “There is no doubt that Saudi Arabia becoming a member of the China-dominated SCO and BRICS would accelerate the bilateral trading being conducted using the yuan as the trading currency.” Subsequently, continuing the de-dollarization that has been present in the BRICS nations.

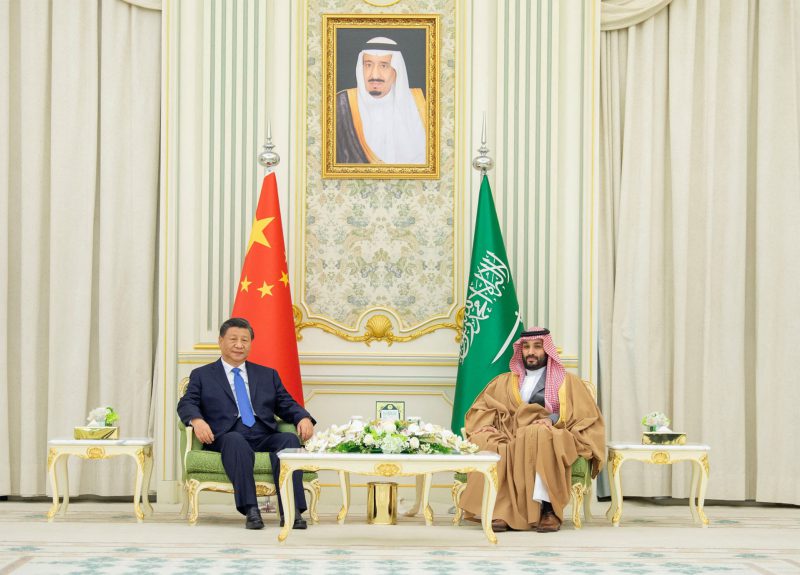

In March, Saudi Arabia became a partner of the SCO, or Shanghai Cooperation Organization. Moreover, the organization was formed in 2001 as a political, economic, and defense alliance. Conversely, although the nation is not yet a part of the BRICS alliance, there has been discussion. Specifically, both Russian President Vladimir Putin and Saudi Crown Prince Mohammed bin Salman Al Saud discussed the idea.

Earlier this year, it was revealed that Saudi Arabia had been executing international settlements with Beijing in the Chinese yuan. Moreover, the development was noted as a “huge step” for China by Professor Swain. Subsequently stating it as a “significant setback to the dollar’s standing.”